Compliance

- Compliance Structure of Tokyo Century Group

- Internal Reporting System

- Compliance Handbooks

- Compliance Education

- Preventing Money Laundering

- Preventing the Transfer of Criminal Proceeds

- Preventing Corruption

- Policy on Political Funds

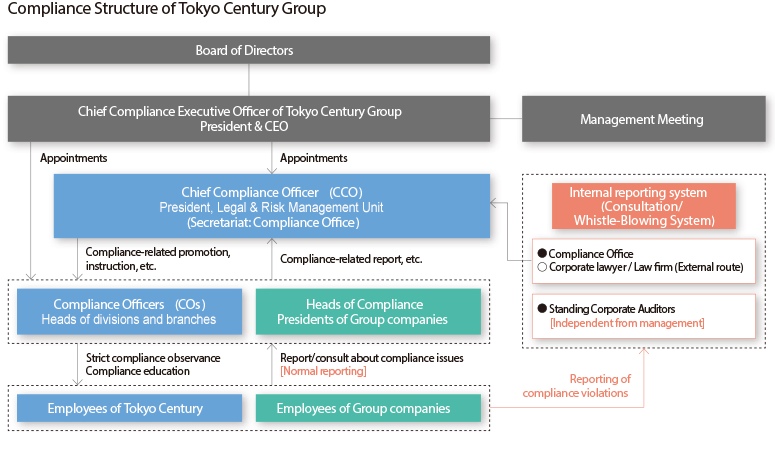

Compliance Structure of Tokyo Century Group

Based on the awareness that thorough adherence to compliance is essential to the continued existence of a company, Tokyo Century Group strives to ensure the establishment of a system of management which will be trusted by society at large and in which all officers, managers, and employees act based on a just and high sense of ethics.

In Tokyo Century Group, the President & CEO of Tokyo Century Corporation heads the compliance of the entire Group as the Chief Compliance Executive Officer, and the Compliance Office plays a role in exercising, promoting, educating and reviewing compliance matters, such as human rights, anti-corruption including bribery across the entire Group in accordance with compliance programs under the supervision of the Chief Compliance Officer (CCO) who is appointed by the President & CEO.

At each organizational group, such as divisions and branches, the head of each group acts as the Compliance Officer (CO) to take responsibilities for promoting compliance awareness of each own group, including handling compliance matters and carrying out compliance trainings in collaboration with the Compliance Office.

At our consolidated subsidiaries, the President or an officer equivalent to president acts as head of compliance, in order to take control of building, maintaining and managing the compliance of each subsidiary through the instructions, guidance and advices from CCO. As for non-consolidated group affiliates, the Compliance Office gives guidance and advice on compliance structure management and promotion in a timely manner.

We report and review the Group’s compliance structure and operation as well as identified compliance violations at the Management Meeting and the Board of Directors every half year for review, including its effectiveness. Based on the results of the review, we make and implement compliance promotion plans. Apart from this, we oblige all the officers and employees to submit a compliance pledge once every year in order to comply with our compliance regulations.

In fiscal 2024, there was no major compliance violation, including human-rights violations deserving of public announcement.

Internal Reporting System

Tokyo Century Group strives to detect and address risks at the earliest possible stage, enhance its organizational self-cleansing ability, and reinforce its compliance management by operating an internal reporting system (Consultation/Whistle-Blowing System) that allows officers and employees who become aware of a compliance violation to directly report such the matter without the intervention of their superiors.

1. Outline of Internal Reporting System

All officers and employees of Tokyo Century Group companies in Japan and overseas are eligible to use this internal reporting system, including directors, officers, permanent employees, contractors, temporary staff, seconded employees, part-time staff, and others), as well as those who have retired within the past year.

We have set up three contact points: the Compliance Office inside the Company; the legal counsel’s office outside the Company, which is well informed in this field; and full-time corporate auditors in order to ensure independence. Reports can be submitted through any of these channels, irrespective of content, and be submitted in any form, such as by email or other writing, as well as phone or otherwise verbally, to the contact points listed on the Company’s intranet and included in the Group’s Compliance Handbook.

The system covers a wide range of issues, including violations of the Anti-Monopoly Act that impede fair competition; bribery and other acts of corruption; violations of the Financial Instruments and Exchange Act that undermine the interests of investors; harassment; violations of any laws concerning business operations, including human rights violations; and misconduct that violates corporate ethics or internal rules. Furthermore, the reporting system is open to consultation for when an individual becomes aware of or is concerned about a compliance violation or when they have a question about compliance in the course of executing business.

Whistleblowers are placed under stringent protection. We strictly prohibit any disciplinary action, retaliation, or other disadvantageous treatment of whistleblowers by the Company and strive to thoroughly secure anonymity and maintain confidentiality concerning their reports. Personnel involved in responding to these reports are designated as in charge of whistleblowing, as stipulated in Japan’s Whistleblower Protection Act, and are obliged to maintain complete confidentiality relative to the identity of the whistleblower or risk of being recognized.

2. Response to Issues Raised by Internal Reports

When an issue is reported, the chief compliance officer (CCO) is consulted to determine a response with due consideration to the whistleblower’s wishes, and as deemed necessary, an investigation is promptly conducted to establish the facts. The Company is obliged to notify the whistleblower (within no more than 20 days) as to whether an investigation will be conducted, and provide reasons for the decision, except when the report has been submitted anonymously.

During this process, we impose strict confidentiality on those involved in or subject to any investigation and prohibit any disadvantageous treatment of those under investigation or cooperating with it, as is the case with a whistleblower.

Timely reports on the status of an investigation are made to the CCO, who, in the event of a confirmed compliance violation, will implement corrective measures and seek to prevent further damage based on the advice of legal counsel while also taking action to prevent a recurrence. The CCO will take remedial action if the case is related to a violation of human or other rights.

Serious compliance violations will be reported to the chief compliance executive officer of Tokyo Century Group (president and CEO of Tokyo Century Corporation) and the corporate auditors.

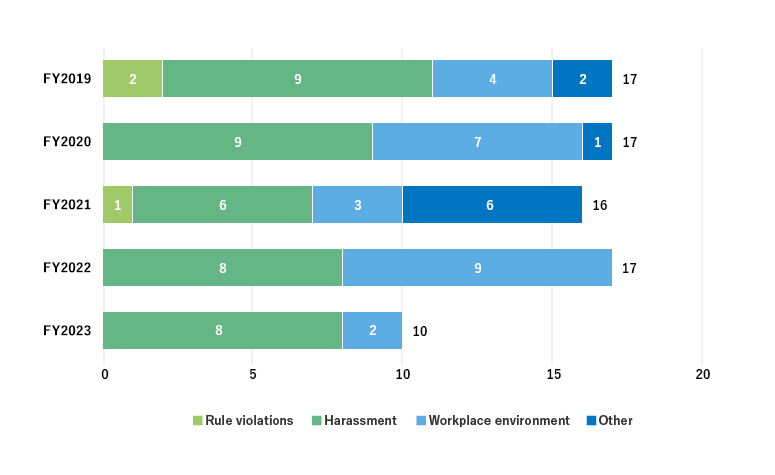

3. Status of Reports Received by Internal Reporting Contact Points

The types of cases received by the contact points for internal reporting are roughly classified into such categories as rule violations, harassment, workplace environment, and other. The number of cases received over the years, including those reported by Group companies in Japan and overseas, are summarized in the graph below. There was a total of 28 cases in fiscal 2024.

Appropriate corrective measures are being taken in accordance with the content in all types of cases.

4. Review and Promotion of Internal Reporting System

Use of the internal reporting system and responses to individual cases are reported semiannually to the Management Meeting and Board of Directors and regularly checked and evaluated by our legal counsel to make any necessary improvements.

We also promote use of the system among all officers and employees through an annual compliance survey, which serves to remind them about the system, and through semi-annual e-learning sessions and additional training seminars that explain its purpose and related details.

Compliance Handbooks

The Tokyo Century Group has prepared a Compliance Handbook that lays out the basics of compliance and makes it available on its corporate portal at all times. Themes include our Management Philosophy, Corporate Code of Conduct, compliance-related internal regulations, the Group’s stance toward respect for human rights, prohibition of harassment, prevention of insider trading, and prevention of corruption, and all officers and employees can review and look back at them at any time to deepen their understanding of compliance and to share their awareness.

The Group also strives to improve the compliance mindset at our local subsidiaries overseas and has created an English edition of the handbook for these companies.

Compliance Education

Aiming to instill a compliance mindset in its organizations, Tokyo Century Group provides systematic and continuous compliance education through such means as rank-based training; e-learning programs for all officers, managers, employees, contractors, and temporary staff; and compliance training at workplace conducted by compliance officers (the head of divisions and branches).

Scrollable horizontally

| Targets (Training Methods) |

Major Subjects | No. of Training Per Year |

|---|---|---|

| New employees |

Introduction to Compliance

Information security

and others |

1 |

| New head of divisions and branches |

Roles and responsibilities of the head of divisions and branches concerning risk management and compliance

and others |

1 |

| Mid-career hires (e-learning) |

and others |

As needed |

| All officers and employees (e-learning) |

and others |

2 |

| Employees at each division and branch (Training conducted by compliance officers/the head of each division or branch at workplace) |

and others |

About 4 |

| Employees at overseas bases (Training for assignees /training conducted by the head of compliance (base head)/e-learning) |

Training for overseas assignees

|

As needed |

|

Training conducted by the head of compliance (base head) at workplace

and others |

4 or more | |

|

As needed |

Preventing Money Laundering

In accordance with our Corporate Code of Conduct and Guidelines for Our Action, Tokyo Century Corporation recognizes the importance of taking action against money laundering, financing of terrorism, and proliferation financing (hereafter ML/FT) and strives to prevent Tokyo Century Group, our customers, and our employees from becoming involved in ML/FT.

The Group therefore works to prevent regulatory violations associated with ML/FT while continuously strengthening its countermeasures to fulfill the requirements of international organizations such as the United Nations and the Financial Action Task Force on money laundering (FATF) and to adhere to the laws and regulations of Japan and other countries, including those imposed by the U.S. Office of Foreign Assets Control (OFAC).

A specific internal control framework and operations are stipulated in our Regulations for Anti-Money Laundering and Financing of Terrorism.

1. Establishment of a framework to prevent money laundering and financing of terrorism

The Company recognizes measures against ML/FT as an important management issue and will establish and maintain an effective control framework.

2. Commitment by management

The Company’s management takes a leadership role in preventing ML/FT.

3. Identification, assessment, and mitigation of risks associated with money laundering and financing of terrorism

The Company takes a risk-based approach to verifying and identifying risks related to ML/FT that are relevant to the Company, assesses the risks identified, and takes appropriate action to mitigate the risks in light of the assessment results.

4. Customer verification

To ensure public security and sound economic practices, the Company takes Know Your Customer (KYC) measures in a timely and appropriate manner to prevent ML/FT that encourages organized crime and to block any relationships with anti-social forces. To this end, we make use of databases and other tools to filter prospects prior to transactions and conduct checks during transactions in addition to monitoring contract procedures based on internal rules.

5. Notification of suspicious transactions

The Company will promptly notify the authorities in the event that it detects suspicious transactions based on checks and monitoring conducted during transactions or through reporting by sales and other divisions.

6. Training of officers and employees

The Company provides ongoing training so that its officers and employees can deepen their knowledge of prevention of ML/FT and take appropriate action at any time necessary.

7. Compliance auditing

To ensure appropriate operations regarding the prevention of ML/FT, the Company conducts internal audits on a regular basis and strives to improve its internal framework.

Preventing the Transfer of Criminal Proceeds

Tokyo Century Corporation takes appropriate actions during transactions, such as pre-transaction verification, recordkeeping, and reporting of suspicious transactions, in accordance with the Act on Prevention of Transfer of Criminal Proceeds.

Under this act, we have established strict rules, which are enforced when it is considered necessary to conduct high-risk transactions that pose a greater degree of potential for money laundering or other illegal activities. In addition to the implementation of standard pre-transaction verification, these rules require the verification of the identity of each customer and the ultimate beneficial owner through a stringent method, as well as the decision—made by the supervisor of inspections of the verification—on whether or not to proceed with the transaction.

1. Transactions subject to pre-transaction verification:

- (1)Finance lease

- (2)Lending of funds and intermediation of loan transactions

- (3)Transactions concerning the purchase and sale of securities, including deemed securities, as defined by the Financial Instruments and Exchange Act

- (4)Transactions as an agency and intermediary for customers concerning the buying and selling of real estate

- (5)Other specified transactions as defined by the Act on Prevention of Transfer of Criminal Proceeds

- (6)Transactions that require special attention in regard to customer management

2. High-risk transactions that pose a greater degree of potential for money laundering or other illegal activities:

- (1)Specified transactions* where the counterparty is suspected of impersonating a customer or a formally designated person based on verified identities from previous transactions

- (2)Transactions with a customer suspected of having provided false information during verification for a specified transaction* in the past

- (3)Specified transactions* involving the transfer of assets with a customer residing in or located within a country or region specified by Cabinet Order

- (4)Specified transactions* conducted with foreign nationals who are politically exposed persons

*Transactions that fall under “1. Transactions subject to verification”

Preventing Corruption

Tokyo Century Group is committed to preventing corruption by conducting fair, equitable, and transparent transactions in all our operating activities.

1. Initiatives for preventing corrupt practices

The Group makes a concerted effort to ensure compliance and prevent corruption while addressing issues such as prevention of money laundering, financing of terrorism, and proliferation financing; the blocking of any relationships with anti-social forces; prohibition of insider trading; and compliance with the Anti-Monopoly Act, including cartels and bid-rigging, as well as the competition laws of other countries.

2. Prohibition of bribery

Except as permitted by the relevant rules, the Group prohibits offering entertainment, cash, or any other benefits to domestic and foreign public officials* and engaging in behavior such as receiving, demanding, or promising illicit or unjustifiable business profit with the intention of obtaining favors, rewarding public officials for favors obtained, or gaining illicit profit, either directly or indirectly through agents, consultants, or any other third party.

*Includes public officials, quasi-public officials, foreign public officials, and officials and employees of special companies.

In our international business, we remain particularly committed to acting prudently and appropriately with regard to entertainment and gifts to and from foreign public officials in stringent compliance with the laws and regulations of Japan and those of other countries and regions.

- (1)Key considerations for providing entertainment and gifts to public officials

- ①Entertainment and gifts should not be given with the intention of obtaining favors or rewarding public officials for favors obtained.

- ②Cost and other expenses must be within the scope of typical social norms.

- ③The location of meetings and handling of expenses must be open and transparent.

- ④Confirmation with the recipient must be made that the provided entertainment or gift does not violate any internal rules nor any public laws or regulations.

- ⑤If the recipient is a foreign public official, in addition to meeting the above requirements from ① to ④, it must be clear that the purpose is not to obtain illicit business profits, and the expenses must be kept within the customary and socially acceptable range of the country of the foreign public official.

- ①

- (2)Prohibition of entertainment and other benefits that violate social normsExercise caution and refrain from frequently offering entertainment or gifts to specific business partners and related parties as well as those regarded as expensive according to some social norms or industry practices.

3. System and response

We ensure whistleblower protection so that no disadvantageous actions are directed toward any officer or employee who reports on, or who provides information concerning violations or potential violations of laws, regulations, or internal rules on preventing corrupt practices.

4. Education and training

To ensure that these anti-corruption initiatives are thoroughly understood and implemented by officers and employees across the Group, they are clearly laid out in our compliance handbook in Japanese and English, and they are also incorporated into e-learning and other in-house training as necessary.

We have compiled Guidelines on Offering Entertainment to Public Officials in Japanese and English that state the points to be noted to ensure that they are well understood by officers and employees of overseas Group subsidiaries.

5. Reporting

The progress and status of initiatives for preventing corrupt practices are reported to and reviewed by the Management Meeting and Board of Directors to implement the Group’s compliance system.

In fiscal 2024, no fine was imposed on the Group and no officers or employees were dismissed or disciplined for corruption.

Policy on Political Funds

Tokyo Century Group Code of Conduct stipulates we act from a global perspective that is highly transparent and sincere, by respecting the cultures and customs of the countries and regions in which the Group operates and complying with all laws, regulations, and rules, in addition to conducting sound and fair corporate activities in accordance with social norms.

Our policy on political funds prohibits donations to political parties, political fundraising groups, other political organizations, and candidates for public office (e.g., politicians).

Therefore, no political contributions are recorded each year.