Strategy of TC Transformation

INTEGRATED REPORT 2024

PX—Transformation Pursuing

a Highly Profitable and Stable Portfolio

Strategy of TC Transformation

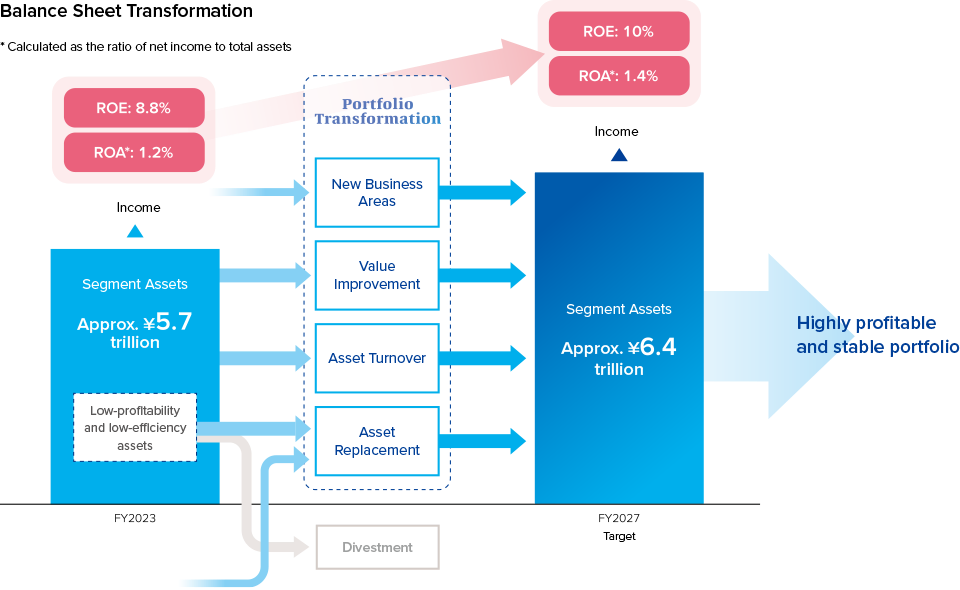

In crafting Tokyo Century’s long-term corporate value improvement story, it is absolutely essential that we pursue a highly profitable and stable business portfolio by improving asset and capital efficiency, reducing performance volatility, and achieving steady earnings growth. As we work toward the targets of return on assets (ROA) of 1.4% and return on equity (ROE) of 10% set for the final year of Medium-Term Management Plan 2027, we will push forward with portfolio transformation on a Companywide basis with a strong focus on income growth and ROA improvement.

Overview of Portfolio Transformation Initiatives

1. Promotion of Asset Turnover Businesses

Utilizing our discerning eye for the value of ICT equipment, aircraft, ships, real estate, and other assets, we will promote asset turnover businesses that entail investing in and selling assets at the ideal timing in order to build a quality portfolio.

2. Replacement and Divestment of Low-Efficiency Assets

Tokyo Century will conduct exhaustive qualitative assessments, looking at factors such as growth potential and risks, and quantitative assessments of ROA, return on invested capital (ROIC) spread, and other indicators and replace low-profitability and low-efficiency assets with higher-quality assets in order to enhance its business portfolio.

3. Improvement of Value of Existing Businesses

The business models of existing businesses will be reviewed to instill a focus on profitability and efficiency.

4. Exploration of New Business Fields

We will seek to develop new growth businesses through the Companywide acceleration of the implementation of our partnership strategy and of green transformation and digital transformation initiatives that contribute to the resolution of social issues.

Moreover, ongoing examinations will be conducted by operating segments as we aim to construct Companywide frameworks for investing in growth fields.

Investment Risk Control

It is crucial for Tokyo Century to practice appropriate control of the increasingly diverse investment risks. For this reason, we have introduced an investment management framework and are strengthening our control frameworks through management based on ROIC spread.

Investment Management Framework

Tokyo Century has introduced an investment management framework to facilitate effective investment governance. Under this framework, quantitative and qualitative evaluations are conducted as part of the process of screening individual investment projects, and the appropriateness of the triggers defined for commencing the withdrawal process is assessed. After investment, projects are monitored on an ongoing basis to gauge progress with regard to quantitative and qualitative standards and determine whether a project has become applicable under withdrawal standards. The results of this monitoring are used to make decisions when promoting portfolio transformation.

ROIC Spread Management

Tokyo Century regularly monitors ROIC spread, which is ROIC less weighted average cost of capital (WACC), as a cost-of-capital-based indicator of the risk-and-return balance of specific business areas, taking into account business and risk characteristics in such monitoring. Going forward, ROIC spread will be utilized to identify issues needing to be addressed in order to achieve an ideal risk-and-return balance as part of promoting portfolio transformation.

Response to Expansion of Business Domain

Initiatives in First Year of Medium-Term Management Plan 2027

In fiscal 2023, the first year of the medium-term management plan, Tokyo Century made steady progress in initiatives for supporting future portfolio transformation efforts, such as reassessing low-efficiency businesses and promoting real estate, ship, data center, and other asset turnover businesses.

Revision of Holdings in Two Subsidiaries

- Case Study 1

- Replacement and Divestment of Low-Efficiency Assets

Tokyo Century has revised its holdings in two subsidiaries that are joint ventures with Orient Corporation, promoting a partial transference of our equity holdings in these companies and resulting in their conversion to equity-method affiliates.

Although the reduction of our holdings lowered the stake of the profits of these companies attributable to the Company, the resulting decrease of approximately ¥200.0 billion in segment assets effectively doubled asset efficiency (ROA). Ongoing growth will be pursued at these companies following their conversion by utilizing the Orico Group’s capabilities to bolster their sales capacity.

Development of Asset Turnover Businesses Related to Aviation and Shipping

- Case Study 2

- Promotion of Asset Turnover Businesses

Tokyo Century is promoting the sale of assets in aviation and shipping businesses when market prices are high in order to improve asset efficiency.

Going forward, we will maintain an up-to-date understanding of the market prices for aircraft, ships, real estate, and other products so that we can turn over these assets at the ideal timings to improve asset efficiency.