Risk Management

INTEGRATED REPORT 2024

Response to Expansion of Business Domain

RiskManagement

Investment Management Framework

For the purpose of establishing an investment governance framework for use in optimizing its business portfolio, the Tokyo Century Group has instituted an investment management framework. Primary focuses of this framework include clarifying investment screening and withdrawal standards and developing standardized monitoring processes.

Overview of Investment Management Framework

-

Investment Screening

Verification of Investment Risks and Profitability

- Due diligence processes

- Business plan formulation and synergy verification

- Post-merger integration and investment recovery policy formulation, etc.

-

Investment Standards

Confirmation of Conformity to Investment Management Framework Standards

- Quantitative standards: Confirmation that present value (calculated as cash flows after taxes attributable to the Company and discounted based on cost of capital) is greater than investment amount

- Qualitative standards: Compatibility with Companywide portfolio strategies and operating segment business strategies

- Individual withdrawal standards: Confirmation of financial figures defined as triggers for commencing the withdrawal process and effectiveness of withdrawals

-

Progress Management

Monitoring

- Preparation of charts detailing profit margins after deduction of cost of capital

- Confirmation of conformity to quantitative and qualitative standards, applicability under withdrawal standards, and progress of initial business plans

-

Continuation /

Withdrawal DecisionInvestment Continuation Judgment

- Confirmation of changes in strategic importance, market growth potential, etc.

- Assessment of impacts of withdrawal on relevant parties, etc. (items to be considered when withdrawing)

Continuation or Withdrawal

As part of the process for screening investments under this framework, it is confirmed whether the present value (calculated as cash flows after taxes attributable to the Company and discounted based on cost of capital) is greater than the investment amount, whether the business area targeted for investment conforms with business portfolio strategies, and whether appropriate triggers for withdrawal decisions have been set. After such confirmation, the Investment Management Committee meets and multifaceted evaluations are conducted by dedicated divisions with regard to projected risk exposure, legal risks, and taxation circumstances. The decision of whether to conduct a specific investment is made by the Management Meeting based on comprehensive discussions taking into account the evaluations by the Investment Management Committee.

After investment, projects will continue to be monitored through standardized processes. Charts detailing profit margins after deduction of cost of capital are prepared for all applicable projects, and confirmation is sought regarding whether any projects have become applicable under shared or individual withdrawal standards. The Investment Management Committee compiles the results of evaluations into annual monitoring reports, which are submitted to the Management Meeting and the Board of Directors.

If a project is judged to have become applicable under withdrawal standards, the Investment Management Committee will suggest withdrawal to the Management Meeting. Should a sales organization seek to maintain an investment even after the project has become applicable under withdrawal standards, the Investment Management Committee will evaluate the appropriateness of continuation, and the final decision will be made by the Management Meeting based on comprehensive discussions taking into account the evaluations by the Investment Management Committee.

ROIC Monitoring in Operating Segments

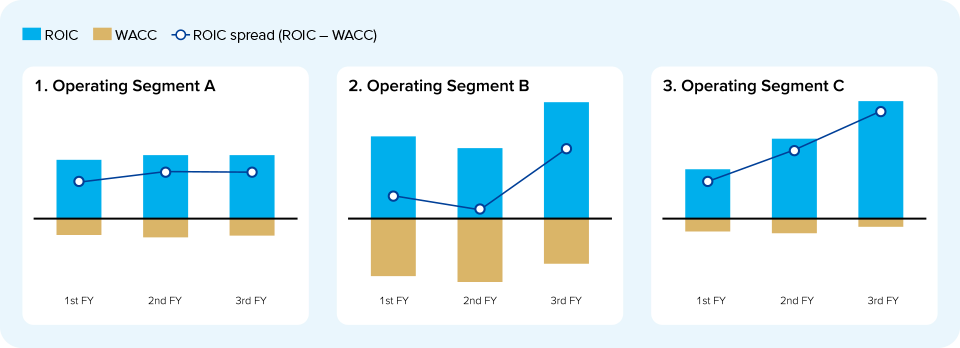

Tokyo Century regularly monitors the return on invested capital (ROIC) spread, which is ROIC less weighted average cost of capital (WACC), as a cost-of-capital-based indicator of the risk-and-return balance of specific business areas reflecting business and risk characteristics. Moreover, this timing-based monitoring approach is used to promote management that emphasizes cost of capital along with sound financial discipline. Factors examined through this monitoring include whether an appropriate balance is being maintained between risks and returns in different operating segments and whether the necessary risks are being taken to generate value and stimulate growth. Under Medium-Term Management Plan 2027, the Company continues its approach toward managing risks and returns with an emphasis on cost of capital. At the same time, enhancements to this approach are being pursued by reviewing methods for managing the ROIC spread by operating segment and incorporating this indicator into performance evaluations and portfolio allocation.

Management of ROIC Spread by Operating Segment