INTEGRATED REPORT 2023

BACK NUMBERS

Message from the President of the Corporate Planning Unit

SUSTAINABILITYMANAGEMENT

By promoting sustainability management based on an integrated approach toward financial and non-financial strategies, I aspire to generate a virtuous cycle of ongoing growth.

Meaningfulness of Tokyo Century’s focus on sustainability management

Tatsuya Hirasaki

Director and Managing Executive Officer President, Corporate Planning Unit

President, Accounting Unit

Even in our everyday lives, we are made aware of the various issues that plague our world, including the environmental destruction threatening the future of our planet, the food and energy shortages, and the rising geopolitical risks. Against this backdrop, everyone must now think seriously about the future of the planet while companies need to focus on more than just the development of the economy and society; they also need to exercise responsibility in protecting the planet.

Tokyo Century was founded as a leasing company, and leasing is a circular business that entails the ongoing reuse and recycling of resources, as opposed to mass production and consumption. This founding has shaped our Management Philosophy, which we continue to embrace even as the scope of our operations expands. Our mission based on this philosophy is to continue to develop businesses that contribute to the creation of an environmentally sound, sustainable economy and society in order to preserve a pristine global environment for future generations. The advancement of business activities by Tokyo Century that are highly compatible with eco-friendly circular businesses is a component of our approach toward sustainability management for contributing to the resolution of social issues while also driving ongoing growth and corporate value improvement for the Company.

Effective sustainability management requires us to generate a virtuous cycle of heightening the Company’s earnings power to generate steady profits that can be invested in environmental, social, and governance (ESG) initiatives that will contribute to future earnings power. Medium-Term Management Plan 2027, which was announced in May 2023, calls on us to strengthen our earnings power and promote ESG initiatives. This belief in sustainability management was one of the factors behind this decision.

A company that lacks sufficient earnings power will have to devote its efforts toward the numbers right in front of its eyes, which will no doubt result in it resorting to a short-term management approach. Raising future earnings power from a medium- to long-term perspective, meanwhile, will require a company to invest in non-financial areas, like human resources and carbon neutrality. By advancing steadfast efforts targeting such areas, Tokyo Century believes that it can increase the number of investors who resonate with its vision and strategies and heighten the number of employees who feel pride in the Company.

I want to make Tokyo Century a company that shareholders, investors, employees, and other stakeholders will look at five to 10 years from now and realize that we have developed a virtuous cycle of ongoing growth.

Tokyo Century’s materiality and unique value creation process

Tokyo Century has defined five key issues in terms of its materiality. These issues were identified based on their importance to stakeholders, as indicated by guidelines including the United Nations Sustainable Development Goals, and on their importance to Tokyo Century, which is shaped by the characteristics of our business focused on asset value, the various businesses we develop in a highly free operating environment, and our partnership strategy. I expect that these issues will serve as a compass for guiding the daily activities of officers and employees. Moreover, by continuously addressing these issues, we stand to achieve earnings growth while also contributing to the resolution of social issues.

Our ability to practice management based on these key issues will hinge on our contributions to the resolution of social issues and on the degree to which we can evolve our business model and expertise. Tokyo Century’s competitive edge is built on its services and businesses that emphasize value going beyond financial functions, the expertise of its employees, and its various business partners. If we can effectively take advantage of this competitive edge, we are sure to be able to establish a unique presence in a highly competitive market.

Process for Identifying Materiality (Key Issues)

Effective sustainability governance as viewed by the chairperson of the Sustainability Committee

I am in charge of both corporate planning and sustainability, which puts me in the position of drafting and enacting both financial and non-financial management strategies. There is a benefit of having one person oversee said areas and strategies, mainly that it makes it easier for me to take an integrated approach. Moreover, since fiscal 2022 I have chaired the Sustainability Committee, which was established in fiscal 2018. Sustainability-related themes form the very foundations of management. This means that the committee has to examine a wide variety of such themes, and discussions are always quite lively. Of course, we do not stop at just talking about these topics; we also issue reports and encourage discussions by the Management Meeting and the Board of Directors from the perspectives of accountability and transparency. This process allows the Company to advance forward-looking strategies based on a breadth of input.

In fiscal 2022, a major theme for the activities of the Sustainability Committee was setting our policy of working to achieve carbon neutrality by fiscal 2040. The introduction of carbon taxes is being discussed around the world. Seeking to get ahead of such taxes, Tokyo Century has decided to implement an internal carbon pricing system on a trial basis. We have also begun scenario analyses based on the recommendations of the Task Force on Climate-related Financial Disclosures in order to track and formulate responses to risks and opportunities pertaining to environmental issues, and information on these scenario analyses is being disclosed. In fiscal 2021, we performed our first analysis, which was on solar power generation businesses. We then went on to expand the scope of these analyses to include the aviation business in fiscal 2022 and the automobility business in fiscal 2023. We intend to gradually broaden this scope further to cover an increasingly wider range of our businesses going forward. Alongside such environmental initiatives, we are monitoring the progress of other wide-ranging medium- to long-term sustainability management initiatives for purposes such as improving employee engagement.

The previous medium-term management plan concluded in fiscal 2022. Looking back at the three years of the plan, I feel that we have steadily begun addressing the topics discussed as part of the plan and that officers and employees have heightened their awareness regarding sustainability management. The sales organizations that are at the forefront of our business are also exhibiting a commitment to sustainability, and we are witnessing the aggressive advancement of business activities based on our key issues in terms of materiality. Moreover, these efforts have started culminating in our seizing of business opportunities.

Going forward, we will have to address the challenge of developing Groupwide frameworks for further entrenching awareness of the link between financial and non-financial strategies. Other companies have been putting forth various non-financial key performance indicators (KPIs). Tokyo Century, meanwhile, needs to more deeply examine the relationship between such indicators and its business and financial strategies to define KPIs and develop frameworks for accomplishing the targets for these KPIs via the implementation of a PDCA (plan–do–check–act) cycle. We are still lacking in certain aspects concerning the above. Therefore, I think our first step should be to create easy-to-understand frameworks that illustrate how the accomplishment of our financial and non-financial targets will generate a virtuous cycle in order to help heighten officers’ and employees’ awareness in this regard.

Themes of Medium-Term Management Plan 2027

Since its foundation through the merger in 2009, Tokyo Century has enjoyed rapid growth, earning a strong and enduring reputation from the market in the leasing industry. Regardless, under the previous medium-term management plan, we had to face an incredibly challenging operating environment as a result of unforeseen factors at the time of the plan’s formulation, including the COVID-19 pandemic, Russia’s invasion of Ukraine, and the rapid move toward carbon neutrality. Such developments provided us with a good opportunity to reassess our past initiatives. Based on this introspection and the issues identified thereby, Medium-Term Management Plan 2027, the new plan that kicked off in fiscal 2023, is based on the theme of “Transform Ourselves and Bring About Change.” At the core of this theme is the understanding that, if we do not transform ourselves, we will be unable to continue to grow. This understanding gave rise to the concept of TCX, or Tokyo Century Transformation, based on which we intend to work toward ongoing growth through four types of transformation—portfolio transformation, human resource and organizational transformation, green transformation, and digital transformation.

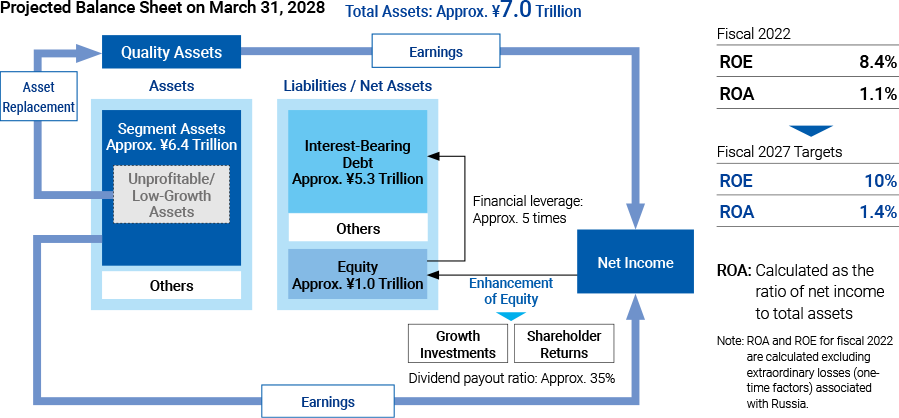

Balance Sheet Management Approach

In addition to TCX, the new plan calls on us to strengthen our earnings power and promote ESG initiatives, as I mentioned earlier, and we aim to heighten corporate value through such efforts. To strength earnings capacity, we will commit to profit growth and ROA improvement. Through this commitment, we express our dedication toward transforming to create a highly profitable and stable portfolio and toward regaining the trust of and creating a sense of anticipation for our growth in the market by communicating this dedication to investors.

Medium-Term Management Plan 2027 defines four measures for transforming our portfolio: increase the value of existing businesses, facilitate asset turnover in business investments, replace or divest unprofitable assets, and explore new business fields. Strengthening our foundations for the promotion of ESG initiatives will also be an important part of supporting these measures. Key considerations in this regard will include contributions to carbon neutrality and to the creation of an environmentally sound, sustainable economy and society, expansion of investments in human capital, and the creation of new businesses with significant social meaning based on our aforementioned key issues. By accelerating sustainability management, we look to establish a virtuous cycle for improving corporate value by creating social and environmental value that translates to future earnings power.

Financial strategy themes of investment in growth areas, mitigation of performance volatility risks, and improvement of asset and capital efficiency

Performance fell significantly short of the targets for profit set for the period of the previous medium-term management plan. I recognize that this failure may have damaged the trust the market places in the growth potential and reliability of Tokyo Century. This recognition informed our decision to put forth financial strategies focused on transformation to create a highly profitable and stable portfolio under the new medium-term management plan.

In advancing these strategies, we will boldly execute investments in growth businesses anticipated to see market growth in which Tokyo Century can leverage its strengths. In addition, all officers and employees will need to be very mindful of enhancing risk management to mitigate performance volatility risks. Other things we should be mindful of include the reallocation of management resources through the replacement of unprofitable assets and the turnover of assets in business investments to improve asset and capital efficiency. I would like to take a moment to discuss these three focuses in a little more detail.

With regard to investments in growth businesses, we will continue to advance our partnership strategy together with prime partners as we develop business models founded on the strength of our “Finance × Services × Business Expertise” concept to enhance our value proposition to customers. Through collaboration with partners, we look to invest in services and businesses with high expected returns. Focus areas for our concerted efforts will include decarbonization, social infrastructure, and circular economies, all themes that coincide with our Management Philosophy and key issues.

The enhancement of risk management is imperative to mitigating performance volatility risks. During the three-year period of the previous medium-term management plan, we were forced to record massive losses, the majority of which were attributable to business categories that entailed relatively high levels of risk capital, such as aviation and investment businesses. Based on this experience, we have begun looking into the possibility of setting risk limits for such categories involving high risk exposure in order to prevent risks from becoming concentrated in these categories. The Investment Management Committee has been moving ahead with measures to strengthen our project screening and monitoring functions. However, a rise in the number of investment projects has created a need for us to enhance our functions for the effective assessment of investments and for withdrawal. The main cause behind the losses in the aviation business was our inability to recover aircraft we owned in Russia after it invaded Ukraine. Realizing that this represented an inability on our part to address geopolitical risks, we have begun the process of redefining country risks and revising overseas exposure management methodologies as part of our efforts to reinforce our risk management systems on a global basis.

In improving asset and capital efficiency, we are transforming our business model to allow for increased flexibility in divestiture of unprofitable assets. Return on assets (ROA) is an important management indicator for Tokyo Century, but it is not perfect in terms of assessing profitability with consideration for cost of shareholders’ equity. Tokyo Century is thus introducing more precise return on invested capital (ROIC) spread management processes to increase employee awareness with regard to the fact that high-risk businesses entail higher levels of cost of shareholders’ equity. We anticipate that this will result in inefficient, unprofitable assets being replaced with quality assets featuring superior investment efficiency, which in turn will lead to a better balance of risks and returns along with improvements in overall capital efficiency. This approach will require officers and employees to be endowed with an increased understanding of cost of shareholders’ equity. Different businesses involve different types of risks and consequently different costs of shareholders’ equity. Accordingly, we look to enhance our management of ROIC spread on an individual operating segment basis.

The exhaustive management of risks and earnings is critical. However, as we pursue growth, we will also have to identify promising business opportunities for driving the ongoing growth of the Company. For example, we, the directors, might need to make the decision to pursue inorganic growth through an M&A transaction. In this manner, we must practice management that allows us to make the necessary decisions, and this will involve reinforcing the frameworks for the Investment Management Committee and developing risk assessment systems so that we are prepared when opportunities present themselves.

Non-financial targets for greenhouse gas emissions reduction initiatives and employee engagement index

Under the new medium-term management plan, we have set new non-financial targets for initiatives for reducing greenhouse gas emissions and for the employee engagement index. One reason for this decision was the recognition that promoting ESG is imperative to strengthening earnings power. Perhaps even more significant, though, was our desire to demonstrate our commitment to such non-financial initiatives to stakeholders and to thereby foster a common understanding and clarify Tokyo Century’s direction in this regard.

In terms of initiatives for reducing greenhouse gas emissions, Tokyo Century has already declared its intent to achieve carbon neutrality by fiscal 2040. Accordingly, the target for fiscal 2027 contained in the new medium-term management plan is somewhat of an interim target toward the accomplishment of this greater goal.

Around 98% of the Tokyo Century Group’s total Scope 1 and Scope 2 greenhouse gas emissions are associated with our biomass co-firing power plant. For this reason, our initiatives to reduce greenhouse gas emissions could be reframed as a project to make this plant carbon neutral. Based on our strong dedication to accomplishing this goal, we are advancing initiatives in accordance with the transition road map we have formulated for this purpose.

Meanwhile, the target for the employee engagement index was introduced based on the recognition that Tokyo Century’s growth is dependent on its people. We conduct regular employee awareness surveys, and the fiscal 2022 iteration returned with a 63% rate of positive responses to multiple-choice questions. This would seem to indicate that our employees have a relatively high opinion of the Company. Still, we cannot allow ourselves to become preoccupied with achieving improvements to such numerical outcomes. Rather, we must take an earnest stance toward any input received and engage with our employees to reform our organizational culture and implement better human resource measures. It is our people and our organization that are responsible for advancing the Company’s strategies. If Tokyo Century is to overcome the challenges present in today’s era of volatility and to continue to grow, it will need to recruit and develop human resources who possess the various skills required of its management and business strategies. Moreover, we must create a workplace environment that allows diverse employees to exercise their skills while feeling pride and fulfillment from working at Tokyo Century. A number of measures are underway with this aim in mind.

Medium-Term Management Plan 2027PDF:327KB

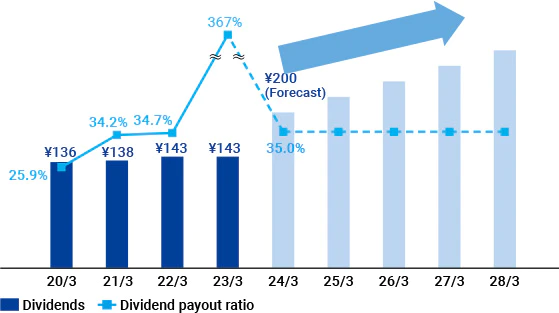

Shareholder Return (Dividend) Policy

- Stable, long-term returns to shareholders

- Ongoing increases to per-share dividends in conjunction with profit growth

- Dividend payout ratio of around 35% for foreseeable future

Pursuit of profit growth and ROE surpassing cost of shareholders’ equity

Tokyo Century’s return on equity (ROE) is currently at a level around 8%, lower than before. As we recognize that our cost of shareholders’ equity should be about 10% at the moment, this situation represents a negative equity spread, which is underscored by a poor standing in the market, as indicated by our price book-value ratio being less than 1.0 times.

To rectify this situation, we are working to increase ROA (ratio of net income to total assets) to the level of 1.4% by improving asset efficiency and investing in profit growth. We are also reassessing our portfolio allocations with an eye to incorporating a focus on both cost of shareholders’ equity and ROIC into operating segment management in order to achieve a better balance of risks and returns.

At the same time, we are looking into the optimal levels of financial leverage and the ideal capital measures for Tokyo Century. Specifically, the Company has adopted an approach of controlling risk exposure to keep it within the scope of capital use rate guideline targets to ensure that we have capital available to cover the rise in risk exposure that accompanies increases in growth investments. Based on our current level of risk exposure, we anticipate that the shareholders’ equity ratio will rise to around 14% as a result of this approach.

Moving on to shareholder returns, we have judged that the appropriate level for the dividend payout ratio over the foreseeable future will be around 35% based on the ideal balance of equity against our ROE target of 10% and plans to amass around ¥1 trillion in segment assets over the next five years. As net income is expected to show steady growth over the period of the new medium-term management plan, we should see an upward trend in dividend amounts if all goes as expected.

We also recognize the importance of investor relations activities for gaining the understanding of investors with regard to our growth strategies through comprehensive information disclosure and for using this understanding to lower cost of shareholders’ equity. In the past, our performance was quite volatile and hard to predict, which was no doubt a cause for concern among investors. We therefore aim to regain the trust of the market through proactive information disclosure and effective investor relations activities based on an easy-to-understand growth narrative. If successful, these efforts are anticipated to help lower cost of shareholders’ equity and raise our price bookvalue ratio to 1.0 times or more.

As the president of the Corporate Planning Unit, I will lead us in the steady advancement of concrete actions that capitalize on Tokyo Century’s unique characteristics to accomplish the targets to which we have committed. I will do this by taking an integrated approach toward financial strategies and sustainability management in our pursuit of profit growth and ROE surpassing cost of shareholders’ equity. Looking ahead, Tokyo Century will practice ongoing engagement with all members of capital markets as it moves forward with proactive information disclosure to address disparities in information availability for the market. I would like to ask our stakeholders for their ongoing support in the months and years to come.