Actions for Realizing Management That Emphasizes Cost of Capital and Stock Price

- Current Status

- Direction of Initiatives for Stock Price Improvement

- Promotion of the Reform Projects

- Fostering Awareness of Cost of Capital

- Engagement with Shareholders and Investors

- Major IR Activities

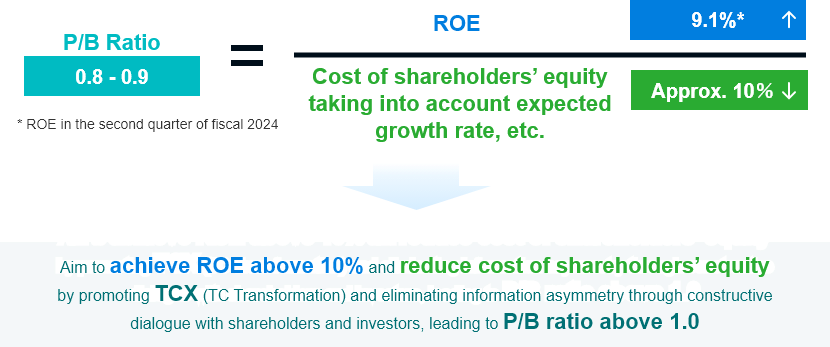

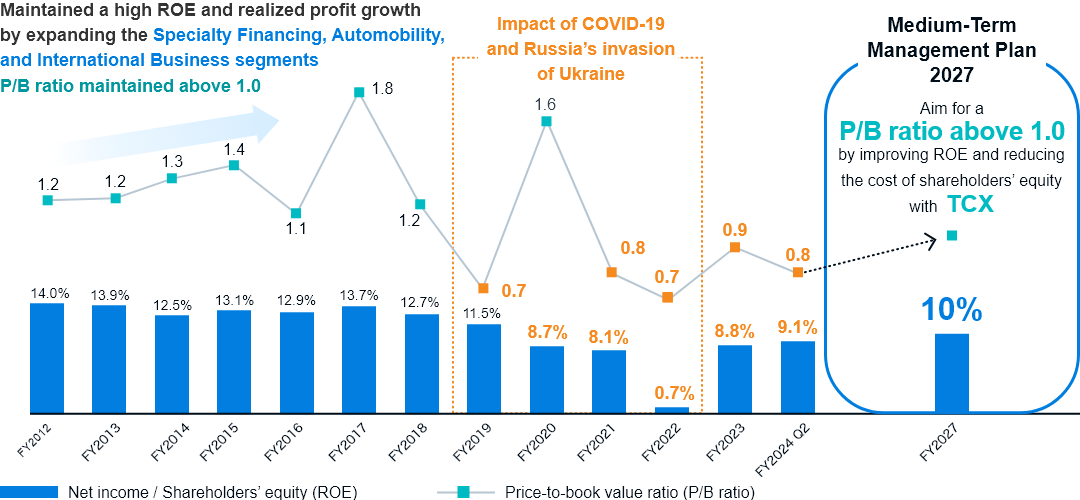

Current Status

The Company's return on equity (ROE) for the second quarter of the fiscal year ending March 31, 2026 was 9.0% (excluding extraordinary income/losses and other one-time factors), an increase of 0.9 percentage points year-on-year, driven by our initiatives to strengthen earnings power. However, it still falls below our recognized cost of shareholders’ equity of 10%, and the current price-to-book (P/B) ratio is below 1.0, which reflects the current level of the Company’s stock price (as of December 2025).

Given this situation, we have analyzed and evaluated the current P/B ratio and discussed improvement measures with our directors.

Our analysis shows that the two main factors for the P/B ratio remaining below 1.0 are:

- ROE falling below the cost of shareholders’ equity

- Low market valuation, as reflected by the price-to-earnings (P/E) ratio (low market expectations for our future growth)

We recognize that ROE is currently below the level we expected. This is primarily due to: macro factors such as interest rate trends (including the Bank of Japan's policy rate hike); insufficient profitability and capital efficiency at overseas subsidiaries; and an increase in shareholder’s equity due to the weaker yen.

As part of measures to improve the P/E ratio, we intend to announce the details of our reform projects for achieving our 10-year vision in May 2026. We will drive this reform with vigor, and by communicating and embedding in the market the direction of our transformation and sustainable growth, we will raise market expectations for our growth, based on the enhancement of our fundamental corporate value.

- *1The above P/B ratios are calculated based on the closing stock price at the end of each fiscal year.

- *2Excluding extraordinary income/losses

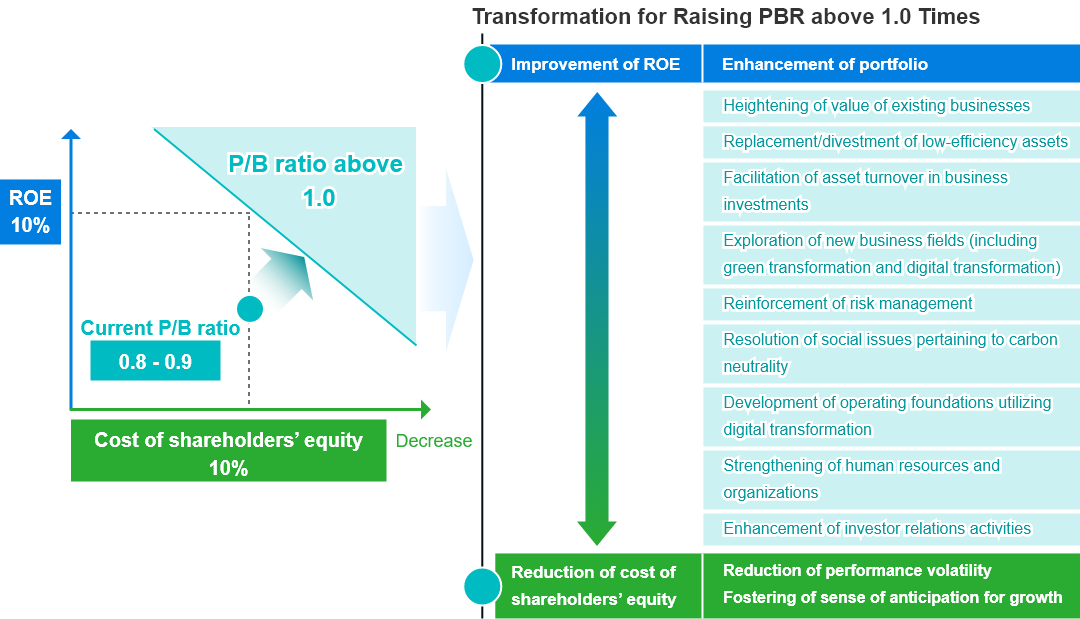

Direction of Initiatives for Stock Price Improvement

We are enhancing our initiatives from the following three perspectives to improve corporate value and achieve the P/B ratio above 1.0 promptly.

Direction of Initiatives

-

1Improvement of ROE

Enhancement of earnings power by evolving business models based on asset value and partnership

-

2Improvement of the P/E ratio

Communication of our medium-to-long-term growth story

-

3Reduction in cost of shareholders’ equity

Development of a disciplined approach to return on invested capital (ROIC) and management foundation focused on ongoing growth

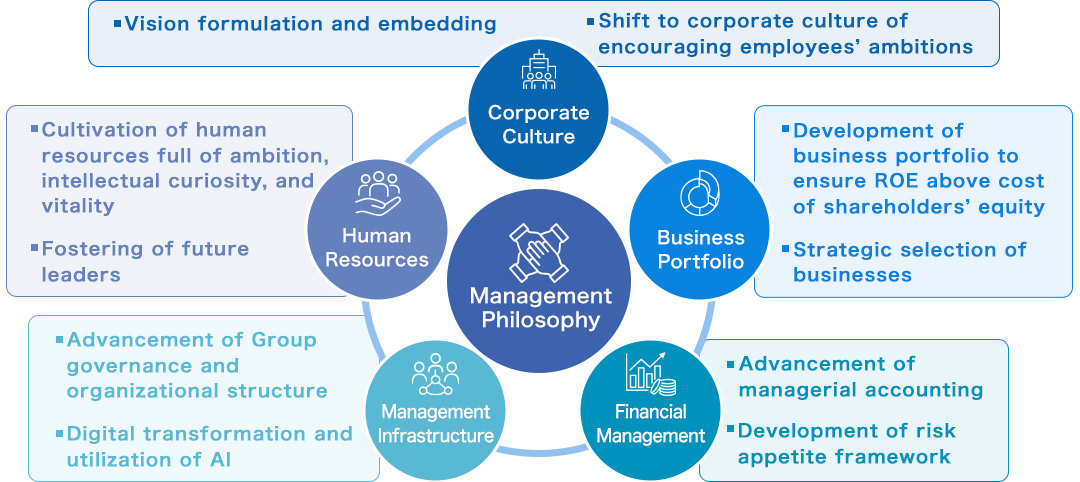

Promotion of the Reform Projects

The projects are implementing reforms in the following five areas, aiming to achieve our 10-year vision.

- Corporate Culture

Efforts are underway to foster a corporate culture of encouraging employees’ ambitions and also clarify our strategic direction. For the latter, we are currently creating a consistent story for medium-to-long-term growth that will be valued by all stakeholders. - Business Portfolio

Our focus is on identifying our business domains to expand or contract and discovering unexplored areas through both qualitative screening (such as for market growth potential and competitive environment) and quantitative screening (such as for capital efficiency and profitability). Furthermore, our approach to M&A is being clarified, since agile non-organic strategies are necessary to achieve significant growth. - Financial Management

Management accounting will be enhanced (such as by introducing return on invested capital (ROIC) into performance evaluation), and a risk appetite framework will be implemented. We are considering using the framework not only to mitigate risk but also to identify which areas of risk we should assume. - Management Infrastructure

Planning is underway for the full-scale implementation of the Group CxO structure (around April 2026). A review is also being conducted regarding the company-wide utilization of Generative AI, organizations, goal frameworks, performance evaluation, and Group governance. - Human Resources

Our review encompasses talent development, evaluation, promotion, and compensation, aimed at creating an environment that attracts and retains talent.

Management will discuss these matters continually at the Management Meetings, Board of Directors meetings, and other forums. We intend to announce the details of the Reform Projects, including the specific growth story, on the earnings announcement date in May 2026.

Achieving the P/B ratio of 1.0 is merely the starting line. By driving the Reform Projects and accelerating business strategies based on the medium-to-long-term growth story, we will aim to further improve the P/B ratio.

Corporate transformation along a consistent story based on the Management Philosophy, aiming to improve corporate value

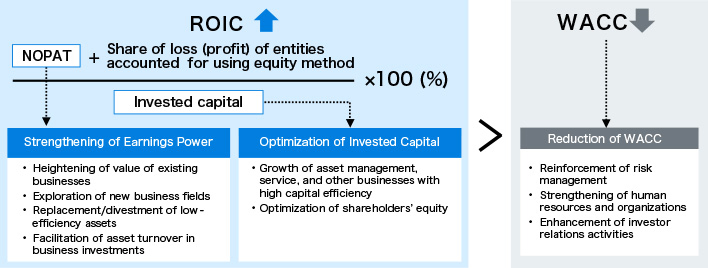

Fostering Awareness of Cost of Capital

Our Medium-Term Management Plan 2027 targets an ROE of 10%. To achieve and exceed this, a shift to a more profitable business portfolio focused on asset quality, rather than just expanding asset size, is indispensable. Based on this view, the Company has decided to emphasize the return on invested capital (ROIC) spread, as an indicator reflecting the cost of capital and risk-and-return balance. The ROIC spread was introduced into the performance evaluation system for each operating segment beginning in fiscal 2025. Given their respective characteristics, the Company requires that each operating segment generate a positive ROIC spread (i.e., ROIC exceeding weighted average cost of capital (WACC)), aiming for company-wide ROE improvement while raising awareness of capital efficiency at the operational level.

Based on these approaches, optimization of our business portfolio is accelerating. We will expand businesses that are expected to have high profitability and generate future cash flow, such as data centers, storage batteries, and principal investment businesses.

Improvement of ROIC and ROIC Spread (ROIC–WACC)

Engagement with Shareholders and Investors

In our investor relations (IR) activities, we place great importance on a cycle of having active dialogue with our shareholders and investors and communicating their input and requests to management and employees. The feedback gained through IR activities is used to improve information disclosure and address management issues, aiming to build trust with shareholders and investors and ensure proper evaluation from the capital markets. We will leverage these initiatives to realize higher corporate value over the medium to long term.

Major IR Activities

Scrollable horizontally

| Activities | FY2023 | FY2024 | Details |

|---|---|---|---|

| Earnings calls | 4 times | 4 times | Quarterly earnings calls Q1 & Q3: Led by the officer responsible for IR Q2 & Q4 (full-year): Led by the President |

| Individual meetings | 260 times | 280 times | Meetings with analysts and institutional investors in Japan and overseas |

| Investor briefings | 4 times | 3 times | Investor briefings led by the president and the officer responsible for IR |

| Business strategy briefings | 1 time | 3 times | Business strategy briefings for institutional investors in Japan and overseas |

| Overseas roadshows | 2 times | 3 times | Face-to-face meetings between the president / the officer responsible for IR and overseas institutional investors |

Scrollable horizontally

| Activities | FY2023 | FY2024 | Details |

|---|---|---|---|

| Company briefings | 1 time | 2 times | Briefings on the Company, business strategies, shareholder return policies, etc. |

Representative Improvements Based on Feedback from Dialogue with Shareholders and Investors

-

1Opinion on management dialogue (fiscal 2025)

- Requests for more dialogue opportunities with management

- Investors requested more such opportunities.

- Improvements

- We have held multiple meetings between the President & CEO and analysts and institutional investors.

-

2Opinion on the expansion of IR events (fiscal 2025)

- Request for business briefings

- Investors requested us to hold a briefing on the aircraft leasing business, which is a focus area of Tokyo Century's growth strategies.

- Improvements

- We held a business briefing for aircraft leasing subsidiary ACG. ACG’s CEO and CFO explained its management policies and business strategies (in English and Japanese). The video of the briefing (presentation and Q&A in English and Japanese) was posted on our corporate website.

-

3Opinion on the disclosure of IR materials (fiscal 2025)

- Trend in the Equipment Leasing segment’s spread

- Investors requested us to disclose the Equipment Leasing segment’s spread so that they can confirm the impact of rising interest rates.

- Improvements

- We have disclosed Equipment Leasing’s quarterly spread trend in a line graph (on a non-consolidated basis) and related contract amount in a bar graph so that improved spread can be compared with contract amount.

-

1Opinion on disclosure of the IR Presentation materials (fiscal 2024)

- Disclosure of the Data Books

- Investors wanted the financial results to be disclosed in Excel format so that quantitative analysis can be easily performed.

- Improvements

- The financial results that had already been disclosed have been organized in Excel format in both Japanese and English and are now disclosed on the Company’s Investor Relations website. The outline of the disclosure is as follows:

Figures disclosed in the financial results materials, such as Consolidated Financial Results (Kessan Tanshin) and IR Presentation materials (balance sheet, profits and losses, and other indices)

Main financial data: For the past 11 years

Detailed financial data: For the past 5 years and quarterly results for the past 3 years including the current fiscal year

-

2Opinion on disclosure of the IR Presentation materials (fiscal 2024)

- Net income forecast by operating segment

- Investors wanted to have more information on the forecast of net income by operating segment.

- Improvements

- Starting from the first quarter of the fiscal year ending March 2025, we have added information on the progress of the net income plan by operating segment in disclosed materials for quarterly financial results.

-

3Opinion on dividends (fiscal 2024)

- Clarification of progressive dividend policy

- Investors wanted dividends to be paid without reducing the amount in line with profit growth.

- Improvements

- We have clarified a dividend policy under the Medium-Term Management Plan 2027 that we aim to increase dividends per share with profit growth while adopting a progressive dividend policy as our basic stance.

-

4Opinion on officer compensation (fiscal 2024)

- Revision of the officer compensation system

- Investors requested that the officer compensation system be revised to reflect shareholder return.

- Improvements

- The Company has created a framework that links officer compensation with their contributions to medium- to long-term business performance and Tokyo Century Transformation (TCX). In addition, it has adopted the Company’s stock growth rate as an evaluation indicator for officer compensation in order to align the Company’s and shareholders’ perspectices and further raise officers’ awareness of increasing shareholder value. In May 2024, the Company revised its officer compensation system in this way and also introduced a new performance-linked stock compensation plan, the Board Benefit Trust-Restricted Stock (BBT-RS).

-

1Opinion on formulation of the medium-term management plan, received prior to disclosure of the Medium-Term Management Plan 2027(fiscal 2023)

- Profit growth scenario for each operating segment

- In terms of disclosure of profit targets under the Medium-Term Management Plan 2027, market participants will consider that Tokyo Century should disclose earnings forecasts and offer a profit growth scenario for each operating segment. Merely indicating figures for the entire plan will not be enough to factor the plan into the Company’s stock price because Tokyo Century is not a corporate group selling a single product.

- Results

- We sought to enhance our disclosure by presenting profit plans, profit growth scenarios, and increases in assets for each operating segment in the Medium-Term Management Plan 2027, based on communication of investor opinions to management and due consideration of our disclosure required through dialogue.

-

2Opinion on profitability(fiscal 2023)

- Improvement of ROA

- To improve ROA, it is important to raise the profitability of each business whose ROA is lower than that of the entire company. I know this will not be easy, as many of Tokyo Century’s businesses are joint ventures, but I hope the Company will make progress on this point.

- Results

- One of the case examples of ROA improvement was attributable to the conversion of Orico Auto Leasing Co., Ltd. (OAL) and Orico Business Leasing Co., Ltd. (OBL) into equity-method affiliates.* They are joint operating companies with Orient Corporation. We decided that OAL and OBL needed to improve efficiency and productivity through flexible business development and create optimal systems in order to respond promptly to customer needs and that their sustainable growth required reinforcement of collaboration with the Orico Group going forward.

- *Converted into equity-method affiliates on September 29, 2023.

-

3Opinion on disclosure of IR materials on earnings(fiscal 2023)

- Identifying core earnings

- Tokyo Century’s business profit includes transitory gains and losses such as gain on sales and impairments. The Company should at least disclose a breakdown of these items so that the core earnings can be identified and reflected in its share price.

- Details

- As for gain on sales, we disclosed gains on sales of real estate and operational investment securities. In addition to the gain on sales, we disclosed figures for transitory gains and losses as “Impairment, bad debt, and gain (loss) on valuation of operational investment securities.”