Specialty

Financing

Unlocking the Future

We are developing unique and viable businesses based on sophisticated expertise for a variety of products.

Specialty Financing

Specialty Financing

Driving Tokyo Century’s growth through business development leveraging a high level of expertise

- Segment Assets

- ¥ 2,972.9 billion

- Distribution of Segment Assets

- 49.1 %

- Net Income Attributable to Owners of Parent

- ¥ 32.9 billion

*As of March 31, 2025

Strengths

The strength of this segment is keenly discerning its areas of expertise, such as shipping, aviation, real estate, principal investments, and structured finance, as well as providing high-value-added solutions and a complementary portfolio of businesses.

We dynamically develop business in Japan and overseas through solid partnerships with prime players in each area, while constantly taking on the challenge of creating new business areas.

Opportunities

- Establishing new technologies such as AI, DX, and smart robotics, and expansion of business fields

- Capturing commercial opportunities associated with the transition to a decarbonized society

- Increasing opportunities in light of current corporate restructuring and carve-out trends

- Acquiring highly skilled human resources in response to the growing mobility of human resources

Risks

- Shrinking domestic market and labor force for products due to population decline

- Earnings under pressure and sluggish consumption due to rising interest rates and resource prices

- Changes in the environment due to manifested and increased geopolitical risks

- Director and Senior Managing Executive Officer,

- President, Specialty Finance Business Development Unit

Mahoko Hara

Achieving Sustainable Growth by Offering Superior Expertise and Flexible Responsiveness to the Changing Environment

In the Specialty Financing segment, we have been expanding our business areas by aggressively pursuing M&A and undertaking collaborations with prime partners based on our high level of expertise in diverse products and the Group’s comprehensive strengths. We also focused on asset life cycle management and directed our energy into constructing a value chain that covers a wide range of activities from development and operation to recycling and resale of assets.

Progress in New Initiatives in the Areas of ESG and the SDGs

In fiscal 2023, the Specialty Financing segment, through its structured finance, aviation, shipping, and real estate businesses, strengthened its contributions to realizing a decarbonized society and developing social infrastructure as key aspects of Tokyo Century’s materiality.

In the structured finance business, we invested in a forestry fund arranged by the Sumitomo Forestry Group. Our involvement in managing the fund will contribute to creating high-quality carbon credits and developing new businesses related to forestry.

Major Offerings

Real Estate

We engage with prime partners in large-scale investment development of domestic offices and hotels and overseas data centers, as well as leasing of real estate such as logistics and commercial facilities in Japan.

Related Services

Structured Finance

We deliver tailor-made solutions to meet diverse customer demand, including off-balance sheet and cash flow improvement needs. We also serve as an incubator in the Specialty Financing segment.

Principal Investments

We promote co-investment with our strategic partner Advantage Partners, Inc. Focus areas include carve-outs of large companies, renewable energy, and business succession for owner-operated companies.

Aviation

Solutions are offered for the entire aircraft life cycle, from aircraft leasing through our wholly owned subsidiary Aviation Capital Group (ACG) to engine leasing, financing, and sales of used airframes and parts.

Shipping

We deliver a wide range of products, including loans and leases to finance the vessel construction and purchase. We also focus on business with our own ships, mainly bulk carriers.

Legendary-Luxury Brand Dorchester Collection Will Open Its Hotel in TOKYO TORCH, Japan’s New Landmark Beckoning the World

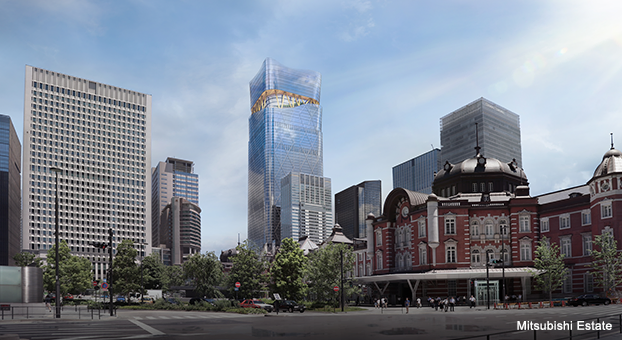

Mitsubishi Estate Co., Ltd. and Tokyo Century Corporation announced that Dorchester Collection, one of the world’s leading luxury brands, has been selected to manage the hotel within Torch Tower, the highest building in Japan, in the TOKYO TORCH district in front of the Nihonbashi Exit of Tokyo Station. The hotel is scheduled to open in 2028.

TOKYO TORCH aims to become a “core of urban tourism” as the gateway to Tokyo and Japan, and the hotel is one of its key components. Located on the upper floors of the nation’s tallest Torch Tower, the hotel offers a panoramic view of Tokyo Bay and the city center and sweeping vistas stretching from the forest in the heart of the city to Mt. Fuji beyond. By combining these aspects with Dorchester Collection, which has carved its name in the history and culture of many parts of the world, the aim will be to create the only worldview with TOKYO TORCH and a true luxury area in Tokyo and Japan that can be experienced nowhere else.