CEO Message

INTEGRATED REPORT 2024

- Koichi Baba

- President & CEO,

Representative Director

CEO Message

Having achieved a rapid recovery and thus moving it closer toward finding a new growth track, the Tokyo Century Group is now poised to tackle new challenges.

In fiscal 2023, the year ended March 31, 2024, Tokyo Century achieved record-high net income attributable to owners of parent of ¥72.1 billion, thereby making a strong start in the first year of Medium-Term Management Plan 2027. This year also saw us make steady progress in expanding the scope of our business through means such as entry into the data center business in the United States, where we expect increasingly rapid market growth driven by the spread of generative AI. Building upon the rapid recovery in performance in fiscal 2023 after its “great reset,” Tokyo Century will aggressively seize business opportunities to achieve further growth and great success going forward.

The past three years have proven to be challenging for Tokyo Century as it faced adversity created by the COVID-19 pandemic and Russia’s invasion of Ukraine. However, I am proud to say that we rose to the challenge, posting an all-time high of ¥72.1 billion for net income attributable to owners of parent in fiscal 2023—breaking the previous record set four years ago—thereby taking a long first step on our path toward finding a new growth track.

I apologize for any concern caused by the tribulations and uncertainty over the last three years for our shareholders and other investors. Nevertheless, I feel that the lessons learned in that period were massive. I am reminded of the importance of having everyone at the Tokyo Century Group earnestly internalize this experience and of my role as the leader of management to guide us in taking action to overcome the challenges placed before us, and I understand the responsibility this entails.

At the moment, our most important tasks include fully embracing an emphasis on generating return on equity (ROE) surpassing cost of shareholders’ equity in management. We also must cultivate a sense of anticipation concerning Tokyo Century’s ongoing growth so that stakeholders will once again look forward with hope toward the expansion of business and other aspects of our growth.

With regard to emphasizing ROE surpassing cost of shareholders’ equity in management, we need to focus on reducing cost of shareholders’ equity by limiting performance volatility, which had been on the rise over the past three years. Meanwhile, we must undertake a restructuring of our business portfolio based on careful examination of the earnings power and efficiency of each business. This restructuring will hinge on our ability to promote portfolio transformation by selecting businesses with an emphasis on profitability and without practicing favoritism in relation to any given business. As for cultivating a sense of anticipation for our growth, we have been making progress in laying the groundwork for future growth through such undertakings as our entry into the U.S. data center business and in overseas renewable energy businesses. Accordingly, it will be important for us to be even swifter in our ongoing growth investments going forward.

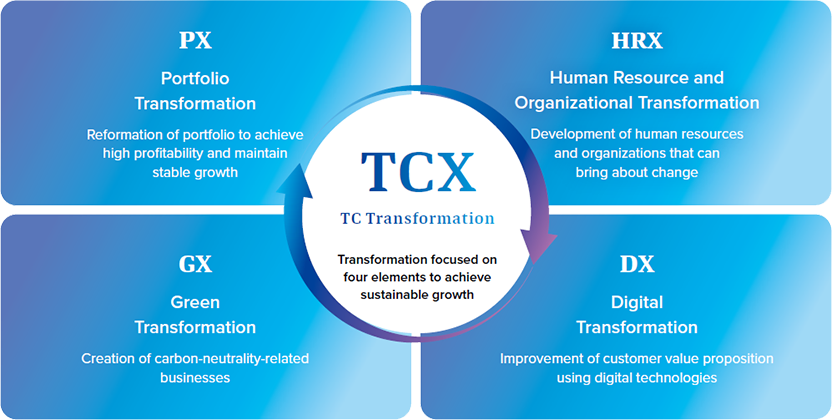

In fiscal 2023, the first year of Medium-Term Management Plan 2027, we got off to a strong start in terms of both performance and growth investments. As the leader of management, it is my mission to achieve our management target of net income attributable to owners of parent of ¥100.0 billion as quickly as possible. Accomplishing this mission will require that I address management issues through proactive engagement with stakeholders and advance the four pillars of Tokyo Century Transformation (TCX)—portfolio transformation, human resource and organizational transformation, green transformation, and digital transformation— aimed at building a more ambitious and resilient organization that is adept at bringing about change.

Progress of Medium-Term Management Plan 2027

Provision of the Assets and Services Society Needs as the Wellspring of Value Creation at Tokyo Century

If Tokyo Century is to keep growing into the future, it will be imperative that we continue to supply the value demanded by customers and society in the given era. In other words, our business activities must always be of benefit to customers and society.

Today, Tokyo Century is developing its business with a focus on its five operating segments. When I look back at how we became involved in each of these business areas, I see that in each case our entry was based on our founding business of leasing and the capabilities cultivated therein for providing the items, as well as the related services, deemed to be important parts of social infrastructure indispensable to economic activities. Accordingly, I believe it is the provision of such items and services that is the wellspring of value creation at Tokyo Century.

Tokyo Century got its start in providing information and office equipment as well as computers and other electronic devices for corporate customers. We then branched out to offer the automobiles and aircraft that are crucial to mobility, the ships and trucks serving as the lifeline for logistics, and infrastructure in the form of real estate. By building upon these asset-related businesses, we have succeeded in expanding the scope of our business to include the renewable energy that is essential to our everyday lives. In this manner, Tokyo Century has continued to grow over the years by creating new services and businesses as it expands the scope of the items it supplies. The discerning eye for ascertaining value cultivated throughout our history of owning various assets also enables us to propose the services and solutions necessary for using such assets. Through such offerings, we have proceeded to maximize the value created by customers, and this process has given rise to the strengths Tokyo Century boasts today.

This business model was further evolved by our partnership strategy, a competitive advantage that has become an important core competency to Tokyo Century’s value creation cycle. Tokyo Century is not satisfied with merely providing customers with assets and services. Rather, we aspire to gain an accurate understanding of the issues faced by our customers so that we can evolve our relationships as a partner through the supply of solutions and the creation of new joint businesses. This culture has become entrenched in the minds of our people and throughout our organizations and has driven us to generate countless synergies in our partnerships with numerous customers. By building relationships in which our customers view us as a partner in the co-creation of value and generating synergies, we are able to take part in various business ventures and thereby drive improvements in Tokyo Century’s corporate value.

Capacity to Bring About Change Necessary in Uncertain Times

As president, I communicate my desire for Tokyo Century to bring about change through our integrated reports, in messages issued to employees, at briefings for investors, and via various other opportunities. This desire is founded on my vision for Tokyo Century to become a company that, in a rapidly changing operating environment, is able to preemptively identify the needs of customers and society and create innovative services that win favor. It is also an expression of my understanding that, if we do not create innovative services and businesses, Tokyo Century will not be able to survive. The current era is one defined by companies winning out against the competition only by offering services focused on the value of intangible assets, such as generative AI and digital technologies. Accordingly, we expect it will become increasingly difficult to provide customers with sufficient value just by owning and providing assets. An important focus of Tokyo Century’s business activities going forward will thus be the extent to which we can respond to contemporary needs by attaching innovative new value to the asset use value customers require.

Based on an understanding of the threat these trends present to Tokyo Century, one of the first tasks I undertook after becoming president was to transform how we perceive our five operating segments. I thereby sought to evolve our operating frameworks to encourage autonomous and independent action by the managers involved in each operating segment, as opposed to reliance on top-down instruction. With an expansion in a company’s business areas comes a tendency for organizations to become more divided, which can result in insight and expertise becoming locked within organizational units. To address this issue, we organized two cross-Company task forces: the DX Task Force, responsible for digital transformation measures, and the GX Task Force, charged with initiatives pertaining to green transformation. These task forces are membered by individuals from across Tokyo Century’s five operating segments. These members share information on needs of customers pertaining to digital technologies and to the environment as well as on the types of proposals being made in response to such needs. This approach is designed to facilitate coordination and the accumulation of expertise in a manner that spreads across operating segments so that we can develop new value creation proposals and help resolve customer issues.

It has been said that having a diverse range of businesses can make a company subject to a conglomerate discount. Regardless, I think that Tokyo Century’s five operating segments are important as they all handle different products and services while still being related to other segments. The presence of these five segments gives rise to synergies that allow us to provide new value and thus enhances the range of strategic options available to all segments.

Human resource and organizational transformation is another important part of building a management foundation that will enable us to bring about change. The steady advancement of TCX requires the pursuit of ambitions by officers and employees and also organizations capable of supporting such ambitions. Our approach moving forward will be to update our corporate culture to allow for better career autonomy and independence and greater ambition, improve our workplace environment to make employees feel more motivated and empowered in their work, and enhance our evaluation and compensation systems to secure talented human resources. As we move forward with such human resource and organizational transformation endeavors, we will also promote portfolio transformation, green transformation, and digital transformation alongside the strategies of our five operating segments to facilitate the matrix-style management approach necessary for advancing TCX.

Four Pillars of TCX

Three Policies Emphasized as President

There are three policies I emphasize in my organizational management approach, and I constantly inform people at Tokyo Century of these policies.

These policies are “health comes first,” “give and give,” and “bad news first.” I have emphasized these policies throughout my career, and therefore I want to now make them known via this integrated report.

“Health comes first” is based on an understanding of the seminal importance of protecting the health of everyone at the Tokyo Century Group as well as of their family members. It is not enough for our people to be in good physical and mental health. I also want everyone to be motivated at work, build strong interpersonal relationships, and feel proud to be a member of Tokyo Century. This desire coincides with the concept of wellbeing, and I thus want to incorporate this concept into my management approach in order to help Tokyo Century contribute to the individual happiness of all of its officers and employees. I am convinced that doing so will lead to everyone making better contributions and in turn drive the ongoing growth of the Company.

“Give and give” is an embodiment of my belief that when we maintain a keen focus on what we give to customers, always motivated by a pioneering spirit and our instinctual drive, we will reap benefits in the form of success and personal growth. When I was in sales, there were numerous times in which customers would not accept any of my proposals and I was unable to satisfy their expectations. However, if we blame our failures on others, our growth stops there. Conversely, when we tap the depths of our knowledge to search for ways to better respond to customer needs, it marks the start of a new type of relationship with customers. I want all Group employees to keep this in mind as they go about their work. Even as our performance struggled over the past three years, Tokyo Century’s people continued autonomous and independent efforts to overcome this adversity, and it is thanks to this dedication that we were able to achieve a rapid recovery. The Company should keep giving what it can to reward everyone for their hard work, and I am committed to developing and implementing new human resource systems to ensure that this is done.

As for “bad news first,” we are in an era characterized by volatility, uncertainty, complexity, and ambiguity. Meanwhile, Tokyo Century has come to handle a wide range of financial, service, and business offerings. As such, unexpected circumstances may strike at any time. When hit with something unexpected, our initial response is paramount. I therefore want to entrench an organizational management approach that prioritizes the psychological safety of employees and ensures that bad news is quickly reported to me and to other members of management. The cultivation of such a culture is something that must be spearheaded by its leader. Throughout my career, no matter how busy I have been, I have always made a point of stopping to listen when one of my subordinates speaks to me. If I had asked them to wait till later, it potentially would have fostered a culture in which people unconsciously try to accommodate the mood of their supervisors, which can strangle workplace communication. As president, I am always mindful of this danger in my work. Also, I recognize that preparing measures to avoid and respond flexibly to risks is the most effective way to mitigate risks.

Updates to Oneself

As a leader, it goes without saying that there are times in which I need to hand down important management decisions. To prepare for such occasions, I always endeavor to think about the future so I can plan for various scenarios that might arise due to certain changes. I also practice attentive listening so that I can gather new ideas for use in implementing updates to myself.

I have been alive for more than sixty years, and this means that I have internalized a lot of preconceptions. However, these preconceptions can sometimes be a shackle that prevents me from keeping up with new ideas and values. This is why it is so important to refrain from immediately rejecting the diverse ideas presented by people of all ages, including those younger than oneself, and to listen to these ideas from a place of humbleness. To ensure that we do not miss out on an innovative and unique idea, leaders must attentively listen to all corners of their organization. I therefore place emphasis on listening to input from as many members of our team as possible.

It was based on these personal sentiments of mine that we launched the TC-Mee+ project in fiscal 2022. This internal project is aimed at promoting exchanges through free discussion among employees. I actively participate in TC-Mee+ gatherings to take part in free discussion with individuals ranging from junior to mid-level employees. I also make appearances at the overnight training sessions arranged each year for newgraduate hires so that I can have a chance to talk with them. This always proves to be a good opportunity to think seriously about what new Tokyo Century employees expect of the Company.

Past Experience as a Tool for Overcoming Current Challenges

Over the past several years, we have seen a number of unprecedented developments across the globe, such as the COVID-19 pandemic, Russia’s invasion of Ukraine, the reignition of conflicts in the Middle East, and tension between the United States and China. Accordingly, we cannot continue to make business decisions based on the assumptions of global collaboration, low inflation, low interest rates, and a so-called Goldilocks economy. Rather, the uncertain times necessitate that companies take appropriate and agile action with regard to their business portfolios and risk management approaches.

Over the period from fiscal 2020 to fiscal 2022, Tokyo Century recorded total losses amounting to approximately ¥160.0 billion when accounting for impairment losses and losses on bad debt and revaluation. These losses increased the level of volatility in our performance, and this is definitely something on which we must reflect. Two major factors led to this outcome. The first factor is that, when an investment conducted with synergies in mind suffered a decline in profitability due to an inability to effectively collaborate, our frameworks for quantitatively and qualitatively judging whether to continue or discontinue the investment did not function properly. The second factor is that we failed to adequately perform multifaceted examinations of country risks that took into account factors like geopolitical conditions.

The lessons learned from these failures have been incorporated into our business portfolio transformation approach. Specifically, we will regularly verify the growth potential and profitability of individual businesses in all operating segments to determine when it is necessary to divest and minimize the risk of losses in pursuit of improved profitability. In monitoring profitability, we will, of course, use the key performance indicator of return on assets defined in Medium-Term Management Plan 2027. At the same time, we recognize the need to entrench among all officers and employees the idea of management based on return on invested capital (ROIC) spread, which measures profitability in comparison with risks. We are currently advancing preparations for the introduction of ROIC spread as a monitoring index.

Our risk management approach must feature an appropriate balance of risk taking and risk mitigation. That being said, we must prevent overly rigorous screening from adversely impacting the process or speed of investment and financing decisions. Accordingly, we will strive to maintain frameworks that allow for bold management decisions with regard to the necessary growth investments.

Opportunities and Risks Created by Positive Interest Rates in Japan

In March 2024, the Bank of Japan canceled its negative interest rate policy and decided to abolish its yield curb control policy. Following the July 2024 policy interest rate hike and other returns to normal financial policy, Japan is thus expected to enter into an era of positive interest rates. In this era, it will be crucial for us to assess the impacts this massive change will have on our management strategies.

On March 31, 2024, the Equipment Leasing segment accounted for around 20% of Tokyo Century’s total business portfolio. In this business, we are looking to minimize the impacts of the change in interest rate policy through rigorous asset liability management. Going forward, market interest rate trends will be reflected in new lease contracts. Accordingly, the impacts of higher costs on profits should vanish over the medium term due to the replacement of assets through new contracts. In this manner, we feel that our business is relatively resilient to interest rate fluctuation risks.

However, discussion of this change should not be limited to our resilience to risks; we feel that the positive interest rates will also have benefits for Tokyo Century’s business activities. For example, the rising interest rates may heighten the value of ICT equipment, automobiles, aircraft, ships, and various other assets, thereby creating benefits for business models centered on such asset value, like that of Tokyo Century. Moreover, the rise in market interest rates will reflect economic growth and likely grant us access to a wider range of new business opportunities to provide various solutions to customers considering new growth or other investments.

As we rigorously manage the risks created by operating environment changes, we must also remain receptive so as to not miss out on any opportunities for growth.

Large-Scale Investment in High-Potential U.S. Data Center Business

I view the United States as a critical market in terms of both economic growth and geopolitical considerations. Tokyo Century is expanding its operations in this market centered on U.S. IT equipment leasing subsidiary CSI Leasing, Inc., which is developing operations in more than 50 countries around the world. We have proceeded to build foundations in this market through our joint U.S. real estate business with Mitsubishi Estate Co., Ltd., and the establishment of construction machinery finance company ZAXIS Financial Services Americas, LLC, and of Tokyo Century (USA) Inc., which is responsible for our truck financing and specialty vehicle sales businesses. With these foundations in place, we were able to conduct growth investments totaling about U.S.$460 million in fiscal 2023 to enter into the U.S. data center business. This promising business is expected to see rapid market growth thanks to the spread of generative AI.

Tokyo Century already has data center businesses in India, but entering the U.S. data center business was a venture on a much grander scale. Nevertheless, I am certain that our entry into the U.S. data center business will prove to be a powerful driver of future growth, as the U.S. market is home to hyperscalers and numerous other massive IT companies. Developing our data center operations will require us to bear some up-front costs. Fortunately, our partnership with the NTT Group, the world’s third-largest data center operator, ensures that we can be sufficiently competitive. As we seek to leverage the services of CSI Leasing and support the infrastructure of major IT companies, we anticipate that this business will also generate significant returns for Tokyo Century.

The process of training generative AI consumes massive amounts of electricity, meaning that data centers must have power networks that meet the demanding electricity requirements. We aim to secure this power through solar power and other renewable energy sources and by using storage batteries in order to contribute to a cleaner world. We hope to leverage internal and external insight and expertise through the Environmental Infrastructure segment to take advantage of future business opportunities in this regard.

Management Emphasizing Share Prices

The Tokyo Stock Exchange issued a statement encouraging listed companies to practice management emphasizing cost of capital and share prices, and this statement sparked a startling transformation among Japanese companies over the past year. Tokyo Century, as well, took action, discussing the matter at Board of Directors’ meetings and then disclosing an analysis of its current price-to-book ratio (PBR) and its policies for improving this ratio on its corporate website and in its corporate governance report in December 2023. Based on the strong belief that we must not limit our efforts to the same type of formulaic disclosure that did not reflect the actual conditions at the Company, we shaped our disclosure based on thorough consideration of which methods would best accommodate the perspective of investors. This disclosure took into account aspects such as analyses of our current PBR and the assumption that the Company’s cost of shareholders’ equity at the time of the formulation of Medium-Term Management Plan 2027 was around 10%. The disclosure approach used garnered an incredibly positive response from shareholders and other investors. In addition, investor relations materials released in May 2024 described our intent to adopt a progressive dividend policy as our basic stance, clearly indicating that, in principle, we would institute no reductions to dividend payments going forward. Even before becoming president, I had the opportunity to take part in proactive engagement with domestic and overseas investors, and I continue to make efforts to reflect the input gained from the market into management, a duty of a listed company, and to engage earnestly with the market.

Increasing growth investments and shareholder returns is, of course, important to improving share prices and corporate value. Such increases, I believe, are dependent on a company’s ability to generate cash flows and to make these cash flows more visible to stakeholders. Companies seeing steady improvements in their PBR tend to be growing through an ongoing process of using the cash generated by their businesses to invest in new businesses and expand their operating foundations, thereby increasing their capacity to generate cash flows. It is the high evaluations of investors for this process that drive up share prices. At Tokyo Century, we are always cognizant of the need to use the cash generated through our portfolio transformation activities, which are aimed at improving asset efficiency and profitability, to practice management with an emphasis on growth investments and shareholder returns. If we can make this approach more visible to stakeholders, I am sure we can paint a picture of how we will achieve improvements in our corporate value.

Creation of a Tokyo Century at Which Everyone Feels Happiness

As president, there are a number of important missions I must fulfill, namely, driving the ongoing growth and development of Tokyo Century while contributing to society, increasing our scale and market capitalization, and ensuring that all of our teammates feel proud to work at Tokyo Century.

In the past, the dynamic between companies and employees tilted significantly in the direction of companies as they were the employer. Today, however, companies are expected to form equal relationships with their employees and to promote corporate philosophies that resonate with each individual’s sense of purpose. In other words, we are now in an era in which Tokyo Century must act as a collective that seeks to enact its Management Philosophy while stepping up engagement by making people feel inspired to work here.

My vision for the ideal company is one with an entrenched process through which the company supports the ambitions of its employees, who experience growth by chasing said ambitions, and the results of these undertakings accumulate to improve the company’s corporate value.

Today, there are more than 7,800 individuals working at the Tokyo Century Group. However, no one single employee can create value without the contributions of others. I therefore want to make sure Tokyo Century’s precious values and DNA are passed on to future generations so that the Company can continue to grow. There is still much to be done for this reason. As president, I am committed to doing everything I can to ensure you feel excited about the future of Tokyo Century.

October 2024