Risk Management

INTEGRATED REPORT 2024

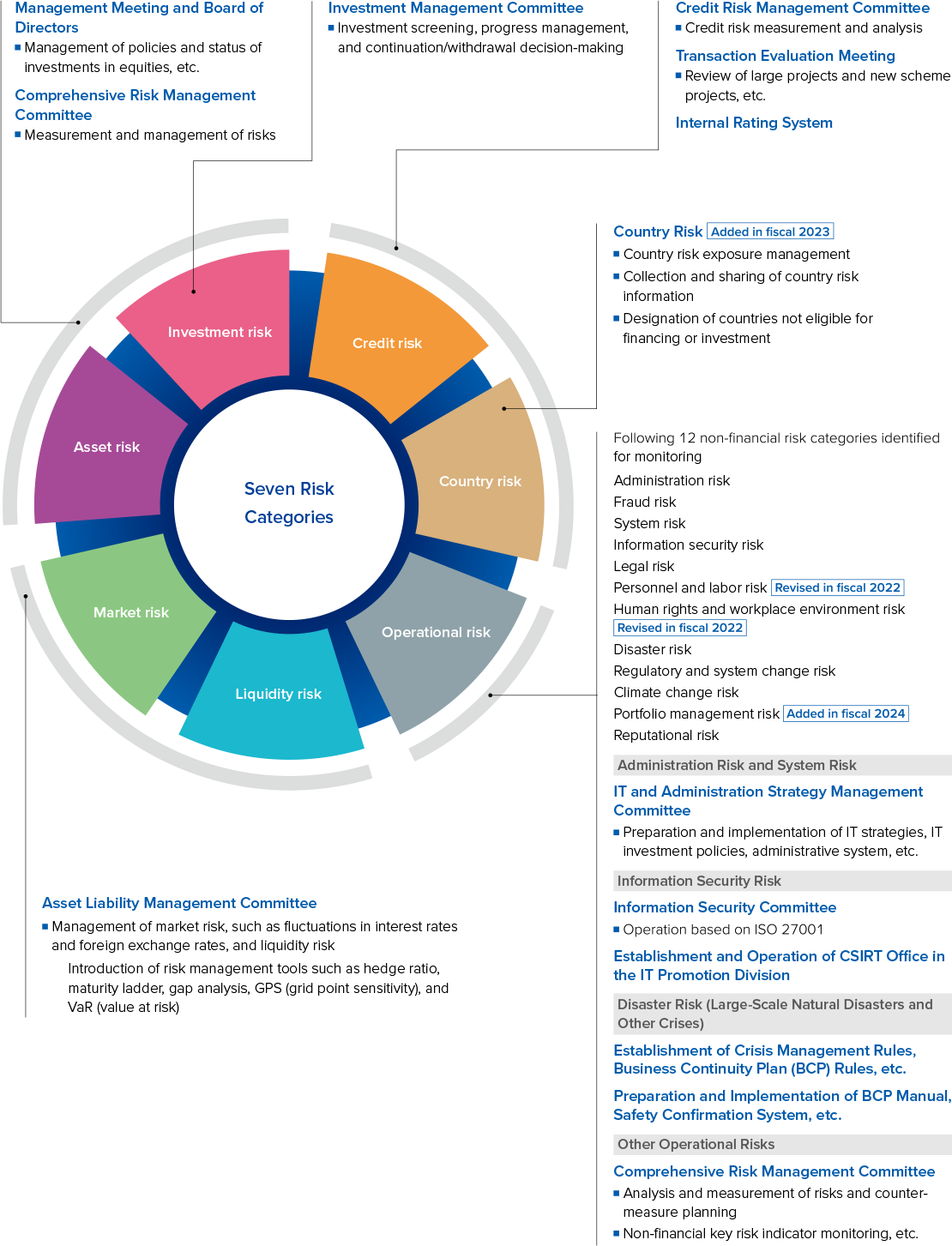

Major Risks and Management Frameworks

RiskManagement

Risk Management Initiatives under Medium-Term Management Plan 2027

Tokyo Century has developed and continues to bolster a risk management framework aimed at the efficient allocation of management resources through an enterprise risk management (ERM) approach to enhance risk management in response to the evolution of its business model and the uncertainty of its operating environment.

1. Appropriately control total risk amount in line with economic capital and diversify business portfolio risks

Continue management with capital use rate guidelines (Capital use rate = Total risk amount / Consolidated economic capital)

Ongoing implementation of consolidated capital use rate guidelines and management and monitoring of consolidated capital use rate from perspective of maintaining financial discipline

Introduce risk limits for specific categories

Official introduction in fiscal 2024 of guidelines implemented on trial basis in fiscal 2023 to limit concentration of risks on specific categories (aviation, investments, and real estate)

Allocate economic capital by operating segment, etc.

Ongoing examination of possibility of allocating economic capital by operating segment as an additional measure for controlling total risk amount and dispersing business portfolio risks

2. Promote business management of risks and returns considering cost of capital

- Regularly monitor return on invested capital (ROIC) spread, which is ROIC less weighted average cost of capital (WACC), as a cost-of-capital-based indicator of the risk-and-return balance of specific business areas reflecting business and risk characteristics

- Identify issues to achieve better risk-and-return balance for use in promoting future portfolio transformation initiatives

3. Entrench and enhance investment management framework

Establish investment guidelines comprising the following six items to foster investment culture

- 1.Meaningfulness of investment

- 2.Conformity with investment standards (profitability commensurate with risks)

- 3.Appropriateness of investment amounts

- 4.Clarification of risk appetite

- 5.Flexibility of investments necessary to facilitate appropriate portfolio management

- 6.Consideration for ESG issues and the SDGs

4. Enhance country risk and global risk readiness

- Conduct multifaceted control through monitoring of country-specific exposure management and political, social, economic, and other operating environment changes in relevant countries and regions

- Position country limits set based on sovereign and other rates as guidelines and, in principle, keep country-specific exposure within guideline limits

- Utilize external information resources when undertaking large-scale transactions and avoid or cancel transactions based on designations of countries not eligible for financing or investment

- Promote exhaustive country risk management at ACG based on unique approach accounting for characteristics of aviation business model

Major Risks and Management Frameworks

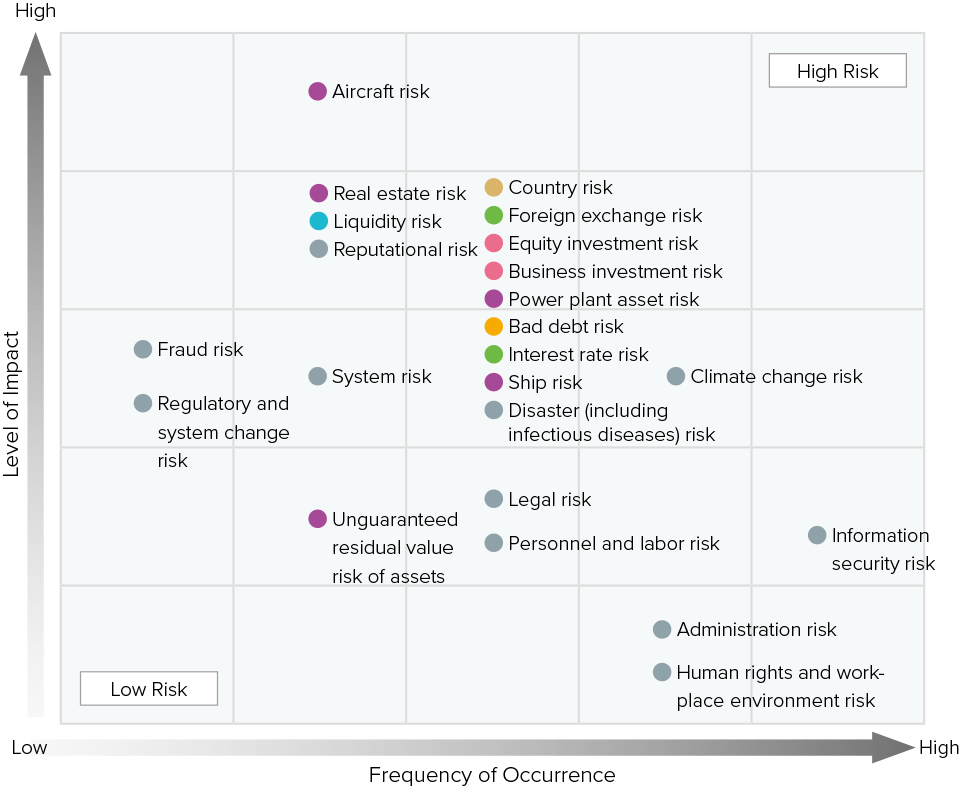

Risk Heatmap

The Basic Risk Management Policy and the Comprehensive Risk Management Rules define risk categories. The Group assesses secular changes annually in its business operations and maps these categories using a matrix that measures the level of impact and frequency of occurrence. The resulting map is reviewed every year with comprehensive consideration paid to various factors, such as trends in risk scenarios identified via risk audits, the risk amount for each risk item, initiatives, and incidents or accidents. In fiscal 2023, the Company began having reports on the risk heatmap submitted to the Board of Directors, and other steps are being taken to visualize identified risks and share this information with relevant parties.