INTEGRATED REPORT 2023

BACK NUMBERS

Risk Management

RISK MANAGEMENTComprehensive Enterprise Risk Management

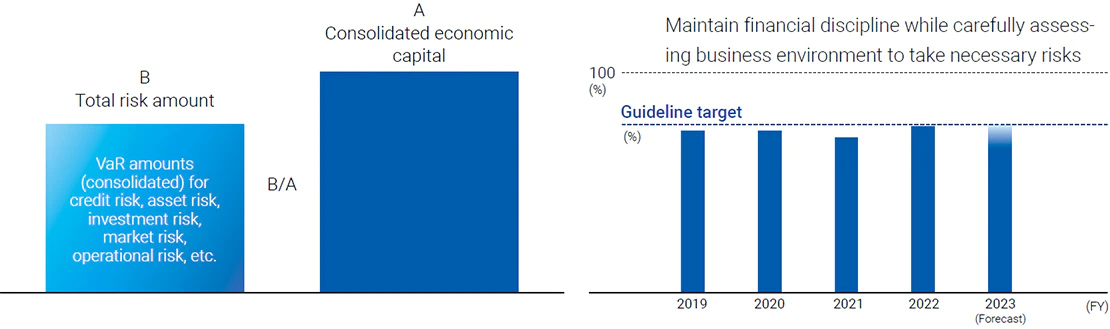

The Tokyo Century Group will continue to practice comprehensive ERM in accordance with its management guidelines for capital use rates based on quantitative risk control on a consolidated basis. The capital use rate is used to assess risk resilience, an important criterion for rating financial institutions. We have therefore sought to keep the risk amount within a certain level of capital buffers by adhering to the aforementioned management guidelines. As our business domain continues to expand, the relationship between the amount of capital and level of risk receives greater attention from investors and other interested parties. For this reason, the capital use rate has become a key indicator for objectively determining prospects for our sustainable growth and investment capacity.

We refer to the targeted level of the capital use rate only as a guideline, since the regulations regarding capital use levels for financial institutions are not applied to us. In operating a business, seizing business opportunities, such as the opportunity to take part in M&A activities, is also an important factor considered under the risk management framework. Rather than adopting a passive approach to the soundness of corporate management, we pay due consideration to the magnitude of increase in the amount of risk over a medium-term period of about three years, the projection for organic increases in the shareholders’ equity ratio from profit growth, and the level of tolerance of our capital policy.

Medium-Term Management Plan 2027 prescribes the enhancement of our risk control framework aimed at the efficient allocation of management resources through an ERM approach. In fiscal 2023, the first year of the plan, we will introduce, on a trial basis, risk exposure guidelines (soft limits) for the categories that account for a large portion of our risk profile (aviation, investment, and real estate). These guidelines will be used to drive the diversification of the Company’s business portfolio and otherwise enhance portfolio management (portfolio transformation).

The main objective of risk management at the Tokyo Century Group is to support growth and value creation by allowing for bold risk taking. We will continue to control the capital use rate to maintain it at the appropriate guideline level. At the same time, we will constantly improve on the level of our risk management framework in conjunction with the expansion of our business domain and changes in the operating environment in order to sustainably improve corporate value.

Capital Use Rate Guidelines

Visual Risk Information Tracking at the Management Level

In addition to measuring risks on a consolidated basis and controlling the capital use rate, we implement a visual management information system (MIS). Under the system, the Credit Risk Management Committee and the Comprehensive Risk Management Committee take the lead in regularly monitoring risk information on multiple criteria and report the results to the Management Meeting and the Board of Directors.*

In our global operations, we pay particular attention to Aviation Capital Group LLC (ACG) and CSI Leasing, Inc. (CSI), our U.S.- based subsidiaries that specialize in leasing and for which the scale of investments and assets is quite large. ACG has achieved success as a textbook example of a resilient company made so through a unique risk management approach that includes introducing a risk appetite framework to clarify the risks to be accepted, such as aircraft asset risks, and the risks to be avoided (mitigated or transferred), such as interest, liquidity, and foreign exchange rates. In light of the extraordinary losses recorded in relation to operations in Russia, ACG has implemented a new risk management framework to be used in dispersing previously concentrated risks on a country and airline bases and ensuring an appropriate risk and return balance based on the characteristics of a given project. This framework will be introduced for managing individual projects on a trial basis in fiscal 2023.

- *For information on the monitoring activities by the Company’s committees, please refer to “Major Risks and Management Frameworks.”

ACG’s Risk Appetite Framework

Scrollable horizontally

| Risk Tolerance | Ability to Influence*1 | Risk Category*2 | Risk Management Method |

|---|---|---|---|

|

Positive | Asset acquisition risk 1 |

|

|

Neutral | Residual value risk 2 Country/geopolitical risk Credit risk Aviation market risk |

|

|

Positive | Remarketing risk 3 Model risk 4 Operational risk |

|

|

Positive | Capital management risk Interest rate risk Liquidity risk Currency risk Reputational risk |

|

- *1Proactive and autonomous management made possible by ACG’s high level of expertise

- *2Examinations underway with regard to feasibility of introducing new category of ESG risk and related risk levels and risk management methodologies

- 1.Asset acquisition risk: Risk that appropriate portfolio management cannot be practiced in relation to aircraft acquisition methods, selected models, etc.

- 2.Residual value risk: Risk that aircraft cannot be sold or disposed of at the residual value anticipated at the time of leasing

- 3.Remarketing risk: Risk that lessees cannot be found for new or re-lease aircraft due to declines in aircraft demand, etc.

- 4.Model risk: Risk that sufficient returns cannot be generated by projects due to inability to appropriately reflect interest rate or aircraft value trends into lease rates in pricing models

Non-Financial (Non-Quantitative) Risks

As our business domain grows and we branch out from the financial sector to provide business services, it is becoming increasingly important to account for non-financial operational risks that cannot be measured quantitatively. Based on this recognition, Tokyo Century has established key risk indicators (KRIs) for non-financial risks. Regular monitoring of these KRIs is performed, and the results are reported to the Board of Directors and other relevant bodies. KRIs have been set pertaining to human resources, information security, accidents, compliance, climate change, legal affairs, and corruption. We are also expanding our range of environmental KRIs in relation to renewable energy, CO2 emissions, and the portion of our portfolio accounted for by fuel-efficient aircraft and electrified vehicles and have broadened the scope of personnel and labor risk (from non-consolidated to consolidated) amid the rising importance of tracking and managing human rights and climate change risks. Nevertheless, stakeholder concern for non-financial risks is constantly rising. From the perspective of sustainability, Tokyo Century will continue to bolster its range of effective indicators related to human rights and climate change risks as well as to other environmental, social, and governance (ESG) factors and to the United Nations Sustainable Development Goals (SDGs).

Environmental and Climate Change Risks

The Tokyo Century Group recognizes that responding to climate change is an important task. We have therefore endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and are advancing climate change response measures including scenario analyses and information disclosure based on these recommendations.

Scenario Analyses through Risk Materiality Assessments

Given that it operates in five business fields, the Tokyo Century Group has chosen an approach for selecting businesses subject to scenario analyses entailing risk materiality assessments. These assessments involve industry-specific evaluations of the impacts of climate change risks and comparative analyses of the greenhouse gas emissions and asset portfolios of different operating segments. To date, scenario analyses have been conducted targeting the environment and energy businesses (solar power generation), the aviation business (aircraft leasing), and the automobility business (auto leasing for individuals and companies). Going forward, the Company will continue to examine the appropriate risk countermeasures and related opportunities by expanding the scope of businesses subject to scenario analyses and improving the accuracy of said analyses based on risk materiality assessments.

Risk Materiality Assessments

Scrollable horizontally

| Importance for stakeholders |

|

|---|---|

| Importance for Tokyo Century |

|

Selection through risk materiality assessment

Scrollable horizontally

| Businesses subject to scenario analyses |

|

|---|

Risks and Opportunities Based on Scenario Analyses

Environment and energy businesses (solar power generation)

Tokyo Century recognizes the potential for the emergence of physical risks requiring urgent attention related to abnormal weather events, such as typhoons and heavy rain, and transition risks including the introduction of carbon taxes and strengthening of laws and regulations. Conversely, solar power generation and other renewable energy businesses are expected to see a wider range of opportunities.

Aviation business (aircraft leasing)

The aviation business may be impacted by the emergence of physical risks associated with the increasing severity of extreme weather events and transition risks such as the implementation of carbon emissions reduction targets in various countries and regulations specific to the airline industry. At the same time, increased earnings opportunities are anticipated from the transition to low-emission aircraft with higher fuel efficiency and lighter weights and the adoption of next-generation aircraft that are powered by alternative forms of fuel, electricity, or hydrogen.

Automobility business (auto leasing for individuals and companies)

For the automobility business, physical risks could include impacts from the increasing severity of extreme weather events, such as vehicle production delays due to flooding and heavy rainfall, while potential transition risks might include the shift from gasoline and diesel vehicles to electric vehicles (EVs), which would entail a switch from fueling to charging. Meanwhile, earnings opportunities related to charging service and secondhand EV battery reuse businesses are projected to emerge amid the shift toward EVs.

Detailed Disclosure Based on TCFD Recommendations

For more information on governance, strategies, risk management, and metrics and targets pertaining to disclosure based on TCFD recommendations, please click here.

Environmental Impact Assessments

Tokyo Century aims to make contributions to the environment through its business activities. Thus, we believe it is important to understand the positive and negative impacts on the environment of the projects we undertake. Accordingly, environmental impact assessment worksheets are used to assess the environmental risks and opportunities of candidate projects to be submitted to the Management Meeting and Transaction Evaluation Meeting.

Climate Change Risks

Preliminary measurements of exposure to transition risks and physical risks are conducted and the results are reported regularly to the Comprehensive Risk Management Committee to determine the potential impact of climate change risks on Tokyo Century’s credit portfolio.

Exposure to transition risks is quantified through Monte Carlo simulations targeting sectors chosen based on TCFD recommendations after accounting for the potential impact of these risks on debtor ratings and asset value.

Physical risk exposure is measured as the maximum loss projected to be incurred based on statistical simulations of specific business assets (solar power generation businesses, etc.) that have suffered damages from natural disasters.

Environmental Management System Organization

Acquisition of ISO 14001 Certification for Environmental Management Systems, please click here.