INTEGRATED REPORT 2023

BACK NUMBERS

Response to Expansion of Business Domain

RISK MANAGEMENTInvestment Management Framework

For the purposes of effectively controlling diversifying investment risks and optimizing its business portfolio, the Tokyo Century Group has instituted an investment management framework. Primary focuses of this framework include clarifying investment screening, continuation, and withdrawal standards and developing standardized monitoring processes.

Under this framework, meetings of the Investment Management Committee are held prior to discussions by the Management Meeting as part of the process for screening investments of a predetermined scale, in order to confirm the anticipated level of profitability after considering capital costs based on the inherent risks (quantitative standards) and the compatibility with Tokyo Century’s strategies (qualitative standards). In addition, multifaceted evaluations are conducted by business divisions with regard to business plans, investment structures, and projected risk exposure and environmental impacts. Shared standards for determining when withdrawal from an investment should be discussed (withdrawal standards) are applied to all projects, and clear numerical values for financial indicators are defined on an individual project basis to serve as the trigger for commencing the withdrawal process. By clarifying the standards for withdrawal in this manner, the Company is practicing effective portfolio management.

After investment, projects will continue to be monitored through standardized processes, and the status of projects and their conformity to the scenarios formulated at the time of their selection will be confirmed regularly. Should a project become applicable under withdrawal standards, the Investment Management Committee will provide opinions and assess the appropriateness of continuation, and the Management Meeting will determine whether or not investment should be continued based on a comprehensive evaluation of such factors.

Overview of Investment Management Framework

-

Investment Screening

Verification of Investment Risks and Profitability

- Confirmation of conformity to investment management framework standards

-

Investment Standards

Confirmation of Conformity to Investment Standards

- Quantitative standards (profitability versus risks with consideration for cash flows, etc.)

- Qualitative standards (compatibility with management policies, strategies, etc.)

- Definition of triggers for withdrawal decisions

-

Progress Management

Monitoring

- Confirmation of conformity to quantitative (cost of capital, etc.) and qualitative standards

- Verification of business plan progress

-

Continuation / Withdrawal Decision

Investment Continuation Judgment

- Confirmation of changes in strategic importance, market growth potential, etc.

- Assessment of withdrawal impacts

Continuation or Withdrawal

Common Withdrawal Standards

Loss of conditions deemed necessary for implementation of initial business plan, etc.

Individual Withdrawal Criteria

Project-specific trigger figures set for P&L, balance sheets, cash flows, etc.

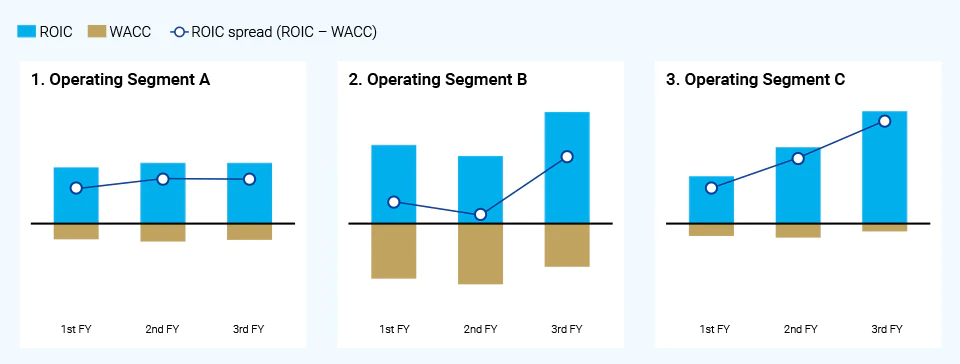

ROIC Monitoring in Operating Segments

Tokyo Century regularly monitors the return on invested capital (ROIC) spread (ROIC less weighted average cost of capital [WACC]) as a cost-of-capital-based indicator of the risk-and-return balance of specific business areas. Business and risk characteristics are accounted for in this monitoring. Moreover, this timing-based monitoring approach is used to promote management that emphasizes cost of capital along with sound financial discipline. Factors examined through this monitoring include whether an appropriate balance is being maintained between risks and returns in different operating segments and whether the necessary risks are being taken to generate value and stimulate growth. Under Medium-Term Management Plan 2027, the Company will continue its approach toward managing risks and returns with an emphasis on cost of capital. At the same time, enhancements to this approach will be pursued by reviewing methods for managing the ROIC spread by operating segment and incorporating this indicator into performance evaluations and portfolio allocation.

Management of ROIC Spread by Operating Segment Figure