Overview

INTEGRATED REPORT 2024

Unique Growth Strategies

Overview

- Growth Strategies of Aviation Capital Group

- Growth Strategies of CSI Leasing

- Partnership with the NTT Group

Growth Strategies of Major U.S.-Based Aircraft Lessor Aviation Capital Group

Goal of Acquisition

- Major U.S.-based aircraft lessor Aviation Capital Group LLC (ACG) was converted into a wholly owned subsidiary in 2019 in order to accelerate the Tokyo Century Group’s initiatives for serving the growing aviation market, which is expected to experience a global rise in air travel demand.

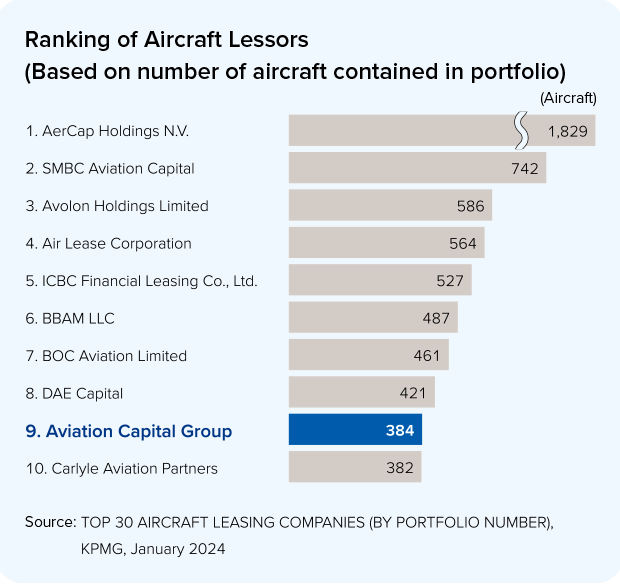

- With a fleet of 371 owned and managed aircraft and 112 committed aircraft (as of June 30, 2024), ACG is a major lessor ranked among the top 10 in the global aircraft leasing industry.

- ACG was forced to surmount two major challenges, namely, the COVID-19 pandemic in 2020 and Russia’s invasion of Ukraine in 2022, but it was able to overcome these challenges by utilizing its resilient portfolio and begin a recovery in performance. ACG is thus expected to continue to expand and grow.

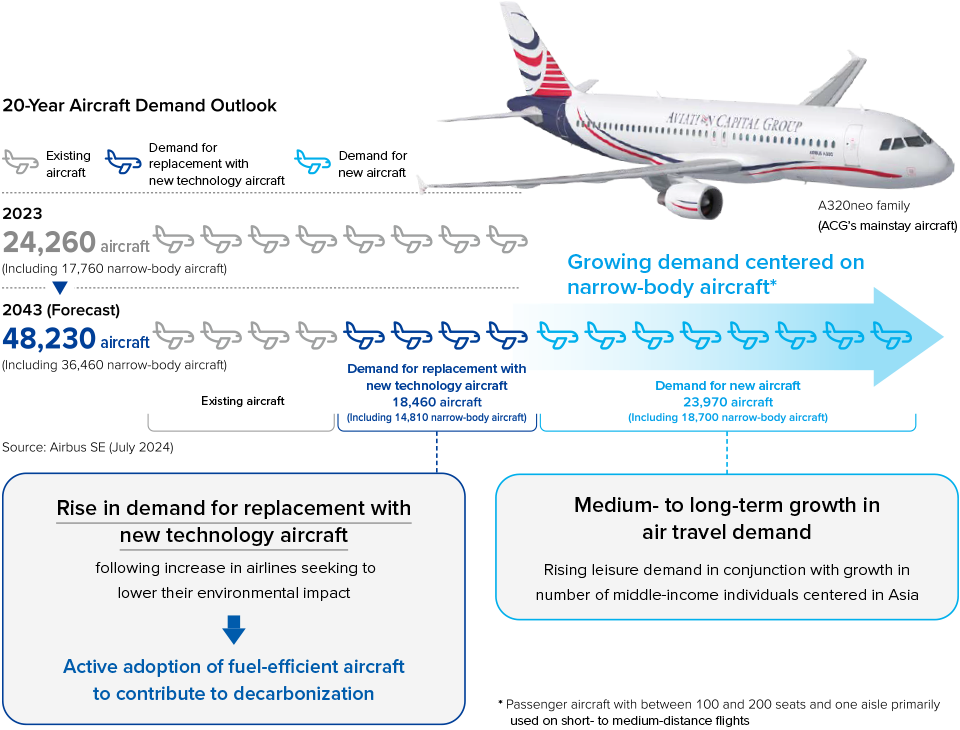

Market Opportunities

Approaches and Competitive Advantages for Addressing Market Opportunities

Scrollable horizontally

|

|

|

|

|---|---|---|

| Portfolio Centered on Mainstay Narrow-Body Aircraft | Portfolio of Committed New Technology Aircraft | Marketing Capabilities Granted by Broad Customer Base |

| Narrow-Body Aircraft by Count 97% (Based on number of aircraft) | Number of Committed New Technology Aircraft 112 (As of June 30, 2024) | Customer Base Approx. 90 airlines |

| Narrow-body aircraft represent 97% of ACG’s portfolio. Use of narrow-body aircraft is expected to increase going forward amid growing leisure demand. Meanwhile, high value is anticipated for secondhand narrow-body aircraft given that this type of aircraft features higher liquidity in the secondary market than widebody aircraft. | ACG boasts strong relationships with Airbus SE and The Boeing Company as well as an industry-leading portfolio of 112 committed aircraft. All of said aircraft are fuel-efficient, new technology aircraft for which we are receiving an increasing number of inquiries from airlines. New technology aircraft feature higher leasing fees and prices than older models and are thus expected to function as a source of earnings and enjoy a growing market share going forward. | ACG has business relationships with some 90 airlines, ranging from low-cost carriers to certain national flagship carriers, in around 45 countries. This broad customer base allows ACG to engage in flexible marketing activities for finding lessees, which in turn enables the company to generate stable earnings while minimizing the risk of impairment losses on aircraft. |

Management Team

ACG’s management team includes a director and senior managing executive officer of Tokyo Century who acts as executive chair of ACG as well as four other individuals dispatched from the Company. Meanwhile, everyday management at ACG is conducted by the senior leadership team, which comprises nine individuals with extensive industry experience who guide the company in the funding, marketing, technical, original equipment manufacturer commercial negotiation, and legal affairs activities that are crucial to an aircraft lessor.

Mahoko Hara

Executive Chair

(Director and Senior Managing Executive Officer of Tokyo Century Corporation)

Thomas. G. Baker

Chief Executive Officer and President

Senior Leadership Team

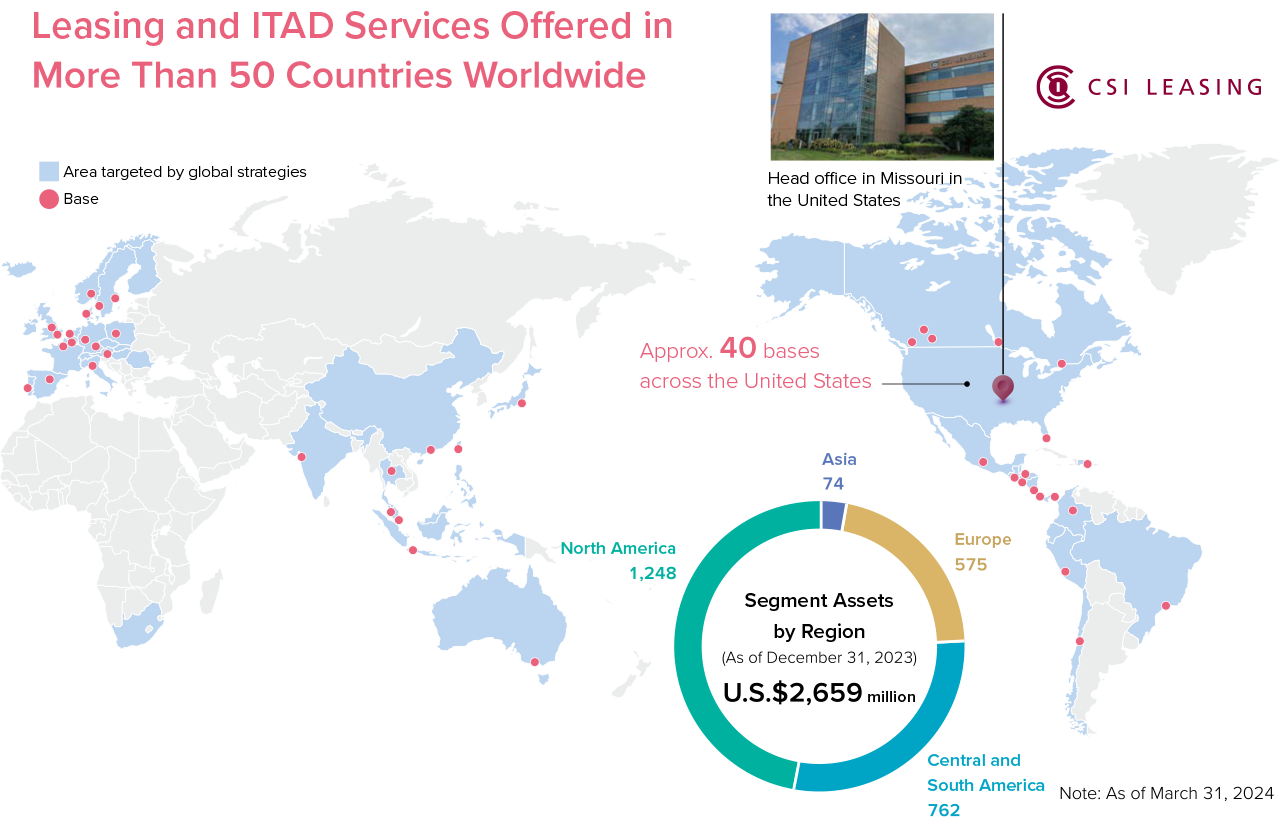

Global Strategies of U.S. IT Equipment Leasing Company CSI Leasing

Goal of Acquisition

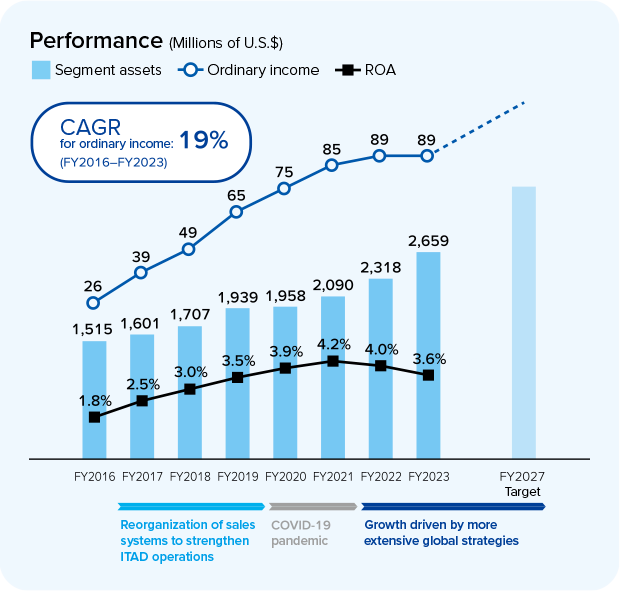

- U.S. IT equipment leasing company CSI Leasing, Inc. (CSI), was converted into a subsidiary in 2016 with the goal of catering to the growth in demand for IT equipment anticipated to be seen globally due to the spread of digital technologies.

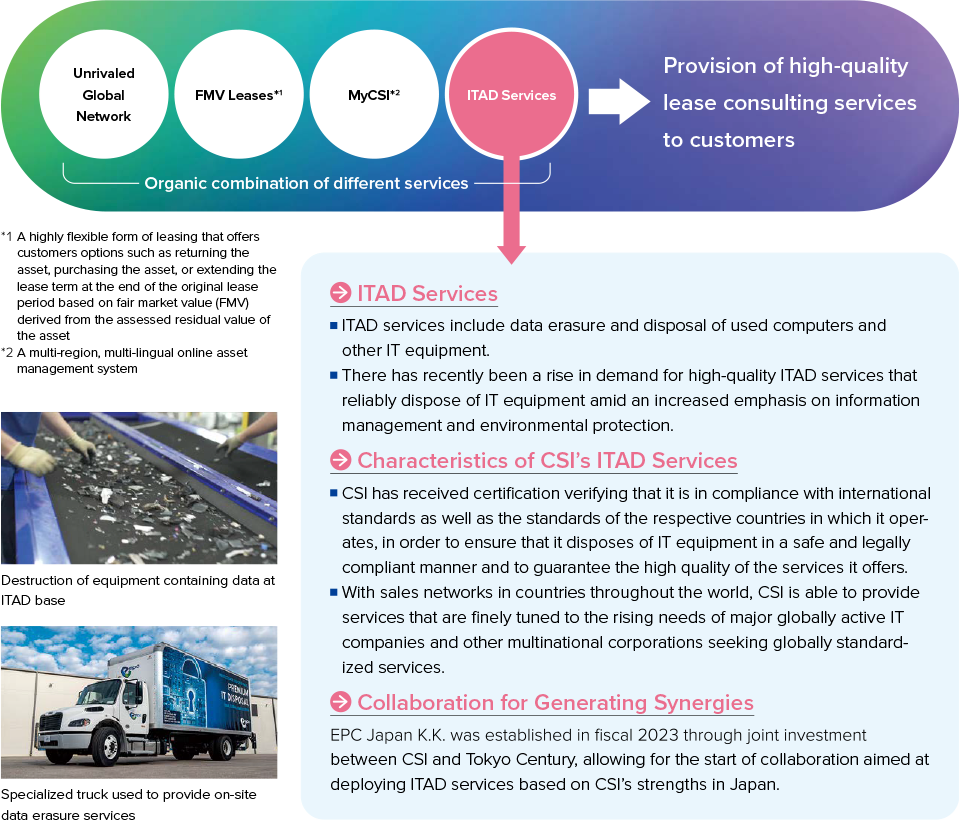

- CSI possesses strengths in the leasing of computers, servers, and other IT equipment as well as IT asset disposition (ITAD) services, an example of which being the erasure of data from end-of-lease equipment. With these strengths, the company is developing a business model that allows it to generate subsequent earnings from end-of-lease equipment via the re-leasing or sale of computers based on their residual value. As a result, CSI boasts high profitability surpassing that of standard leasing companies.

Global Strategies

Competitive Advantages

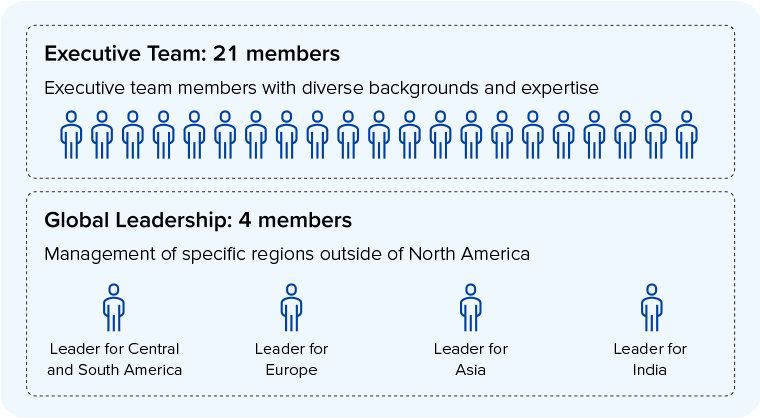

Management Team

A senior managing executive officer of Tokyo Century serves as vice chairman of CSI, and the Company has dispatched three employees and one executive officer to CSI.

Steve Hamilton

Chairman and Chief Executive Officer

Toshio Kitamura

Vice Chairman

(Senior Managing Executive Officer of Tokyo Century Corporation)

North American Executive Team and Global Leadership

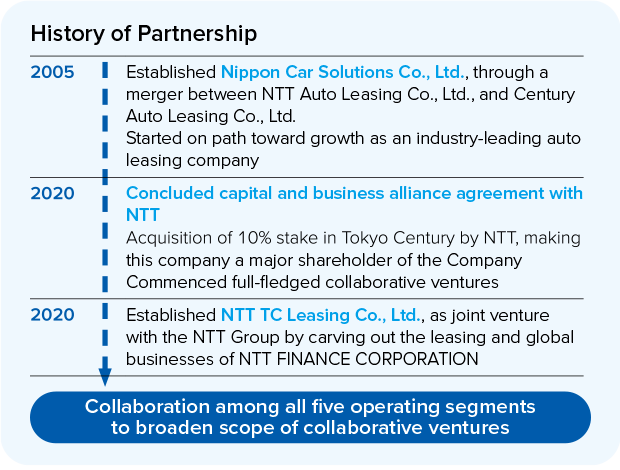

Expansion of Business Scope through Capital and Business Alliance with NTT

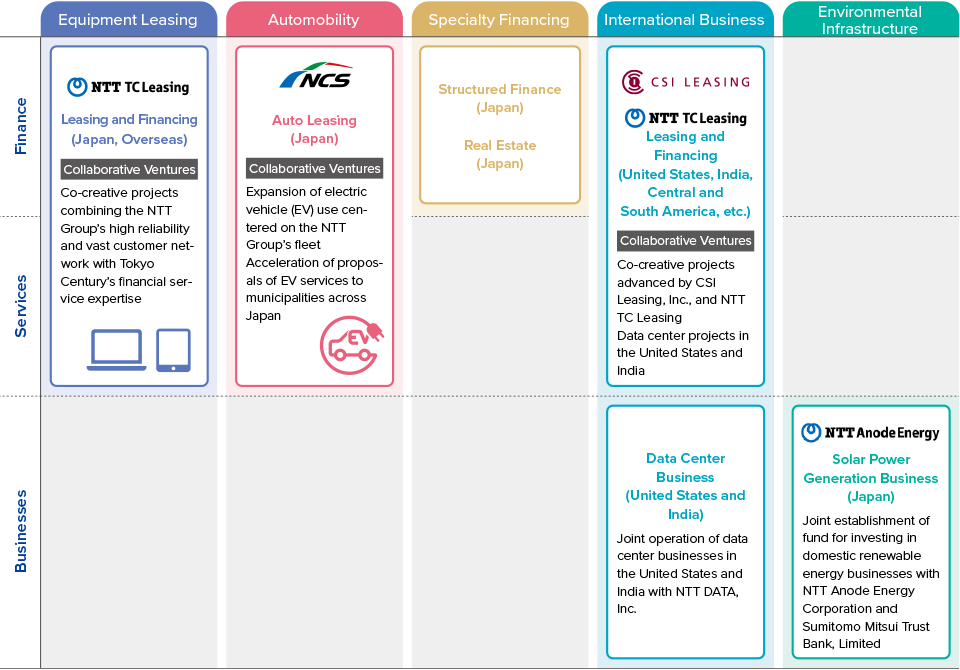

Collaborative Ventures through Partnership with the NTT Group

- Our partnership with the NTT Group has continued for the nearly two decades that have passed since the merger of the auto leasing businesses of the NTT Group and of Tokyo Century in 2005. This partnership was further strengthened by the capital and business alliance formed in 2020, which expanded our collaborative ventures outside of the Automobility segment. As such, we are currently collaborating and pursuing synergies with the NTT Group in all five operating segments.

- To facilitate these efforts, Tokyo Century has set up the NTT Collaboration Office in the Corporate Planning Unit, positioning the creation of opportunities for collaborative ventures with the NTT Group as a priority focus area.

Ever-Broadening Scope of Collaboration with the NTT Group

Future Growth Fields

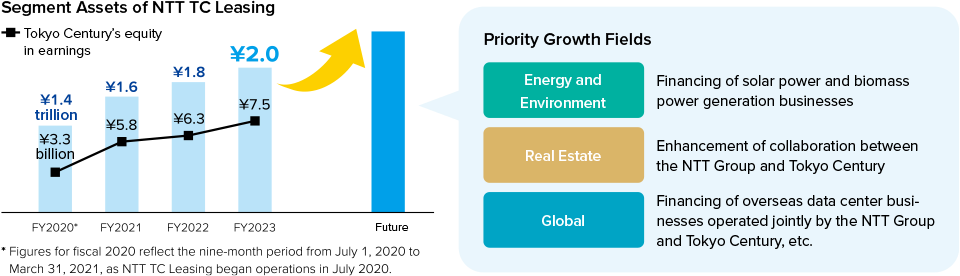

NTT TC Leasing

Since its founding, NTT TC Leasing has continued to achieve smooth growth in its operating asset portfolio by capitalizing on the NTT Group’s unparalleled brand power, high reliability, and vast customer network and on Tokyo Century’s financial service expertise to enhance its proposal capabilities.

- *Ownership NTT Group: 50% Tokyo Century: 50%

Data Center Business

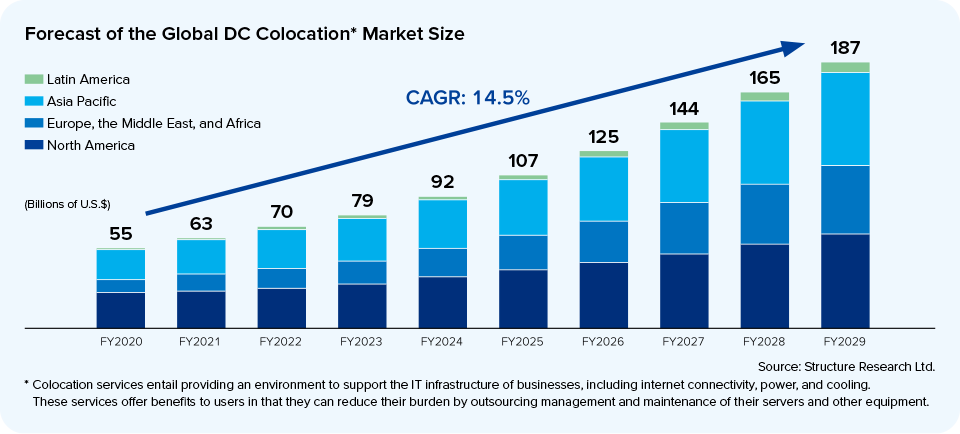

The data center business is anticipated to see growth amid market expansion driven by the popularization of generative AI and other technologies. In this market, the NTT Group has carved out an impressive competitive position as the No. 3 data center business operator in the world.

Moreover, the data center business promises reliable cash flows, through rent revenues received from hyperscalers and other major IT companies, and ongoing increases in business value. Tokyo Century is actively developing operations in this priority field together with the NTT Group.