Operating Lease

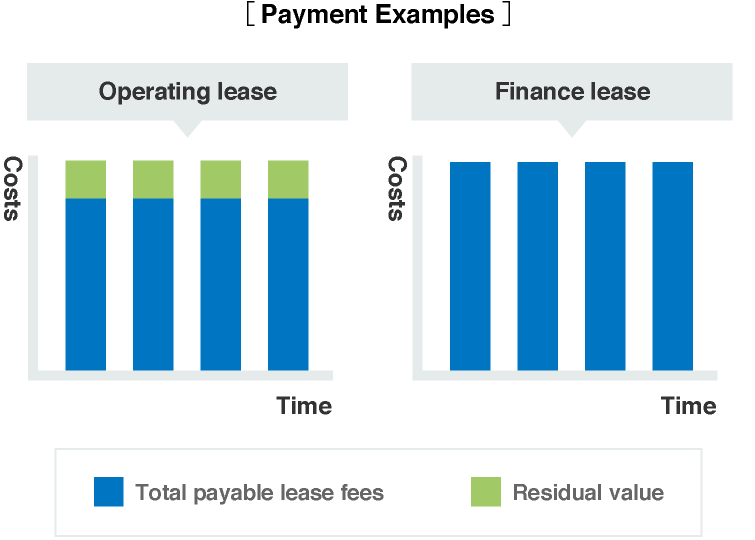

Tokyo Century Group estimates the market value (establishes the residual value) of equipment which has reached the end of its leasing period and calculates lease fees by subtracting this residual value from the value of the equipment. Tokyo Century Group bears residual value costs, making it possible for customers considering equipment investment to lessen their own costs.

Applicable Equipment

General purpose equipment for which a residual value can be set are applicable to operating lease.

Example Equipment

- Machine tools

- Forge press and sheet metal equipment

- Injection molders

- Printing presses

- Semiconductor equipment

- Electronic component mounting devices

Post-Lease Processing

Customers may choose from the following options by four months prior to lease completion.

- 1.Return of leased equipment

- 2.Secondary lease

- 3.Purchase of leased equipment

Benefits

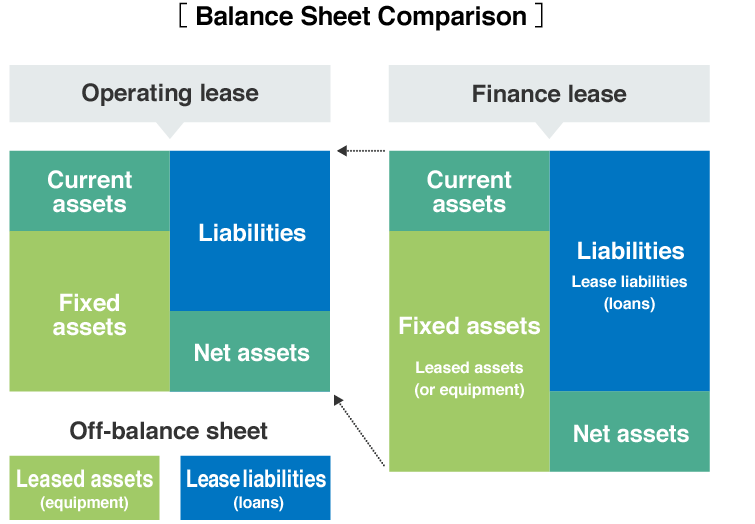

Operating leases are off-balance sheet

Operating leases are off-balance sheet. In comparison with capitalization, operating leases make it possible to improve financial condition.

In addition, lease fees may be processed as a standard lease, making it possible to reduce administrative workload as well.

Reduction of Equipment Costs

The establishment of residual value makes monthly lease fees economical. In principle, there is no obligation to pay equivalent residual value when it is time to return leased equipment.

Flexible Lease Periods Available

Unlike a standard finance lease, lease periods can be set flexibly in line with production plans or other purposes.

Post-Lease Choices Which Meet Customer Needs

Customers can purchase leased equipment upon contract expiration for fair market value. In addition, just like a standard finance lease, customers can also choose to continue using their leased equipment (as secondary lease when operating lease was applied) or return the equipment to Tokyo Century Group.

Serviced Countries and Regions

Tokyo Century Group provides services in more than 30 countries and regions.

We can also meet your needs in countries and regions in which we do not have a local subsidiary, however, the services available will vary by country and region.