Actions for Realizing Management That Emphasizes Cost of Capital and Stock Price

- Current Status and Future Approaches

- Initiatives to Improve Stock Price

- Engagement with Shareholders and Other Investors

- Major IR Activities

Current Status and Future Approaches

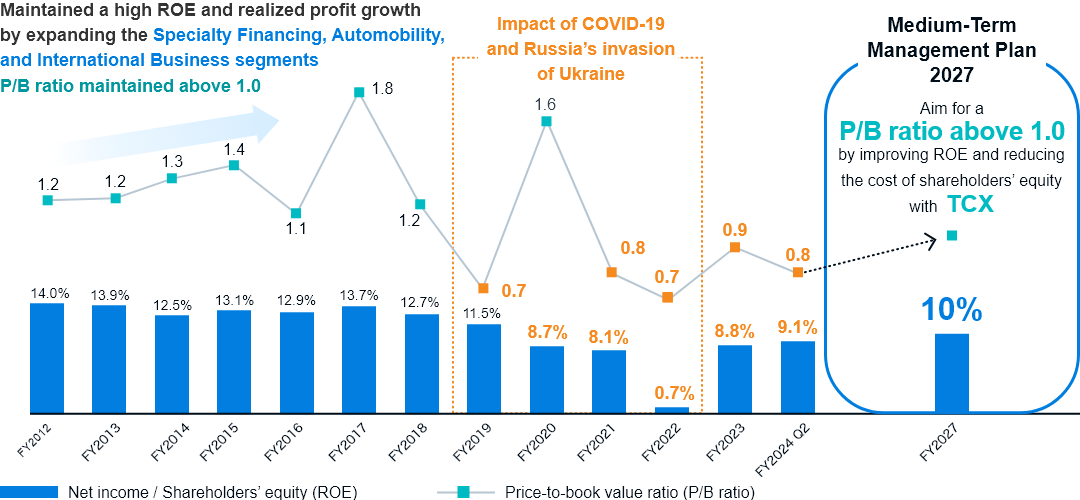

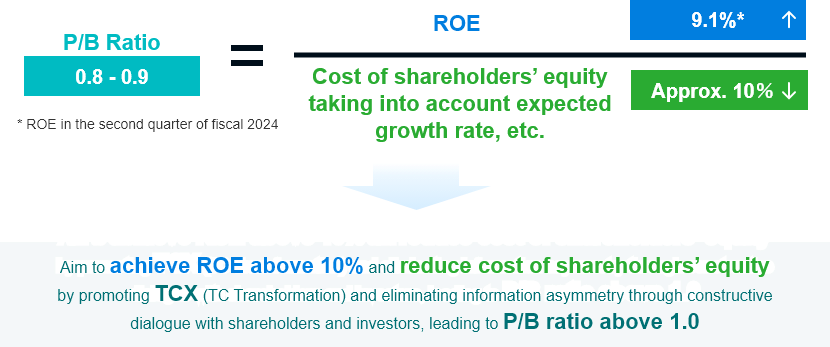

Regarding actions for realizing management that emphasizes cost of capital and stock price, Tokyo Century disclosed the status, future approaches, and related information, including the recognition that its cost of shareholders' equity was 10%, in December 2023. Recently, in the second quarter of the fiscal year ending March 2025, the Company's return on equity (ROE) has recovered up to 9.1% from its level at the end of the fiscal year ended March 2024, due to improved market conditions and our initiatives. However, it is still below the cost of shareholders’ equity of 10%, equity spread was negative, and thus price-to-book (P/B) ratio was below 1.0 time, reflecting the current level of its stock price. Based on these situations, we have discussed our current assessment and future improvement actions with our directors.

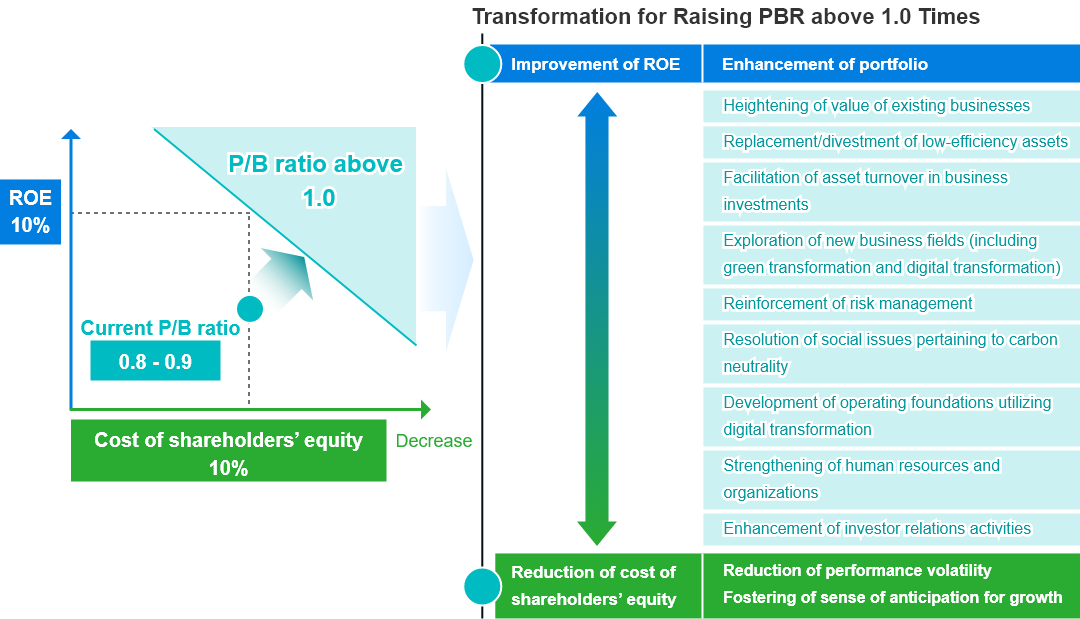

One of the factors that prevents improvement in the Company’s stock price is a lack of investment for portfolio transformation, one of the basic policies for Medium-Term Management Plan 2027 that aims to build a highly profitable and stable portfolio. We recognize that the lack of investment is reducing an expected growth rate, bringing about a decrease in the price earnings ratio (PER). In addition, a capital increase as a result of yen depreciation, as well as a sluggish improvement in ROE due to movements of interest rates in Japan and the U.S., are also factors in a low stock price. We have also concluded that cost of shareholders' equity still remains 10% for the moment.

In order to improve PER, we will strive to strengthen and expand collaboration with prime partners such as Itochu and the NTT Group in businesses focused on asset value, which are one of our strengths, and thereby cultivate a sense of anticipation for our future growth. As for reducing cost of capital, we will also make efforts to resolve information asymmetry through investor relations activities, in addition to strengthening risk management and corporate governance.

We will steadily implement measures formulated under the Medium-Term Management Plan 2027 so that we can gain adequate recognition for our medium- to long-term earnings stability and growth from the stock market. We aim to achieve an ROE of 10% or higher early by improving ROA while emphasizing cost of capital based on risks and returns. We recognize it is also essential that we will strive to improve information disclosure and have a productive dialogue with market participants, thereby reducing cost of shareholders’ equity.

- *The above P/B ratios are calculated based on the closing stock price at the end of each fiscal year.

Initiatives to Improve Stock Price

| Item | Performance (for Medium-Term Management Plan 2027) and Future Approaches |

|---|---|

| Advancement of portfolio transformation: Replacement/divestment of low-efficiency assets; facilitation of asset turnover in business investments; heightening of value of existing businesses; and exploration of new business fields |

Improving ROE requires higher ROA. To this end, we will advance portfolio transformation through growth investment and divestment. |

| Reinforcement of risk management |

Through integrated control of capital, risks, and returns, we will maintain financial health, improve capital efficiency, and achieve a better risk-and-return balance in order to maximize earnings. We are approaching this task from four perspectives, management of capital use rate guidelines, management of risks and returns emphasizing cost of capital, entrenchment and enhancement of the investment management framework, and country risk and global risk readiness. As for management of risks and returns emphasizing cost of capital, we are working to utilize return on invested capital (ROIC) spread in a more sophisticated manner by taking into account the cost of capital. Measures include introducing weighted average cost of capital (WACC) reflecting risk characteristics for each operating segment in such endeavors as the replacement of assets in our portfolio and the assessment of businesses. |

| Strengthening of human resources and organizations |

|

Engagement with Shareholders and Other Investors

Tokyo Century advances its investor relations (IR) activities focused on generating a cycle of proactive dialogue with shareholders and other investors and communicating their input and requests to management and employees. The input gained during IR activities is used to improve information disclosure and respond to management issues to build trust with shareholders and other investors and to ensure that capital markets accurately appraise the Company, which in turn is expected to contribute to higher corporate value over the medium to long term.

Major IR Activities

Scrollable horizontally

| Activities | FY2023 | 1st Half of FY2024 | Details |

|---|---|---|---|

| Earnings calls | 4 times | 2 times | Quarterly earnings calls (Three-month and nine-month calls led by the officer responsible for IR; six-month and full-year briefings led by the president) |

| Individual meetings | 260 times | 150 times | Meetings with analysts and institutional investors in Japan and overseas (Of which, approx. 60 meetings with overseas institutional investors) |

| Investor briefings | 4 times | 1 time | Investor briefings led by the president and the officer responsible for IR |

| Business strategy briefings | 1 time | - | Business strategy briefings for institutional investors in Japan and overseas |

| Overseas roadshows | 2 times | 1 time | Face-to-face meetings between the president and IR representatives and overseas institutional investors |

Scrollable horizontally

| Activities | FY2023 | 1st Half of FY2024 | Details |

|---|---|---|---|

| Company briefings | 1 time | 1 time | Briefings on the Company, business strategies, shareholder return policies, etc. |

Representative Improvements Based on Feedback from Dialogue with Shareholders and Other Investors

-

1Opinion on disclosure of the IR Presentation materials (fiscal 2024)

- Disclosure of the Data Books

- Investors wanted the financial results to be disclosed in Excel format so that quantitative analysis can be easily performed.

- Improvements

- The financial results that had already been disclosed have been organized in Excel format in both Japanese and English and are now disclosed on the Company’s Investor Relations website. The outline of the disclosure is as follows:

Figures disclosed in the financial results materials, such as Consolidated Financial Results (Kessan Tanshin) and IR Presentation materials (balance sheet, profits and losses, and other indices)

Main financial data: For the past 11 years

Detailed financial data: For the past 5 years and quarterly results for the past 3 years including the current fiscal year

-

2Opinion on disclosure of the IR Presentation materials (fiscal 2024)

- Net income forecast by operating segment

- Investors wanted to have more information on the forecast of net income by operating segment.

- Improvements

- Starting from the first quarter of the fiscal year ending March 2025, we have added information on the progress of the net income plan by operating segment in disclosed materials for quarterly financial results.

-

3Opinion on dividends (fiscal 2024)

- Clarification of progressive dividend policy

- Investors wanted dividends to be paid without reducing the amount in line with profit growth.

- Improvements

- We have clarified a dividend policy under the Medium-Term Management Plan 2027 that we aim to increase dividends per share with profit growth while adopting a progressive dividend policy as our basic stance.

-

4Opinion on officer compensation (fiscal 2024)

- Revision of the officer compensation system

- Investors requested that the officer compensation system be revised to reflect shareholder return.

- Improvements

- The Company has created a framework that links officer compensation with their contributions to medium- to long-term business performance and Tokyo Century Transformation (TCX). In addition, it has adopted the Company’s stock growth rate as an evaluation indicator for officer compensation in order to align the Company’s and shareholders’ perspectices and further raise officers’ awareness of increasing shareholder value. In May 2024, the Company revised its officer compensation system in this way and also introduced a new performance-linked stock compensation plan, the Board Benefit Trust-Restricted Stock (BBT-RS).

-

5Opinion on formulation of the medium-term management plan, received prior to disclosure of the Medium-Term Management Plan 2027(fiscal 2023)

- Profit growth scenario for each operating segment

- In terms of disclosure of profit targets under the Medium-Term Management Plan 2027, market participants will consider that Tokyo Century should disclose earnings forecasts and offer a profit growth scenario for each operating segment. Merely indicating figures for the entire plan will not be enough to factor the plan into the Company’s stock price because Tokyo Century is not a corporate group selling a single product.

- Results

- We sought to enhance our disclosure by presenting profit plans, profit growth scenarios, and increases in assets for each operating segment in the Medium-Term Management Plan 2027, based on communication of investor opinions to management and due consideration of our disclosure required through dialogue.

-

6Opinion on profitability(fiscal 2023)

- Improvement of ROA

- To improve ROA, it is important to raise the profitability of each business whose ROA is lower than that of the entire company. I know this will not be easy, as many of Tokyo Century’s businesses are joint ventures, but I hope the Company will make progress on this point.

- Results

- One of the case examples of ROA improvement was attributable to the conversion of Orico Auto Leasing Co., Ltd. (OAL) and Orico Business Leasing Co., Ltd. (OBL) into equity-method affiliates.* They are joint operating companies with Orient Corporation. We decided that OAL and OBL needed to improve efficiency and productivity through flexible business development and create optimal systems in order to respond promptly to customer needs and that their sustainable growth required reinforcement of collaboration with the Orico Group going forward.

- *Converted into equity-method affiliates on September 29, 2023.

-

7Opinion on disclosure of IR materials on earnings(fiscal 2023)

- Identifying core earnings

- Tokyo Century’s business profit includes transitory gains and losses such as gain on sales and impairments. The Company should at least disclose a breakdown of these items so that the core earnings can be identified and reflected in its share price.

- Details

- As for gain on sales, we disclosed gains on sales of real estate and operational investment securities. In addition to the gain on sales, we disclosed figures for transitory gains and losses as “Impairment, bad debt, and gain (loss) on valuation of operational investment securities.”