Enhancement of Management Foundation

INTEGRATED REPORT 2025

Risk Management

Comprehensive Enterprise Risk Management (ERM)

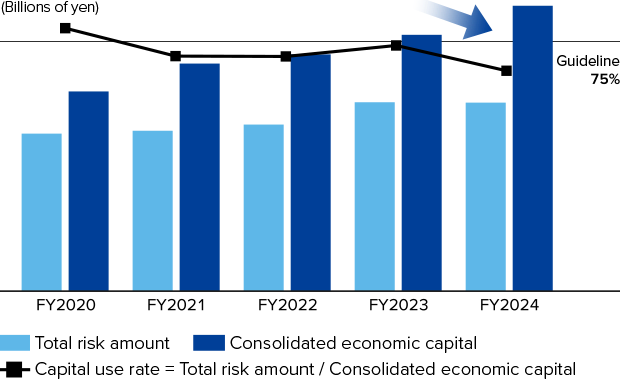

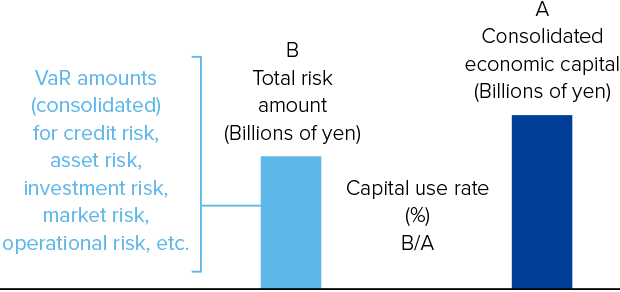

The Tokyo Century Group practices comprehensive ERM in accordance with its management guidelines for capital use rates based on quantitative risk control on a consolidated basis. The capital use rate is used to assess risk resilience, an important criterion for rating financial institutions. The risk amount is measured on an item-by-item basis using a methodology established for each risk category, such as investment risk, asset risk, and credit risk. While investment risk is relatively high, asset risk is comparatively low, backed by physical assets, although the precise level of this risk depends on their characteristics. By adhering to these management guidelines, we have sought to keep the total risk amount within consolidated economic capital buffers (based on shareholders’ equity). As our business domain continues to expand, the relationship between the amount of capital and level of risk receives greater attention from investors and other interested parties. For this reason, the capital use rate has become a key indicator for objectively determining prospects for our sustainable growth and investment capacity.

We treat our targeted capital use rate of 75% as a soft limit, since the capital regulations for financial institutions do not apply to us. Seizing business opportunities, such as M&A activities, is also an important factor in our risk management framework. Rather than passively ensuring corporate soundness, we actively consider several key factors, including the potential increase in risk over the medium term (about three years), projected organic growth in the shareholders’ equity ratio, and the tolerance level of our capital policy.

Medium-Term Management Plan 2027 calls for enhancing our risk management framework to ensure the efficient allocation of management resources through an ERM approach. In fiscal 2024, we officially introduced risk exposure guidelines (soft limits) for the categories that account for a large portion of our risk profile (aviation, investments, and real estate). In fiscal 2025, we have introduced economic capital allocation by operating segment on a trial basis as an additional measure to control the total risk amount and diversify the risk of our business portfolio. In this way, we are driving our portfolio transformation.

The main objective of risk management at the Tokyo Century Group is to support growth and value creation by allowing for bold risk-taking. We will continue to control the capital use rate to maintain it at the appropriate guideline level. At the same time, we will constantly enhance our risk management framework in conjunction with the expansion of our business domain and a changing operating environment in order to sustainably improve corporate value.

Capital Use Rate Trends

Capital Use Rate Guidelines

- *In fiscal 2024, the capital use rate declined from the previous fiscal year due to an increase in consolidated economic capital, remaining within the guidelines. As for the risk amount, the “Aircraft” category decreased due to a rise in market prices, but this was offset by an increase in “Investment and Others,” resulting in the overall amount remaining flat.

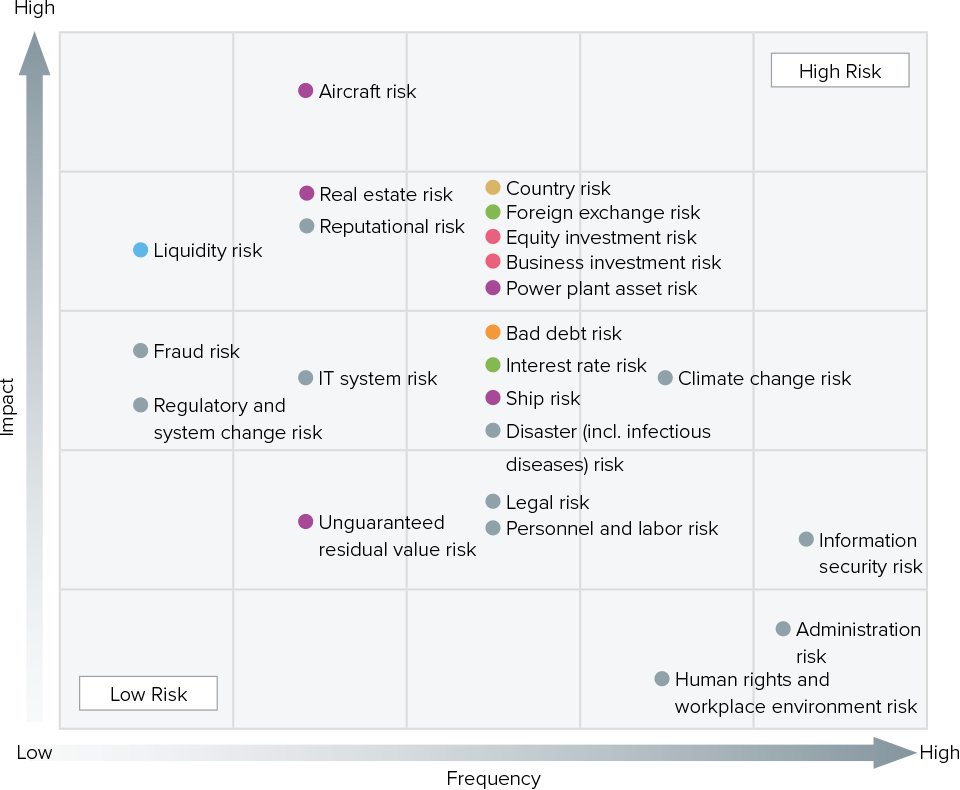

Risk Heatmap

The Basic Risk Management Policy and the Comprehensive Risk Management Rules define risk categories. The Group assesses secular changes annually in its business operations and maps these categories using a matrix that measures the level of impact and frequency of occurrence. The resulting map is reviewed every year, comprehensively considering various factors, such as trends in risk scenarios identified via risk audits, the risk amount for each risk item, initiatives, and incidents or accidents. The Company visualizes identified risks and shares this information with relevant parties, such as by regularly reporting to the Management Meeting and the Board of Directors.

Country Risk

In response to the recent rise in geopolitical risks, we manage country risk as an independent risk category, rather than a part of credit risk. Specifically, we take a multi-layered approach to controlling country risk, focusing on two key aspects: country-specific exposure management and monitoring of geopolitical risks in each country. For country-specific exposure management, we use country-specific limits as guidelines. These limits are set by comprehensively considering geopolitical risks and strategic business importance based on sovereign ratings. For geopolitical risk monitoring, we have established a system to promptly detect signs of risk fluctuations. This involves monitoring changes in each country’s political, economic, and social conditions, allowing us to take appropriate and timely measures.

Global Risk Management

In global risk management, we pay particular attention to our U.S. specialized leasing subsidiaries, Aviation Capital Group LLC (ACG) and CSI Leasing, Inc. (CSI), which have large investment and asset scales. ACG has introduced a risk appetite framework that clarifies the risks to be accepted (for example, aircraft asset risk) and those to be avoided, mitigated, or transferred (for example, interest rate, liquidity, and foreign exchange risks). This unique risk management approach has proven highly effective in enhancing the company’s resilience. Furthermore, ACG has implemented a risk management framework for individual projects that is centered on diversifying country- and airline-specific concentration risks and ensuring an appropriate risk-and-return balance based on the characteristics of a given project.

ACG’s Risk Appetite Framework

Scrollable horizontally

| Risk Tolerance | Ability to Influence*1 | Risk Category*2 | Risk Management Method |

|---|---|---|---|

|

Positive | Asset acquisition risk➀ |

|

|

Neutral | Residual value risk➁ Country risk Credit risk Aviation market risk ESG risk OEM risk➂ |

|

| Positive | Remarketing risk➃ Model risk➄ |

|

|

|

Neutral | Geopolitical risk MRO*3risk➅ |

|

| Positive | Capital management risk Interest rate risk Liquidity risk Currency risk Reputational risk Operational Risk |

|

- *1Level of proactive risk management leveraging ACG’s expertise

- *2OEM risk and MRO risk have been added as new risk categories.

- *3MRO: Maintenance, repair, and overhaul

- ➀Asset acquisition risk:Risk that appropriate portfolio management cannot be practiced in relation to aircraft acquisition methods, selected models, etc.

- ➁Residual value risk:Risk that aircraft cannot be sold or disposed of at residual value anticipated at time of leasing

- ➂OEM risk:Risk that OEMs cannot make deliveries on schedule and that there will be aircraft quality issues

- ➃Remarketing risk:Risk that lessees cannot be found at time of lease maturity or cancellation due to declines in aircraft demand, etc.

- ➄Model risk:Risk that sufficient returns cannot be generated by projects due to inability to appropriately reflect interest rate or aircraft value trends in lease rates of pricing models

- ➅MRO risk:Risk that an MRO company’s services fail to meet the quality standards of ACG or the airline, potentially causing damage to an asset

Non-Financial (Non-Quantitative) Risks

As our business domain grows and we branch out from the financial sector to provide business services, it is becoming increasingly important to account for non-financial operational risks that cannot be measured quantitatively. Based on this recognition, Tokyo Century has established key risk indicators (KRIs) for nonfinancial risks. We regularly monitor these KRIs and report the results to the Management Meeting, the Board of Directors, and other relevant bodies. KRIs have been set pertaining to personnel and labor, information security, accidents, internal reporting, climate change, legal affairs, and corruption. Amid the rising importance of tracking and managing human rights and climate change risks, we have broadened the scope of personnel and labor risk (from non-consolidated to consolidated) and are also expanding our range of environmental KRIs in relation to renewable energy, CO2 emissions, and the portion of our portfolio comprising fuel-efficient aircraft and electric vehicles. Recognizing that stakeholder concern for non-financial risks is constantly rising, Tokyo Century will continue to bolster its range of effective indicators related to human rights, climate change, and other ESG and SDG factors from the perspective of sustainability.