Our Strategies for Sustainable Growth

INTEGRATED REPORT 2025

Message from the President of the Corporate Planning Unit

Tokyo Century will pursue ongoing improvements in corporate value through an emphasis on heightening capital profitability and achieving earnings growth via disciplined portfolio management.

Tatsuya Hirasaki

Director and Senior Managing Executive Officer

President, Corporate Planning Unit

President, Accounting Unit

In fiscal 2024, the second year of Medium-Term Management Plan 2027, Tokyo Century made progress in improving profitability through major measures such as heightening the value of existing operations and increasing asset turnover. The results of these efforts include net income attributable to owners of parent of ¥85.3 billion, making for our second consecutive year of record-breaking income, as well as return on equity (ROE) of 9.0%, a year-on-year increase of 0.2 percentage point. For fiscal 2025, we are projecting net income attributable to owners of parent of ¥93.0 billion, which will represent smooth progress toward the financial target of ¥100.0 billion set for fiscal 2027 in the medium-term management plan.

However, I recognize that in fiscal 2024, we were unable to conduct a sufficient number of growth investments that promise significant returns and that are in keeping with Tokyo Century’s growth story.

Consolidated Financial Performance

Scrollable horizontally

| (Billions of yen) | Fiscal 2023 | Fiscal 2024 | Year-on-Year Change | Fiscal 2025 (Forecast) |

|---|---|---|---|---|

| Ordinary income | 117.3 | 132.3 | +15.0 | - |

| Net income attributable to owners of parent |

72.1 | 85.3 | +13.1 | 93.0 |

| Segment assets | 5,720.4 | 6,059.9 | +339.4 | - |

| Shareholders’ equity | 872.2 | 1,029.6 | +157.4 | - |

| Return on assets | 1.2% | 1.3% | +0.1pt | - |

| Return on equity | 8.8% | 9.0% | +0.2pt | - |

Capital and Financial Strategies for Improving Corporate Value

Improving our price-to-book ratio (PBR) and heightening ROE are both important commitments that we have made to our shareholders and investors.

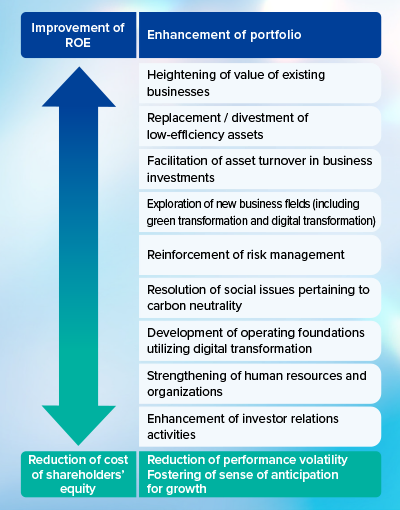

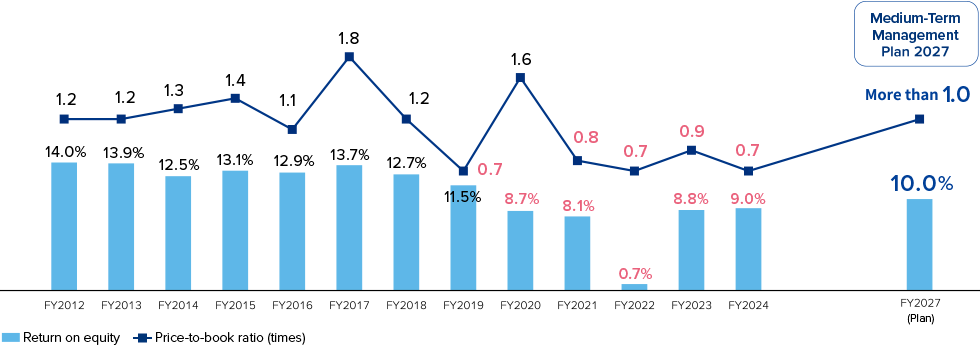

Tokyo Century seeks to quickly recover its PBR to above 1.0 times, reach ROE of more than 10%, and achieve a positive equity spread. These goals will be pursued through management emphasizing cost of capital and share prices. Our focus will be on measures for improving corporate value by heightening capital profitability and reducing cost of shareholders’ equity.

A crucial part of heightening capital profitability, one focus of our measures for improving corporate value, will be to reinforce our business portfolio. For this reason, we will be using the cash generated through existing businesses and the funds created via strategic divestment of low-efficiency assets to reinvest in growth fields that promise high profitability. In such ways, as well as through increases in asset turnover, we will seek to improve ROE and achieve ongoing growth in net income attributable to owners of parent.

As for reducing cost of shareholders’ equity, the other focus of our measures for improving corporate value, we will turn our attention toward the enhancement of non-financial capital. Specific efforts will include building sophisticated risk management frameworks, promoting human capital management, and ramping up highly transparent investor relations activities. Through these efforts, we hope to gain the trust of the market and have our business accurately evaluated.

Tokyo Century is currently in a stage of growth. Accordingly, we do not project that we will fall into a socalled diminishing equilibrium in which the amount of capital that we are able to allocate to growth investments will deplete. Rather, we will be heightening capital efficiency to strengthen our earnings power.

I would now like to explain some of the concrete measures we are advancing in this regard and describe the current operating conditions that are affecting these measures.

Transformation for Raising PBR Above 1.0 Times

Current Operating Conditions Pertaining to Management

Emphasizing Cost of Capital and Share Prices

When meeting with an investor in 2024, I remember being told that Tokyo Century was not surprising the market as much as it had been previously. This comment was made in the context of a comparison between the past and present performance of Tokyo Century—the Company maintained a PBR of above 1.0 times from the 2009 merger to the COVID-19 pandemic, but currently has a PBR of less than 1.0 times.

Previously, Tokyo Century achieved smooth and ongoing improvements in performance by branching out from the financing and leasing operations it has been developing since its founding. As part of this process, we broadened the scope of our operations to include automobiles, real estate, ships, aircraft, and other business areas dependent on the value of assets. We also actively engaged in M&A activities to differentiate our business model from those of our peers.

Notable successes achieved through this process include the conversion of Aviation Capital Group LLC (ACG), a U.S.-based aircraft leasing company that serves airlines around the world, into a consolidated subsidiary; the conclusion of a capital and business alliance with the NTT Group; and the establishment of NTT TC Leasing Co., Ltd. as part of this alliance.

However, we later found ourselves being impacted by emerging risks, such as the COVID-19 pandemic and the Russian invasion of Ukraine. These risks led to losses on impairment and debt defaults that totaled ¥160.0 billion over the period spanning from fiscal 2020 to fiscal 2022. One prominent loss was the U.S.$575 million loss associated with Russia recorded by ACG in fiscal 2022.

These losses, combined with the decline in aircraft prices, caused our capital use rate (Total risk amount / Consolidated economic capital)—a key risk indicator in our enterprise risk management (ERM) framework—to rise to the soft limit guideline of 75%. This prompted us to prioritize the enhancement of risk management frameworks and the health of our asset portfolio. At the same time, we saw changes to the M&A market, which limited the number of potential acquisitions that met our requirements for anticipated returns. The result was a temporary slowdown in growth investments. This invited a fall in expectations of the market regarding Tokyo Century’s growth and was likely one reason why our PBR has recently been below 1.0 times.

ROE and PBR Targets of Medium-Term Management Plan 2027

With regard to the extraordinary losses recorded by ACG, legal proceedings conducted in California requesting that insurance companies make the insurance settlement payments required by our insurance policies reached a settlement in fiscal 2025. As a result, an amount of U.S.$545 million, or roughly 95% of the initial amount of these losses, is expected to be recorded as extraordinary income in the full-year financial statements for fiscal 2025.

Insurance Settlement Proceeds from Legal Proceedings Related to the Exposure to Russian Airlines (As of September 30, 2025)

- *Total amount of insurance settlement proceeds from war risk insurers subject to legal proceedings in California

Organization-Wide Emphasis on Cost of Capital and Optimal Allocation of Capital and Risks

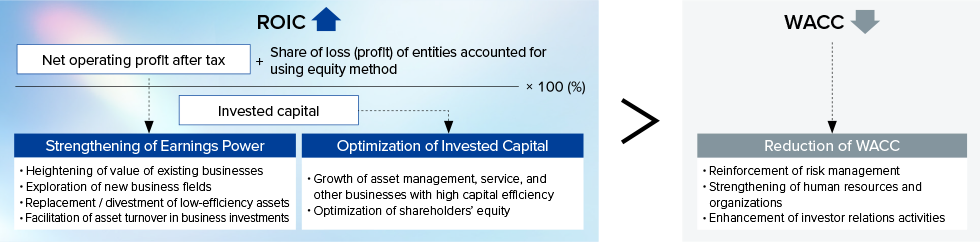

If we hope to achieve ROE that surpasses the level of 10% targeted by Medium-Term Management Plan 2027, increasing the scale of our asset portfolio alone will be insufficient; we must transform our business portfolio to be even more profitable. For this reason, Tokyo Century is placing emphasis on return on invested capital (ROIC), an indicator that reflects cost of capital, risks, and returns. As one facet of this approach, ROIC spread was introduced to the frameworks for assessing performance on an individual operating segment basis in fiscal 2025. With consideration paid to the structure of Tokyo Century’s businesses, we will seek to create an ROIC spread that entails ROIC surpassing weighted average cost of capital in all operating segments. This approach is anticipated to heighten awareness regarding capital efficiency across all operating segments and drive improved ROE on a Companywide basis. Measures to optimize our portfolio are currently being accelerated based on this approach toward capital allocation. We will in particular devote our efforts to growing operations in business fields that promise significant future potential in terms of ROIC spread and cash flow generation. Examples of these businesses include data centers, storage batteries, and principal investment.

Improvement of ROIC and ROIC Spread (ROIC-WACC)

Ongoing Quest to Strengthen Earnings Power

As we seek to transform our business portfolio to drive growth, we will need to further enhance our value creation process, which is born of two strengths: our refined ability to discern the value of assets and the partnership strategy that represents Tokyo Century’s unique core competence. Over the years, we have continued to maximize our potential business value by combining the expertise of partners with Tokyo Century’s asset-based insight pertaining to financing, businesses, and investments. Through this approach, we have created businesses together with prime partners such as the NTT Group and ITOCHU Corporation, whose operations are highly compatible with Tokyo Century’s key businesses.

One area where we are engaging in such partnerships is social infrastructure. Together with the NTT Group, which itself is engaged in communications and various other infrastructure businesses, we are developing data center projects in the United States and India. Data centers are a piece of digital infrastructure expected to see substantial growth in the future. Our operations in this field are made possible by combining the NTT Group’s insight with Tokyo Century’s financial functions. In addition, both companies have a long history of supporting safety and peace of mind in corporate fleet operation in the mobility infrastructure field through the joint venture Nippon Car Solutions Co., Ltd. We are thereby cementing our foundations for future growth in the automotive industry, which currently finds itself in a once-in-a-century period of change. We have also commenced investment in autonomous driving technology leader May Mobility, Inc. of the United States. This strategic investment is geared toward growing our automobility operations by creating new business models and earnings opportunities in preparation for the advent of an autonomous driving society. Meanwhile, we are developing joint renewable energy businesses in the United States together with ITOCHU, a company involved in global-scale trading and infrastructure businesses. These joint efforts are based on the recognition that renewable energy is an area slated for ongoing growth due to the expansion of power infrastructure in the United States amid rising demand for electricity for data center and other applications. Looking ahead, we will continue to seek out investment opportunities in areas where we stand to leverage the strengths of our partners and of Tokyo Century.

We are also making progress in efforts to strengthen earnings power in other businesses. In the Equipment Leasing segment, which handles businesses Tokyo Century has been engaged in since its founding, we are pairing the assets that customers lease with maintenance, communications, and other high-value-added services. These efforts are steadily realizing an upward trend in profitability versus costs.

Steady progress has also been seen in measures for increasing asset turnover in the Specialty Financing segment. For example, ACG has been selling aged aircraft in a timely manner in order to replace them with more profitable new-technology aircraft. This focus on asset turnover is contributing to higher ROA.

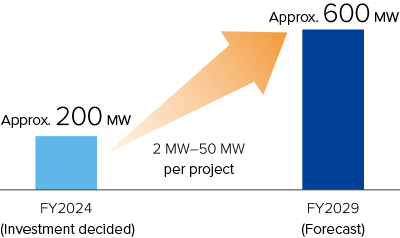

Tokyo Century is also advancing development a step ahead of its peers in the growth area of storage batteries. Specifically, we have secured the commercial properties and power grid connection capacity, which are key to this business. This has allowed us to build a strong position for promptly commencing operations. Renewable energy output is affected by changes in natural conditions. Accordingly, the spread of renewable energy will of course stimulate growth in demand for the storage batteries needed to stabilize the supply of power from renewable sources. By securing the advantage of an early comer in this field, which will no doubt see growth in the future, we look to develop our operations therein as a core business for supporting the decarbonization of society.

Output of Underdevelopment Grid-Use Storage Batteries

M&A Activities and Strengthening of Risk Management Frameworks

I cannot deny the importance of building our portfolio of standalone projects. At the same time, we plan to take a proactive stance toward M&A activities to accelerate business speed. When selecting investees for this purpose, we will prioritize important criteria like governance systems in addition to whether the expected returns are sufficient and if the company in question fits into our strategies.

Taking appropriate risks is an essential part of promoting sound growth investments. Tokyo Century has developed a comprehensive risk management framework for managing the types and amounts of risk exposure we accept and can tolerate, the returns expected from taking these risks, capital use rates, and other indicators of financial health. This framework is one facet of our efforts to enhance risk management. Through integrated monitoring and control of capital, risks, and returns, we look to spur ongoing business growth and build a healthy business portfolio.

Integrated Control of Capital, Risks, and Returns

Cash Allocation and Shareholder Returns

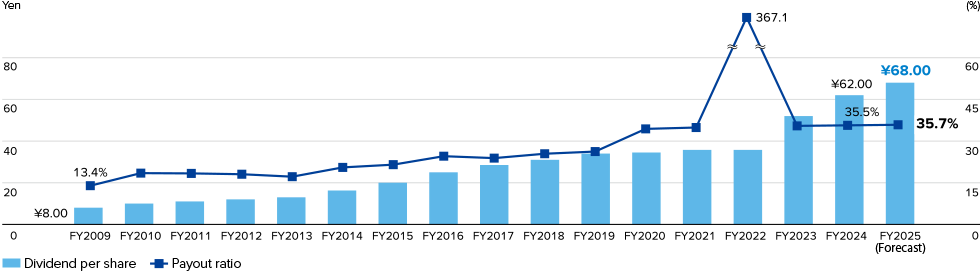

Tokyo Century’s underlying cash flow allocation policy is to take risks to the greatest degree possible, while practicing rigorous risk management, to achieve ongoing growth. We currently have the benefit of a robust growth investment pipeline, and we will thus be prioritizing growth investments when allocating the cash flows we have generated. Our policy for shareholder returns is to target a payout ratio of 35% while steadily increasing return amounts through progressive increases in line with income growth. For fiscal 2024, we raised dividend payments by 19%, or ¥10.00 per share, making for total dividend payments of ¥62.00. This increase was decided in reflection of income growth. Going forward, Tokyo Century will continue to live up to shareholder expectations through improvements in corporate value fueled by ongoing growth investments and through enhancements to shareholder returns in conjunction with said improvements.

Dividend per Share and Payout Ratio

- Note:Effective January 1, 2024, the Company conducted a four-for-one stock split of its common shares. Figures for dividend per share have thus been restated to reflect this change.

Enhancement of Organizational Structures and Human Capital to Support Future Growth

The growth of Tokyo Century’s income thus far has been driven by the priority allocation of management resources to commercial divisions for the purpose of achieving organic growth and promoting M&A activities. This approach, however, has led to income growth outpacing the rate of improvements in corporate functions. If we are to further improve corporate value and transition to the next growth stage, we will need to enhance our corporate functions to support this growth. Certain tasks must be addressed toward this end, one of which is the evolution of operating processes. For this task, we are embracing AI. We have been taking a phased approach toward the introduction of AI up until this point. In April 2025, we chose to ramp up our use of these technologies through the Companywide introduction of Google Gemini and NotebookLM generative AI tools. We have since been encouraging employees to use these technologies on their own accord, and they have been rapidly adopted, with more than 80% of all employees currently utilizing these tools. The massive gains in efficiency in routine work, like research and material preparation, are enabling employees to focus more on creative work that contributes to greater levels of value. Going forward, we will continue to tackle the task of introducing AI into our corporate functions in pursuit of higher levels of operational efficiency and quality.

At the same time, we are looking to enhance human capital. One of the targets of Medium-Term Management Plan 2027 is to conduct investments in human resource recruitment and development of more than ¥800 million by fiscal 2027. We are making full-fledged investments in human capital to move us toward the accomplishment of this goal. Presently, we recognize a need to revise our human resource systems to attract individuals with diverse experience and sophisticated expertise and help them deliver their maximum performance. This will be a vital part of accommodating the evolution and diversification of our business.

We also recognize that employee engagement is an important indicator, and we have thus been making a sustained, Companywide effort to achieve improvements in employee engagement. As a result, the employee engagement index was 56.2 (deviation value) in fiscal 2024, a year-on-year increase of 3.0. A noteworthy factor behind this increase was that we did not see a single decrease in the scores for any of the 128 items included in the employee engagement survey. This is clear evidence of how our efforts are being entrenched throughout all divisions across the Company, resulting in widespread improvements. Moving forward, we will utilize this objective data in dialogue across all divisions, driving a continuous improvement cycle—building on our strengths and addressing our weaknesses—to create an organization that supports employee ambitions.

Reduction of Cost of Shareholders’ Equity Through Enhanced Investor Relations Activities and Message for Shareholders and Investors

My mission in contributing to ongoing improvements in corporate value is to help create and expand a positive equity spread by limiting cost of shareholders’ equity to a level that is lower than ROE. Engagement with the capital market is an important part of my management approach toward accomplishing this goal.

In fiscal 2024, I focused on promoting both qualitative and quantitative improvements in our opportunities for engagement with capital market representatives. We thus had more than 250 meetings with individuals over the year. We also arranged a briefing on ACG’s business, which has been a subject of strong interest from investors and analysts. This online briefing featured an appearance by ACG CEO Thomas Baker, who joined from the ACG head office in Newport Beach, California. Attendees were thereby able to receive direct explanations on ACG’s measures for improving business profitability and its growth strategies. The briefing also served as a declaration of our commitment to increasing transparency in important businesses and practicing accountability by offering opportunities to receive explanations directly from the leaders of operating companies.

Online ACG business briefing

The valuable input and objective guidance gained through such engagement activities are regularly communicated to the Board of Directors and to the Management Meeting. We recognize that such feedback is incredibly important for both enhancing management strategies and increasing the effectiveness of management oversight functions.

We remain committed to the exhaustive provision of information for helping investors make accurate investment decisions and to the heightening of management transparency to ensure that Tokyo Century is always worthy of trust.

I would like to ask our shareholders and investors for their ongoing support of the Tokyo Century Group in the months and years to come.