Portrait of Tokyo Century

INTEGRATED REPORT 2025

Examples of Businesses Developed with Partners

(the NTT Group and ITOCHU Corporation)

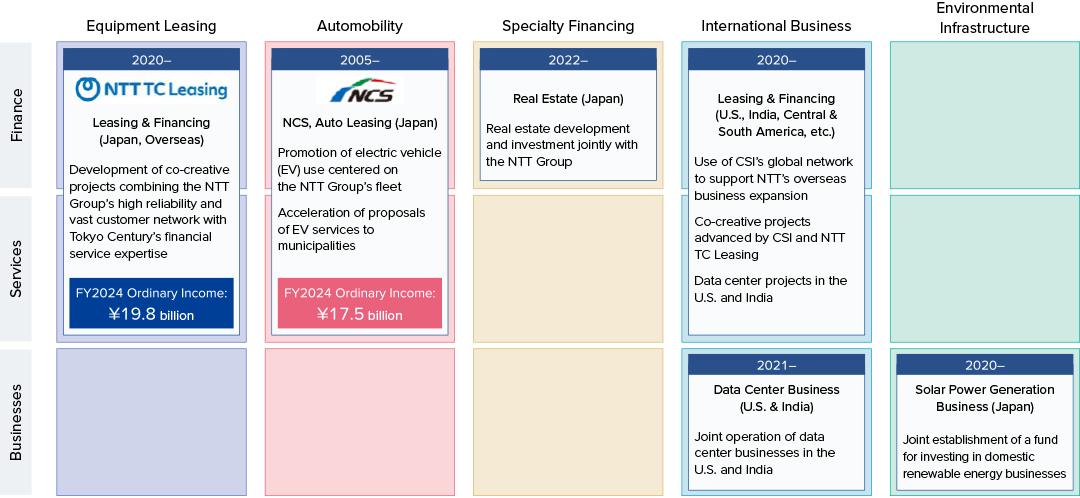

Strategic Partnership with the NTT Group

Tokyo Century’s strategic partnership with the NTT Group began in 2005 with the integration of their auto leasing businesses. This relationship has grown even stronger since their capital and business alliance in 2020. Creating collaborative opportunities with the NTT Group remains a top priority, and the Company continues to expand the scope of its collaboration.

-

1

Creation of Collaborative Projects with Partners

Data Center Business

Our collaboration with the NTT DATA Group in the data center business began in 2021. The data center business is an asset business that requires large initial investments and a long-term perspective. We support this business not merely as a fund provider but as a business partner that co-creates the business and maximizes its value, leveraging the expertise we have cultivated in finance and various other projects.

-

2

Provision of Finance and Services

Optimal Financing Structuring

Leveraging our advanced financial expertise cultivated in leasing and financing, we execute optimal financing tailored to the characteristics of each project. This enables agile and stable business development, even for large-scale operations.

Project Management as a Financer

Rather than simply investing capital, we also play a role in accurately assessing the future potential and profitability of the data center business, managing and supervising its projects to maximize their value.

Maximizing Synergy Through Role Division

We support the entire business from the finance and business management side so that the NTT Group, which possesses world-class technological capabilities and a vast customer base, can concentrate on technology development and operations. This clear division of roles and our mutually complementary relationship create a competitive advantage that other companies cannot match.

-

3

Business Growth Through Synergy Creation

Takayuki Nishimura

General Manager, Global Business Division II, International Business

As the social implementation of generative AI accelerates, data centers have become a fundamental part of infrastructure of our digital society, and their importance continues to grow. As finance professionals, we do more than just provide funds; we are committed as a partner that takes on risks and co-creates the business. Under our corporate slogan, “Solutions to your Pursuits,” we will fully leverage the expertise we have cultivated through joint projects with many partner companies to contribute to maximizing business value. In addition to expanding our collaboration in the data center business, we will further deepen our partnership with the NTT Group within the IT service value chain to enhance the corporate value of both companies and contribute to solving social issues.

Strategic Partnership with ITOCHU Corporation

Tokyo Century is working to create new value in Japan and overseas by combining its expertise with ITOCHU’s broad business portfolio. Our collaboration addresses a wide range of fields where growth is expected.

-

1

Creation of Collaborative Projects with the Partner

Scrollable horizontally

| Construction Machinery and Truck Finance |

|

|

|---|---|---|

| Environment and Energy | Energy Storage |

|

| Hydrogen |

|

|

| Wind Power |

|

|

| Renewable Energy |

|

|

| Biomass |

|

|

| Other |

|

|

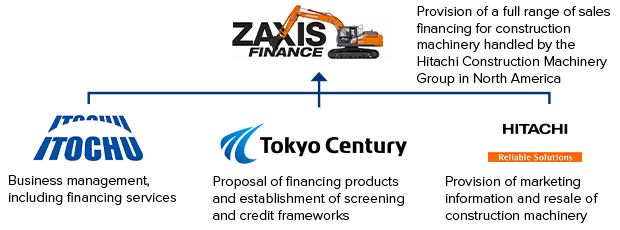

ZAXIS Finance

In fiscal 2022, we established ZAXIS Finance in North America with ITOCHU Corporation and Hitachi Construction Machinery to provide financing for construction machinery. Customers purchasing construction machinery often pay for it in long-term installments. In North America in particular, manufacturers are required to provide dealers and customers with swift screening and competitive financing options that meet their needs.

A Three-Company Joint Venture with ITOCHU and Hitachi Construction Machinery

-

2

Provision of Financial Services

Designing and Providing Financial Programs

To meet the diverse needs of customers, we design and offer flexible financial products such as leases and installment sales. This allows customers to minimize their initial investment and systematically introduce the latest construction machinery.

Credit Screening and Risk Management Functions

Utilizing our credit expertise cultivated over many years in the financial business, we conduct swift and accurate customer screenings. We also support the sound operation of the programs by managing the financial assets (receivables) of the entire business and appropriately controlling risks.

-

3

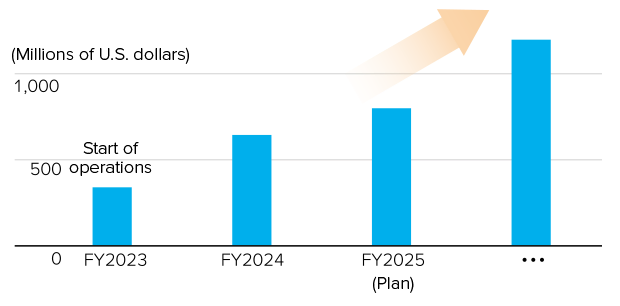

Business Growth Through Synergy Creation

Operating Assets

The North American construction machinery market is one of the largest in the world, and stable demand is expected to continue in the housing construction and infrastructure sectors. Since its establishment in 2022, ZAXIS Finance’s operating assets have grown steadily. The company achieved profitability in fiscal 2023 and increased profits in fiscal 2024. Further growth is anticipated from fiscal 2025 onward.