INTEGRATED REPORT 2023

BACK NUMBERS

Directive for Long-Term Growth

STRATEGYCultivation of sense of anticipation using highly profitable portfolio capable of consistent earnings growth

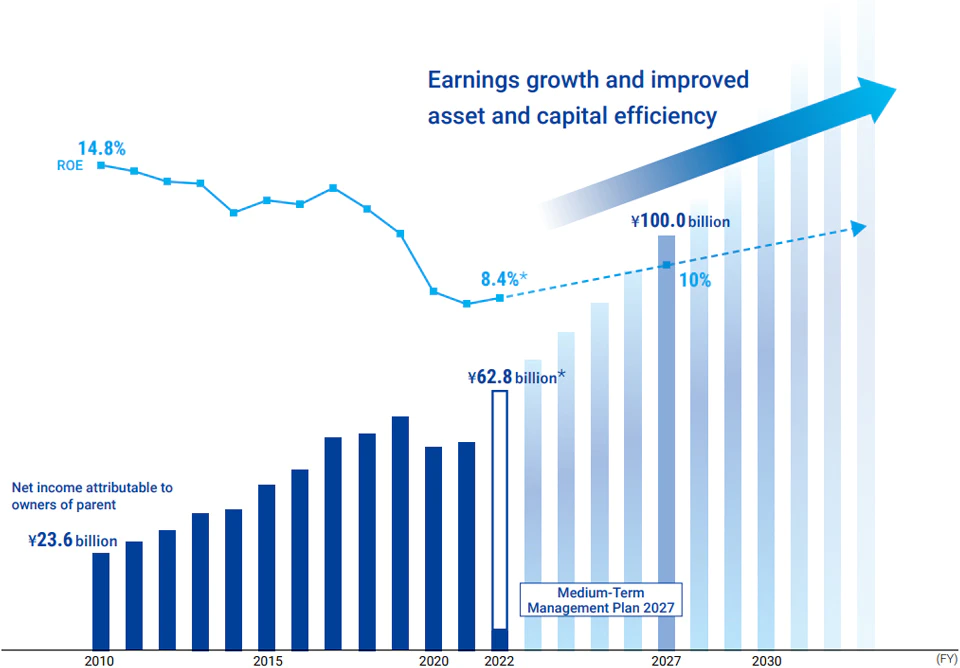

Tokyo Century seeks to achieve ongoing improvements in corporate value by heightening asset and capital efficiency, reducing the volatility and increasing the predictability of performance to lower cost of capital, and achieving stable and high earnings growth.

Expansion of Earnings through Growth Strategies

- *Excludes one-time extraordinary losses related to Russia

Ongoing Improvement of Corporate Value from Long-Term Perspective

- POINT01

Improvement of asset and capital efficiency

- POINT02

Reduction of volatility and increase in predictability of performance

- POINT03

Achievement of stable and high earnings growth

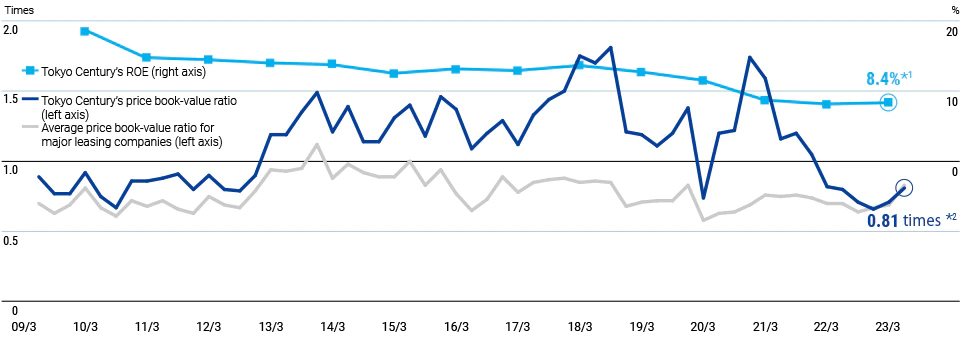

PBR = ROE × PER

ROE

- POINT 01

Scrollable horizontally

| ROA | Expansion of earnings through growth strategies | |

|---|---|---|

| Shift to highly profitable business models | ||

| Financial leverage | Financial discipline and control within capital use rate guideline targets |

PER

Scrollable horizontally

Cost of capital |

Reduction of performance volatility through enhancement of risk management systems | |

|---|---|---|

| Reduction of disparities in information availability through enhanced engagement with analysts and investors, increased information disclosure, and other investor relations activities | ||

| Management emphasizing cost of capital advanced through strong corporate governance | ||

Growth |

Expansion of market’s sense of anticipation toward growth through investments in growth areas and advancement of business strategies | |

| Promotion of non-financial strategies for supporting ongoing growth |

Price Book-Value Ratio and ROE Source: Bloomberg

- *1Excludes one-time extraordinary losses related to Russia

- *2Figure as of June 30, 2023