Tokyo CenturyA Journey of Challenges

Tokyo Century has taken on a variety of challenges as a highly specialized and unique financial services company. Here is a timeline of our history.

1960s Two Predecessors of Tokyo Century Established

-

Century Leasing System, Inc.

Jointly established in 1969 by ITOCHU Corporation, Daiichi Bank, Ltd. (currently Mizuho Bank, Ltd.), Nippon Life Insurance Company, and Asahi Mutual Life Insurance Company.

-

Tokyo Leasing Co., Ltd.

Jointly established in 1964 by Nippon Kangyo Bank, Ltd. (currently Mizuho Bank, Ltd.), Kangin Tochi-Tatemono Co., Ltd. (currently Chuo-Nittochi Co., Ltd.), and Nanoh Co., Ltd. (currently Chuo-Nittochi Co., Ltd.)

2009 Century Tokyo Leasing Corporation Established

-

Century Leasing System, Inc., which excels in leasing and IT services for information and communications equipment, merged with Tokyo Leasing Co., Ltd., with strengths in finance and its global network centered on Asia. The company changed its name to Century Tokyo Leasing Corporation, taking the first step in pioneering a new leasing business model.

2009–2012 Reborn Maximized Merger Effects by Leveraging a Strong Customer Base

Century Tokyo Leasing Corporation took the next step toward becoming a company that provides more comprehensive services beyond the scope of leasing. In the aftermath of the global recession triggered by the 2008 financial crisis, as well as in the face of headwinds such as changes in lease accounting standards, the company vigorously expanded its business by fortifying its strong customer base and financial and service functions.

Major Milestones of the Era

-

Converted IHI’s finance subsidiary, IHI Finance Support Corporation, into a consolidated subsidiary.

-

Established the solar power generation company Kyocera TCL Solar LLC as a joint venture with Kyocera Corporation.

- *Simple sum of the previous two companies immediately before merger

- *"Mobility & Fleet Management" was renamed "Automobility" from April 1, 2023.

Number of employees (consolidated)

1,701

(As of March 31, 2009)

2013–2015 Business Development Full-Scale Entry into a Business Focused on the Value of Assets

This is the period during which we vigorously embarked on mergers and acquisitions to achieve further growth. We actively pursued global expansion, including the establishment of new overseas offices and joint ventures with leading overseas partners, and grew dramatically as a financial services company. From this point on, we focused on high-value-added financial services and mainly the value of assets, and we also developed a way of providing services across the entire assets life cycle, including for IT equipment, automobiles, and aircraft.

Major Milestones of the Era

-

Converted Nippon Rent-A-Car Service, Inc. and Nippon Car Solutions Co., Ltd., a corporate auto-leasing company, into consolidated subsidiaries.

-

Invested in the leasing subsidiary of Bank of the Philippine Islands, a major bank in the Philippines.

- *"Mobility & Fleet Management" was renamed "Automobility" from April 1, 2023.

Number of employees (consolidated)

4,124

(As of March 31, 2016)

2016–2018 Leap Forward Achieved Dramatic Growth as a Financial Services Company

The entire leasing industry reached a major turning point with the growing popularity of new lifestyles and value such as the sharing economy as well as SDG advocacy. In 2016, Century Tokyo Leasing Corporation removed “leasing” from its name and adopted its current name, Tokyo Century Corporation. The company also renewed its commitment as a unique, highly specialized financial services company. We aggressively invested in areas where highly profitable growth could be expected and began to create a stable virtuous cycle in each operating segment, achieving dramatic growth in profitability.

Major Milestones of the Era

-

Entered into the development of the five-star hotel brand ANA InterContinental Beppu Resort & Spa.

-

Converted CSI Leasing, Inc., a leading U.S.-based independent leasing company, into a consolidated subsidiary.

- *"Mobility & Fleet Management" was renamed "Automobility" from April 1, 2023.

Number of employees (consolidated)

7,016

(As of March 31, 2019)

2019–2022 Co-Creation Accelerated Sustainable Business with Partners

Although Tokyo Century had been experiencing steady growth and taking on challenges in profitability and business content, the beginning of the COVID-19 pandemic in 2020 presented a headwind for further movement forward. Meanwhile, we focused on more diversified business development and enhancing corporate value while strengthening partnerships with business partners. We also actively endeavored to develop new businesses to help create a sustainable economy and society, such as resolving social issues through collaboration in the DX and digital fields and expanding co-creative businesses with partners based on social infrastructure.

Major Milestones of the Era

-

Formed a capital and business alliance with Nippon Telegraph and Telephone Corporation (NTT) and established NTT TC Leasing Co., Ltd. as the first joint venture.

-

Converted Aviation Capital Group LLC, a U.S.-based commercial aircraft lessor, into a wholly owned subsidiary.

- *"Mobility & Fleet Management" was renamed "Automobility" from April 1, 2023.

Number of employees (consolidated)

7,634

(As of March 31, 2022)

2023– Focusing on Self-Transformation and Bringing about Change toward Realizing a Better Society

As an entrusted business partner for customers and other stakeholders, Tokyo Century is committed to resolving social issues and achieving sustainable development. We will work to bring about change and seek to transform ourselves without being bound by stereotypes, toward functioning as an indispensable company to the society in which we live. Additionally, we will take on further challenges to contribute to the realization of a better society.

Journey of Challenges from the Perspective ofthe Five Operating Segments

-

Equipment Leasing

Providing a variety of leasing solutions for all types of customers

-

Automobility

Utilizing unparalleled service quality and networking capability to respond to diversifying automobile needs

-

Specialty Financing

Providing unique services with advanced expertise as a strength

-

International Business

Driving the digital and mobility revolutions by leveraging alliance strategies with global prime companies

-

Environmental Infrastructure

Offering environment-related services that contribute to the realization of a decarbonized society

2007

Mar.

Significant revisions to lease accounting standards were announced, and finance leases could no longer be accounted for as leases. As a result, the leasing industry faced headwinds.

2008

Sep.

The bankruptcy of Lehman Brothers triggered a global financial crisis, and the wave of the Great Recession swept through Japan as well.

2009

Apr.

Century Tokyo Leasing Corporation was established.

Century Leasing System, Inc. and Tokyo Leasing Co., Ltd. merged. Under the new company name, Century Tokyo Leasing Corporation, the company sought to further expand its business scale and strengthen its operating base.

2010

Jul.

Converted IHI Finance Support Corporation into a Consolidated Subsidiary

IHI Finance Support Corporation, responsible for the leasing and factoring businesses of the IHI Group, was converted into a consolidated subsidiary, facilitating the combination of the company’s expertise and Century Tokyo know-how to more extensively expand business.

2011

Feb.

Established PT. Century Tokyo Leasing Indonesia (Currently PT. Tokyo Century Indonesia), a Subsidiary in Indonesia

PT. Century Tokyo Leasing Indonesia (currently PT. Tokyo Century Indonesia) was established to meet the diverse needs of customers in Indonesia and began to develop a variety of financial services, including factoring and project finance, as well as a leasing business.

2012

Mar.

Acquired Shares of Jetstar Japan Co., Ltd.

We acquired shares of Jetstar Japan Co., Ltd., a low-cost carrier of the Australian Qantas Group. This represented our first step toward meeting financial needs and asset management outsourcing needs in the aircraft sector by leveraging our versatile financing know-how, including for aircraft leasing.

Jul.

A feed-in tariff (FIT) scheme for renewable energy started in Japan, providing a tailwind for diffusing renewable energy across the country.

Sep.

Established Solar Power Generation Company Kyocera TCL Solar LLC as a Joint Venture with Kyocera Corporation

Kyocera TCL Solar LLC, a solar power generation company, was jointly established with Kyocera Corporation.

Dec.

Converted GA Telesis, LLC, a U.S. Commercial Aircraft Components Company, into an Equity-Method Affiliate

GA Telesis, LLC, a leading U.S. provider of commercial aircraft parts and services with a network of major airlines worldwide, was converted into an equity-method affiliate. We then expanded our business domain to include aircraft leasing as well as engine leasing and parts financing, thereby allowing for aircraft life cycle management from the leasing of newly built aircraft to the dismantling and parts sales of retired aircraft.

Dec.

The second term of the Abe administration was inaugurated and launched the Abenomics economic policy to embark on a national economic revitalization program.

2013

Jun.

Converted Nippon Rent-A-Car Service, Inc. into an Equity-Method Affiliate

We acquired additional shares of Nippon Rent-A-Car Service, Inc. in 2011, which oversees the rental car business of the Nippon Rent-A-Car brand, and made it an equity-method affiliate. This enabled us to meet the wide-ranging needs of customers, including comprehensive proposals on car rentals. The company subsequently became a consolidated subsidiary in 2013.

Dec.

Converted Nippon Car Solutions Co., Ltd. into a Consolidated Subsidiary

Nippon Car Solutions Co., Ltd. merged with Tokyo Auto Leasing Co., Ltd., becoming a consolidated subsidiary of Tokyo Century. This enabled us to provide total car-related services by fully using the management resources of the two companies.

2014

May

Converted TISCO Tokyo Leasing Co., Ltd. into a Consolidated Subsidiary

TISCO Tokyo Leasing Co., Ltd., our joint venture with TISCO Financial Group PCL, a major financial group in Thailand, became a consolidated subsidiary, enabling us to further expand business in the growing Thai market.

Dec.

Converted BPI Century Tokyo Lease & Finance Corporation (Formerly BPI Leasing Corporation), a Philippine-Based Leasing Company, into an Equity-Method Affiliate

BPI Century Tokyo Lease & Finance Corporation is a Philippine-based leasing subsidiary of Bank of the Philippine Islands (BPI), the oldest and largest bank in Southeast Asia. This new joint venture partnership with BPI has enabled us to expand and diversify our business base in the Philippines.

2015

Mar.

Converted CSI Leasing, Inc., a Major U.S. Leasing Company Focused on IT Equipment, into an Equity-Method Affiliate

CSI Leasing, Inc., the largest independent leasing company in the U.S., which mainly handles IT equipment, became our equity-method affiliate. This strengthened the global expansion of our leasing and finance business centered on IT equipment and served as a milestone marking the dramatic growth of the business.

Apr.

Established Orico Business Leasing Co., Ltd., Specializing in Vendor Leasing Business

Orico Business Leasing Co., Ltd. was established as our joint venture with Orient Corporation, enabling us to better meet more diverse needs in vendor leasing by combining our extensive leasing operation capabilities with Orient’s expertise in the consumer credit industry.

Dec.

The signing of the Paris Agreement, an international climate change framework, set countries on the path toward realizing a decarbonized society.

2016

Subscription services expanded into a variety of genres beyond video and music.

Oct.

Changed Company Name to Tokyo Century Corporation

The word “leasing” was removed from Century Tokyo Leasing Corporation, and the company adopted its current name, Tokyo Century Corporation. We expressed our determination to further strengthen our leasing and financing capabilities and develop a wider range of businesses as a unique, highly specialized financial services company.

2017

Dec.

Converted Aviation Capital Group LLC, a Major U.S. Aircraft Leasing Company, into an Equity-Method Affiliate

Aviation Capital Group LLC, a major U.S. aircraft leasing company that mainly provides narrow-body (single-aisle) aircraft to more than 90 airlines in over 45 countries became an equity-method affiliate. This enabled us to provide a wider range of services associated with aircraft in related businesses, which were expected to achieve long-term growth.

2019

Jul.

Converted ITOCHU Construction Machinery Co., Ltd., a Subsidiary of ITOCHU Corporation, into an Equity-Method Affiliate

ITOCHU Construction Machinery Co., Ltd., which had been engaged in the sales and rental of construction machinery and other equipment, was made an equity-method affiliate and renamed ITOCHU TC Construction Machinery Co., Ltd. This enables us to provide advanced services for improving the productivity of construction equipment users.

2020

Feb.

Concluded a Capital and Business Alliance Agreement with Nippon Telegraph and Telephone Corporation (NTT)

Tokyo Century and NTT built a cooperative relationship through the integration of their auto leasing businesses in 2005, including the establishment of Nippon Car Solutions Co., Ltd. The two companies entered into a capital and business alliance agreement to further generate synergies and enhance their respective corporate value. In the same year, they also established NTT TC Leasing Co., Ltd. by spinning off a portion of NTT Finance Corporation’s leasing and global operations.

Mar.

The global COVID-19 pandemic had a major impact on lifestyles and economies.

Oct.

The Japanese government declared that Japan would be carbon neutral by 2050 and took a major step toward a decarbonized society, toward having 100% of new vehicle sales be electric by 2035.

Fall

Semiconductor shortages occurred worldwide, causing a major impact on the manufacture of smartphones and electronic devices.

2021

Mar.

Total Funds Procured through Sustainability-Linked Loans Exceeded 200 Billion Yen

Sustainability-linked loans offer preferential interest rates based on the achievement of ESG initiatives. This year, Tokyo Century raised a cumulative total of more than 200 billion yen, making it the largest sustainability-linked loan provider in Japan.

2022

Sep.

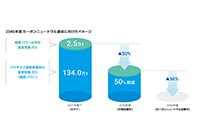

Formulated the Carbon Neutrality Policy for FY2040

Tokyo Century had been promoting the active use of clean energy for contributing to a decarbonized society, as its materiality. This year, we formulated the Carbon Neutral Policy for FY2040 for achieving virtually zero greenhouse gas emissions for the entire Group by fiscal 2040.

-

Equipment Leasing

Providing a variety of leasing solutions for all types of customers

-

Automobility

Utilizing unparalleled service quality and networking capability to respond to diversifying automobile needs

-

Specialty Financing

Providing unique services with advanced expertise as a strength

-

International Business

Driving the digital and mobility revolutions by leveraging alliance strategies with global prime companies

-

Environmental Infrastructure

Offering environment-related services that contribute to the realization of a decarbonized society