Risk Management

Tokyo Century Group has proactively designed appropriate risk countermeasures according to risk scale and likelihood. Our systematic countermeasures to minimize the risk of losses are as follows.

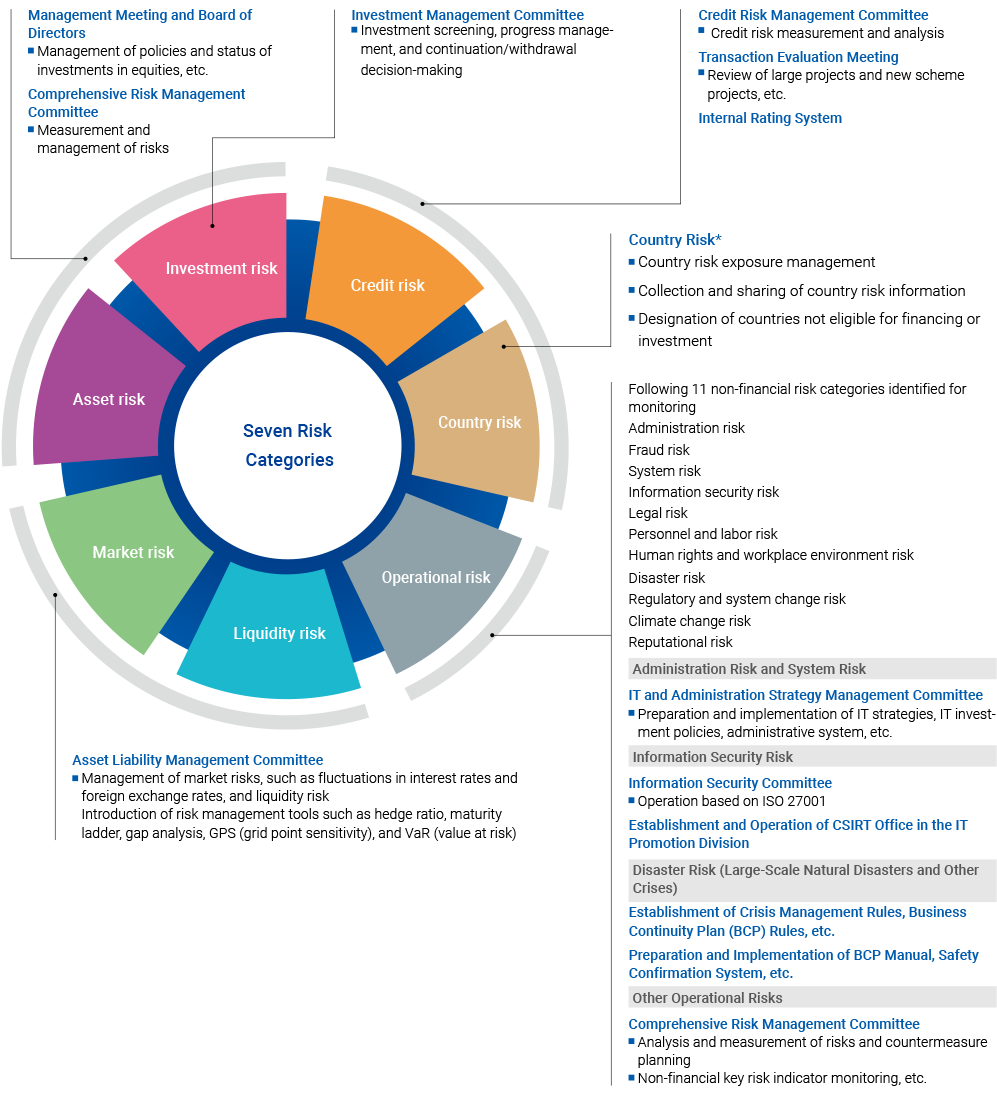

At Tokyo Century, the Board of Directors lays down the Basic Risk Management Policy to ensure appropriate risk management of the Company. The Comprehensive Risk Management Committee comprehensively identifies and assesses risks concerning the Company to appropriately address risks qualitatively and quantitatively as necessary based on the rules of the Committee. Risk management structure, methods and others are specified in the Comprehensive Risk Management Rules that are determined at the Management Meeting after a deliberation by the Comprehensive Risk Management Committee. The Comprehensive Risk Management Committee reports the amount of risks and risk management status of the entire Company at the Management Meeting and the Board of Directors on a regular basis and on a case-by-case basis, and also the President of the Legal & Risk Management Unit reports on risks to the President & CEO of the Company. In addition, through supervision on these reports, the Committee verifies and assesses the effectiveness of risk management and constantly reviews the whole status.

Major Risks and Management Frameworks

Non-Financial (Non-Quantitative) Risks

As our business domain grows and we branch out from the financial sector to provide business services, it is becoming increasingly important to account for non-financial operational risks that cannot be measured quantitatively. Based on this recognition, Tokyo Century has established key risk indicators (KRIs) for non-financial risks. Regular monitoring of these KRIs is performed, and the results are reported to the Board of Directors and other relevant bodies. KRIs have been set pertaining to human resources, information security, accidents, compliance, climate change, legal affairs, and corruption. We are also expanding our range of environmental KRIs in relation to renewable energy, CO2 emissions, and the portion of our portfolio accounted for by fuel-efficient aircraft and electrified vehicles and have broadened the scope of personnel and labor risk (from non-consolidated to consolidated) amid the rising importance of tracking and managing human rights and climate change risks. Nevertheless, stakeholder concern for non-financial risks is constantly rising. From the perspective of sustainability, Tokyo Century will continue to bolster its range of effective indicators related to human rights and climate change risks as well as to other environmental, social, and governance (ESG) factors and to the United Nations Sustainable Development Goals (SDGs).

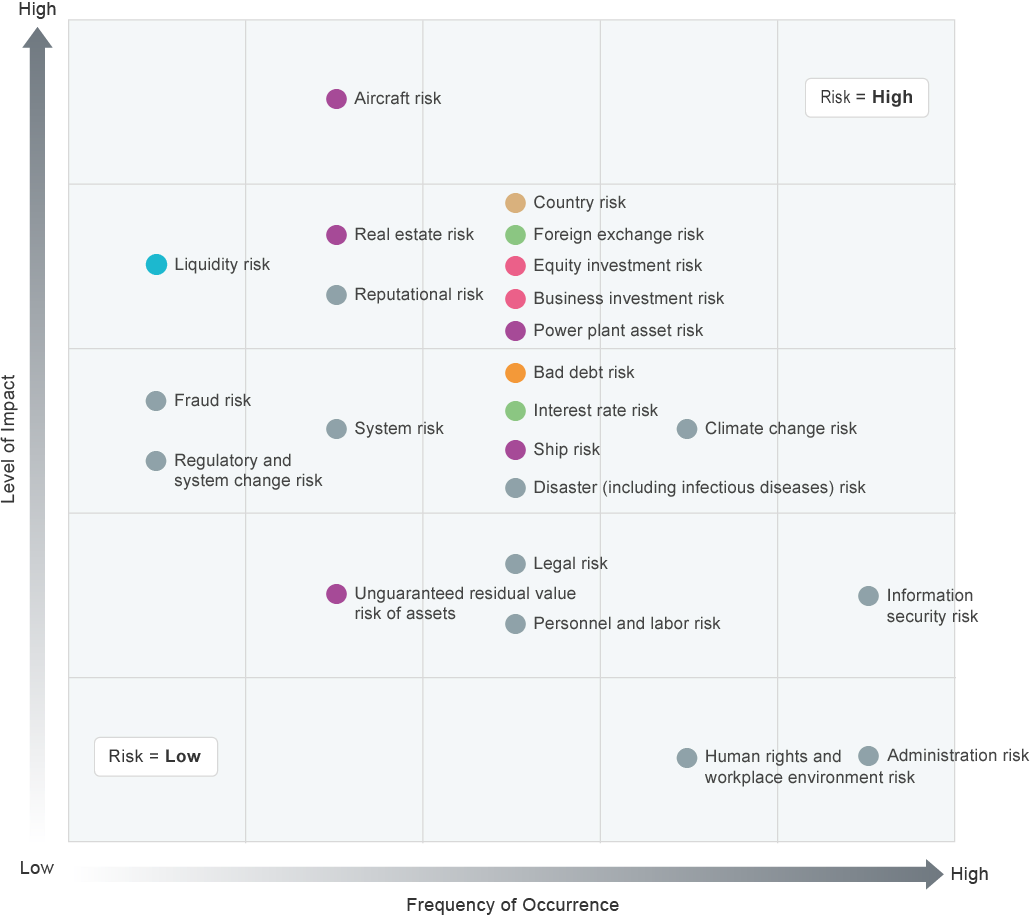

Risk Heatmap

The Basic Risk Management Policy and the Comprehensive Risk Management Rules define risk categories. The Group assesses annual secular changes in its business operations and maps these categories using a matrix that measures the level of impact and frequency of occurrence. This is reviewed every year in comprehensive consideration of various factors, such as trends in risk scenarios in risk audits, the amount of risk in each risk item, initiatives, and incidents or accidents.

Risk Categories and Risk Items

Scrollable horizontally

| Risk Categories | Risk Items |

|---|---|

| Credit risk | Bad debt risk |

| Country risk | Country risk |

| Market risk | Interest rate risk, Foreign exchange risk |

| Investment risk | Equity investment risk, Business investment risk |

| Asset risk | Unguaranteed residual value risk of assets, Real estate risk, Ship risk, Aircraft risk, Power plant asset risk |

| Liquidity risk | Liquidity risk |

| Operational risk | Administration risk, Fraud risk, System risk, Information security risk, Legal risk, Personnel and labor risk, Human rights and workplace environment risk, Disaster (including infectious diseases) risk, Regulatory and system change risk, Climate change risk, Reputational risk |