INTEGRATED REPORT 2023

BACK NUMBERS

Message from the President

- President & CEO, Representative Director

- Koichi Baba

Evolution into Unique Financial Services Company through Tokyo Century Transformation (TCX)

By promoting four types of transformation, Tokyo Century will evolve its asset value innovation and integration capabilities as it seeks to improve corporate value through sustainable growth.

Launch of Medium-Term Management Plan 2027 designed to get Tokyo Century back on a growth track

Tokyo Century unveiled its previous mediumterm management plan in February 2020, strongly determined to achieve the plan’s targets, which called for record-breaking performance. However, developments such as the COVID-19 pandemic and Russia’s invasion of Ukraine created an operating environment much more challenging than had been expected. As a result, net income attributable to owners of parent in fiscal 2022, the final year of the plan, only amounted to ¥4.8 billion, substantially lower than the target put forth by the plan. A major cause behind this outcome was the recording of impairment losses related to aircraft associated with Russian airlines. These circumstances prompted us to position fiscal 2022 as a time for a “great reset,” and I feel optimistic for the future given that we were able to lay the groundwork for long-term growth. We are also intensifying our focus on risk management to boost earnings power while ensuring resilience and continuity in our operations as part of our commitment to get Tokyo Century back on a growth track.

At the same time, we recognize that we achieved certain successes contributing to more solid operating foundations and enhanced profitability under the previous plan. Our car rental business, for example, is heavily impacted by trends in the movement of people, which meant that the pandemic created a very challenging environment for this business. Regardless, we continued to move forward with bold reforms to our car rental operations, including revising sales networks and bolstering sales through our smartphone apps. As a result, this business was able to achieve a swift recovery and record-breaking performance in the final year of the previous plan. We also made progress in the partnership strategy, a strength of Tokyo Century. This progress was seen in the rapid growth of NTT TC Leasing Co., Ltd., and the expansion of collaborative businesses with NTT Group companies. We also advanced collaborative ventures with prime partners including Mitsubishi Estate Co., Ltd.; ITOCHU Corporation; the NX Group; and JFE Engineering Corporation. In this manner, we were massively successful in the creation of businesses that excite me in terms of our future growth. I also expect to see progress in our aviation business, which struggled amid the pandemic. In these businesses, we will work to capitalize on the demand from airlines for aircraft leasing and for secondhand aircraft engines and parts seen amid rising passenger demand, and I suspect that we will thereby be able to achieve growth suitable of a core business going forward. Meanwhile, we are witnessing steady growth in new areas for Tokyo Century, such as the principal investment business, which entails investments in projects including carve outs from major companies, as well as asset and technical management businesses targeting solar power generation projects. I look forward to seeing how these businesses contribute to the enhancement of our financial service functions. I believe that our achieving strong progress in the car rental and other businesses resulted from our commitment to continuously supplying customers with the value they need. This commitment has been the driver behind our many successes and serves to remind me of the substantial potential of Tokyo Century.

The newly launched Medium-Term Management Plan 2027 calls on us to further strengthen the business models and partnership strategy we have hitherto advanced while also marching ahead with the transformation of our portfolio, human resources, and organizations. Operating in the same manner will eventually see us reach the limits of our growth. This is why we cannot simply respond to change; everyone at Tokyo Century needs to transform themselves to bring about change. My mission is thus to lead by example in developing an organization and a culture conducive to such transformation.

Medium-Term Management Plan 2027PDF:327KB

Four pillars of TCX for driving ongoing growth in five operating segments

If Tokyo Century is to continue growing over the next decade, it will need to strengthen the aspects of the Company that do not change. These include the asset value-emphasizing business models and partnership strategy that represent our cohesive strength. At the same time, areas exist in which we need to be aware of changes, such as our efforts to contribute to the resolution of social issues pertaining to trends like progress in digital technologies and decarbonization initiatives. In these areas, we should take bold, swift action to create substantial, unique, and competitive value.

Medium-Term Management Plan 2027, which kicked off in fiscal 2023, is based on the theme of “transform ourselves and bring about change.” Meanwhile, I have been constantly reminding members of Tokyo Century of the importance of being perceptive. It is not enough to merely respond to the circumstances with which we are faced. Rather, we need to formulate short-, medium-, and long-term scenarios so that we can exercise foresight and determine what has to be done in order to get ahead of the trends. I want us to be the first mover, thinking in advance of change and preemptively tackling challenges. This ongoing process of foresight and action will no doubt help us transform our business model and explore new business areas.

The new medium-term management plan defines the concept of TCX, or Tokyo Century Transformation, as an expression of our strong commitment toward such self-transformation. Based on this concept, we are marching forward with four types of transformation—portfolio transformation, green transformation, digital transformation, and human resource and organizational transformation—as we seek to improve corporate value by heightening our earnings power and addressing environmental, social, and governance issues.

In promoting portfolio transformation, we will base decisions on business growth and efficiency, investing capital in growth areas to create new businesses while improving the value of our existing businesses to transform our portfolio. For businesses in which we cannot expect improvements in terms of growth potential or efficiency, we will take a flexible approach toward portfolio replacement and withdrawal in order to effectively utilize our management resources to improve return on assets (ROA).

To facilitate green transformation, we formed the GX Task Force to promote the creation of green transformation-related businesses and cross-organizational coordination among all operating segments. In addition, the Environmental Infrastructure segment was established in fiscal 2023 to consolidate the environment-related expertise that had previously been dispersed among various operating segments. This new segment is also expected to help share information on the latest environment-related trends and customer needs with officers and employees and to thereby generate a virtuous cycle of new business creation. Tokyo Century was quick to begin proactive forays into solar power, biomass power, and other renewable energy businesses. More recently, we have started partnering with companies in the charging service and battery evaluation and reuse businesses with the aims of developing storage battery businesses and responding to the popularization of electric vehicles. We are also eying the development of overseas renewable energy businesses in the future, and we intend to take a concerted Companywide approach positioning these businesses as a new area of growth for Tokyo Century.

As for digital transformation, we aim to continuously create new financial services that make use of digital technologies and data, which have become an indispensable part of business. A central tenet of our digital transformation approach will be to help partners and clients furnish business foundations in response to the various operating environment changes they face and to thereby contribute to the creation of social value. To promote such efforts across operating segment boundaries, we set up the DX Task Force, which I oversee directly. This task force is leading the formulation of plans for cultivating digitally proficient human resources and launching digital transformation initiatives aimed at improving our value proposition for customers and heightening the productivity of internal processes.

Four Pillars of TCX

Human resource and organizational strategies underpinning TCX

Of the four types of transformation described in the TCX concept, we are placing particular emphasis on human resource and organizational transformation, which will be imperative to advancing portfolio transformation, green transformation, and digital transformation as well as to implementing strategies for driving ongoing improvements in corporate value in the next two decades and over the longer term.

Since the announcement of Medium-Term Management Plan 2027, I have continued to explain to all officers and employees how I want them to become transformative people who are able to act as proponents of transformation while also continuing to transform themselves. This is because, if a company is going to change, it is essential for the individuals who make up that company to also evolve. Senior management will play a direct role in developing organizations that enable employees to become such transformative people adept at bringing about change. Moreover, we seek to foster human resources who are able to hypothesize about what initiatives will help resolve customers’ issues in today’s increasingly complex society and who can enact their hypotheses.

In relation to human resources, the new medium-term management plan defines the targets of maintaining and improving the ratio of positive responses with regard to the employee engagement index and more than doubling investments in human resource recruitment and development. We also offer training on a robust range of themes to help employees enhance their specialized expertise and skills. Furthermore, we seek to provide a workplace environment in which everyone is able to make contributions that directly link to improvements in the value of the solutions and other offerings we supply to customers.

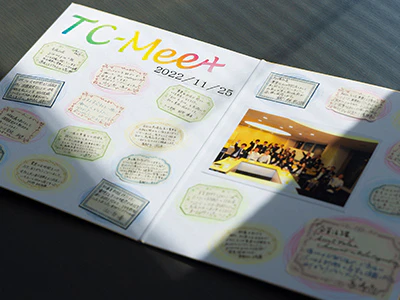

Past initiatives for improving employee engagement have included the introduction of the Career Challenge Program, an internal recruitment system, and the TC Biz Challenge Project, a new business proposal system. In fiscal 2022, we expanded the scope of initiatives through the launch of TC-Mee+, an internal communication enhancement project designed to allow for free discussion among employees of all ranks and in all organizations.

As part of this project, I participate in discussions about envisioning Tokyo Century a decade from now, which are open to all employees, regardless of rank or length of service with the Company. At the end of discussions, participants are handed cards on which they were encouraged to freely write their impressions of the discussion. This project provides a valuable opportunity for me to communicate with employees. Moreover, the passion I felt for the future of Tokyo Century during the discussion and in the participants’ impressions was a major positive that made clear to me the feelings of people on the front lines. For a company to grow, it is important for management and employees to have a relationship built on mutual trust and understanding. Furthermore, they must be aligned along a shared vector as they strive to serve customers. TC-Mee+ plays a key role in fostering such a relationship. The importance of employee input to management cannot be understated. This is why I hope to continue to engage in such steadfast initiatives going forward.

In addition, in an internal newsletter, we declared that the year 2023 will be the first year of full-fledged well-being initiatives. The motivation employees feel toward their work is, of course, important. Equally important, however, is the health of employees and their families and the ability of employees to maintain good interpersonal relationships. These are all aspects emphasized in well-being initiatives, and we have introduced such a well-being perspective into management. Improving the happiness and engagement of all employees will be crucial to ensuring that everyone is able to make contributions and will also certainly help drive the ongoing growth of Tokyo Century and the accomplishment of the goals of the new medium-term management plan.

Collection of the impressions of TC-Mee+ participants

Asset value innovation and integration capabilities as foundation for “Finance × Services × Business Expertise” concept

The operating environment is changing rapidly, and it is becoming increasingly difficult to supply customers with value that will be deemed to be sufficient via only Tokyo Century’s conventional asset and service provider functions.

Until now, we have defined our unique business model based on collaboration with partners and other aspects of our “Finance × Services × Business Expertise” concept, and we sought to provide high-value-added financial services through this model. As part of the process of further refining this business model, it will be important for us to consolidate our innovative ideas related to such processes as green transformation and digital transformation in order to enhance our solutions and functions to better increase the value of assets. At the same time, we must integrate into our business model synergies created based on a stance of openness and innovation through which we share our insight with various partners. This process will no doubt lead to increases in the use value of assets to a degree that Tokyo Century cannot achieve on its own.

By expanding our initiatives in this regard, I hope to evolve the asset value innovation and integration capabilities that will form the foundation for our “Finance × Services × Business Expertise” concept. Through this approach, we are committed to the ongoing improvement of the convenience of the financial services we offer and to other continuous enhancements to our business model. We thereby aim to become an entity that can earn enduring support from its customers and partners so that we can overcome various changes and continue to grow.

Pursuit of highly effective risk management based on diversifying risk profile

During the period of the previous medium-term management plan, we recorded massive impairment losses in relation to aircraft and other assets. These losses are an indication that we did not practice risk management sufficiently accounting for our diversifying risk profile. Accepting the lessons to be learned in this regard will no doubt help us strengthen risk management in a way that contributes to future growth.

In formulating long-term growth strategies, it is important that we focus both on investing in growth and other areas from which we can expect high returns and on effectively controlling risks. At the same time, we must assume that the operating environment will continue to grow increasingly opaque. It will thus be crucial for us to maintain a high degree of sensitivity toward changes in the times and in markets so that we can reinforce our frameworks for effective risk management. Based on this recognition, Tokyo Century is endeavoring to achieve further management stability by enhancing its risk control framework for efficiently allocating management resources and its investment management framework for making appropriate investment decisions.

In terms of profitability, the Company has maintained a compound annual growth rate of more than 10% for ordinary income since it was formed through the merger in 2009. If we are to target further income growth in our various operating segments going forward, an increased emphasis on risk management for strengthening operating foundations will be vital. The approach toward growth can differ by operating segment. Nevertheless, we will continue efforts to build a low-volatility business portfolio by assessing the profitability and efficiency of each operating segment based on past investments.

The effectiveness of risk management is a key factor directly tied to aspects such as performance volatility and cost of capital. Accordingly, rather than limiting our risk management efforts to internal initiatives, we will be proactive in broadcasting and disclosing information on the progress of said efforts to investors. In this manner, we will take a two-pronged approach toward raising the market’s appraisal of Tokyo Century by limiting performance volatility through exhaustive risk management and reducing cost of capital via increased engagement with and information disclosure to investors.

Transformation of portfolio to achieve high profitability and maintain stable growth while supporting aggressive action for contributing to the creation of an environmentally sound, sustainable economy and society

Medium-Term Management Plan 2027 aims to evolve the Tokyo Century Group into a corporate group that can overcome operating environment changes by getting ahead of the times and which can continue to transform itself and bring about change. We may have failed to meet the income targets of the previous medium-term management plan, but we are committed to accomplishing the new plan’s targets in the earliest possible fiscal year. At the same time, we will place strong emphasis on income growth and ROA improvement to transform our portfolio to achieve high profitability and maintain stable growth and thereby quickly recover return on equity and the price book-value ratio to 10% and at least 1.0 times, respectively.

Looking ahead, Tokyo Century will continue aggressive growth investments with a focus on an appropriate balance of risks and returns in order to achieve consistent growth and drive ongoing increases in earnings per share. In this undertaking, it will be crucial for us to evolve the asset value innovation and integration capabilities that form the foundation for our “Finance × Services × Business Expertise” concept and thereby secure a dominating competitive edge. At the same time, we will need to make proactive efforts to advance the four types of transformation described by the TCX concept in a cross-operating segment manner.

The Tokyo Century Group is committed to making ongoing contributions to the creation of an environmentally sound, sustainable economy and society and to the resolution of social issues as a trusted service and business partner. Moreover, everyone at the Group is united in our quest to take bold action to accomplish the targets for fiscal 2027 set out in Medium-Term Management Plan 2027. I look forward to the continued understanding and support of our investors and other stakeholders.

September 2023