Japan’s First Self-Assessment-Based PIF: An Innovative Fundraising Model with Proactive ESG Financing

Sep 26, 2025

Positive Impact Finance (PIF) has drawn attention as an ESG financing framework that evaluates both the positive and negative effects of corporate activities on society, the economy, and the environment, with the goal of advancing sustainability while enhancing corporate value. Tokyo Century has used PIF in the past, and in September 2025 it launched Japan’s first Self-Assessment-Based PIF, arranging three syndicated loans with three megabanks simultaneously. Unlike conventional PIF based on evaluations by financial institutions, the innovative self-assessment model allows companies to evaluate their own impacts and seek funding from financial institutions. Members of the Treasury Division and Sustainability Management Division who drove this initiative spoke about the possibilities they pursued, the challenges they faced, and their outlook for the future.

Chisa Unno, General Manager, Sustainability Management Division (top left), Hiromi Aoki, Sustainability Management Division (bottom left), Shojiro Isobe, Deputy General Manager, Treasury Division (top right), Saki Nakamoto, Treasury Division (bottom right)

What Is PIF and How Does It Support a Sustainable Future?

—Could you go over the basics of PIF?

Isobe

PIF is a type of ESG financing that focuses on the impacts of the corporate borrower’s activities on society, the economy, and the environment. Financial institutions analyze and evaluate these activities, and an independent third party provides certification. The framework encourages companies to maximize positive impacts and reduce negative ones, contributing to the realization of a sustainable society.

—How has Tokyo Century made use of PIF so far?

Isobe

There are broadly two approaches to ESG finance. One, such as Green Finance or Transition Finance, restricts the use of funds. The other, which includes PIF, places no restrictions, and it can be applied to a wide range of businesses.

Because our company requires significant funds for diverse purposes, funding methods that place no restrictions on the use of funds are better suited to our needs. Since 2022, we have used PIF to raise funds from financial institutions multiple times.

Advantages of Self-Assessment-Based PIF—from Saving Costs to Transforming Corporate Culture

—In September 2025, Tokyo Century implemented a Self-Assessment-Based PIF framework. What are its characteristic features?

Isobe

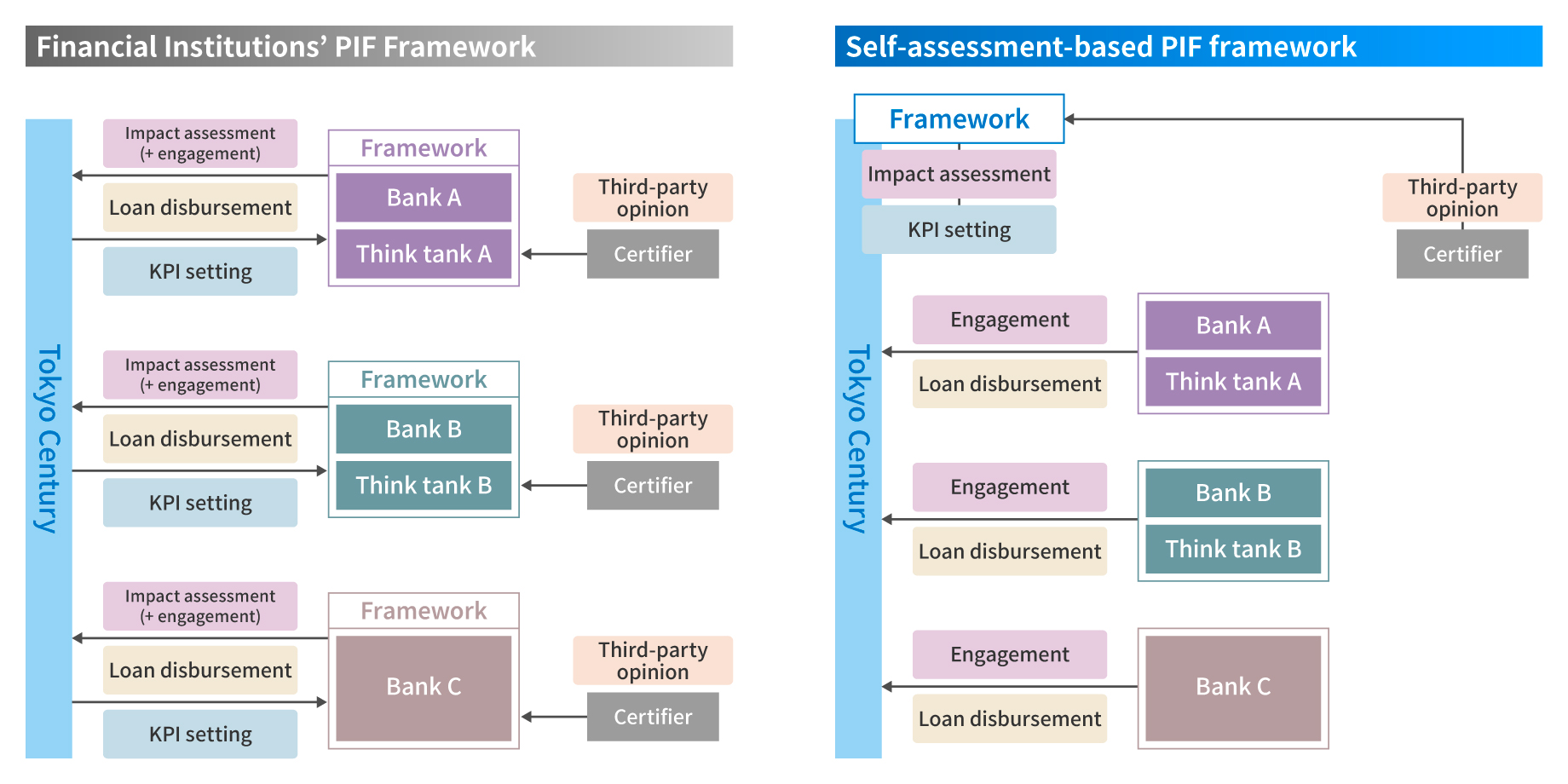

In the conventional PIF model, each financial institution uses its own assessment framework to analyze a company, with the results certified by a third party. Because frameworks differ from bank to bank, every new loan required a new evaluation and certification.

With the self-assessment model, we created our own framework to evaluate the impact of our business activities. We could then seek financing after obtaining approval from an external certifier. The critical difference is that we apply our own framework as the borrower, rather than the lender’s framework.

We have incorporated annual engagement with lenders and annual reviews by external certifiers into the framework, which was the first such initiative in Japan. Maintaining regular dialogue with lenders to confirm KPI progress and direction, and adding third-party evaluation, enhances both transparency and credibility.

Aoki

Self-assessment-based PIF framework

Isobe: We had been considering the idea of a borrower-owned framework for several years.

With the cooperation of our partners, we were able to bring it to fruition in just three months or so.

—What are the benefits of this self-assessment model?

Nakamoto

The greatest benefit is reducing cost, time, and effort. Once in place, the framework only needs to be updated annually, and it can be applied across multiple banks. This reduces the need for third-party certification and legal fees while also shortening the lead time for borrowing from three months to about one month.

Previously, PIF was only feasible for large-scale financing, such as syndicated loans, because it was time- and cost-intensive. Now, the new framework can also be used for bilateral loans with regional banks, making it far more accessible. What’s more, financial institutions keen on promoting ESG financing may offer preferential interest rates, so it can also help reduce overall funding costs.

When we developed the framework, we first came up with potential KPIs and targets in our division and then refined them through dialogue with other divisions. The process itself gives us an opportunity to deepen our understanding of sustainability. When employees see that our business is having a positive impact on society, it can raise their motivation and strengthen their sense of belonging.

Unno

Unno: I hope that this initiative helps colleagues realize that sustainability is not just an abstract concept but something affecting us, because it is directly tied to financing, an essential function of a leasing company.

Our Teamwork Made the Self-Assessment-Based PIF Possible

—Could you walk us through how you established the Self-Assessment-Based PIF?

Isobe

The challenge with conventional PIF is that it depends on assessment standards set up by each financial institution. We had been searching for a solution to that issue for several years. In April 2025, Mizuho Bank proposed the idea of a PFI model based on self-assessment, which prompted us to develop the framework together with the Sustainability Management Division. With support from the Japan Credit Rating Agency (JCR) and Mizuho Research & Technologies, we were able to establish the system.

—What roles did the Treasury Division and the Sustainability Management Division play?

Nakamoto

The Treasury Division was primarily responsible for coordinating with financial institutions. We developed the framework with not only Mizuho Bank but also MUFG and SMBC, drawing upon their valuable insights and advice. When arranging the syndicated loans, we needed the participating financial institutions to understand the benefits of the self-assessment model, so we also held individual discussions with around 30 institutions.

The Sustainability Management Division sought input from Mizuho Research & Technologies in the course of developing the framework. We mapped the social impacts of our business activities, identified links to our materiality initiatives, and set short-term and medium- to long-term KPIs and targets to expand positive impacts and reduce negative ones. We also took care to thoroughly address questions from financial institutions and actively incorporated their suggestions into the framework.

Aoki

—What questions did financial institutions raise?

Isobe

While the framework is based on UNEP FI principles, each bank emphasizes different aspects, so the questions covered a wide range, and we addressed about 70 questions in total.

One frequent question was why we had not set medium- to long-term KPIs. We discussed this internally and set KPIs for items that could be quantified. For items harder to quantify, we plan to continue gathering information for further consideration.

Unno

Internal discussions were also crucial. We explained the purpose of the self-assessment model and the importance of setting KPIs, gaining support from divisions and Group companies. As a result, we were able to include transaction volume (leases, financing, investments, etc.) as a KPI for three materiality items. Financial institutions regarded this indicator highly, as it provides a quantitative measure of our business impact.

Those discussions also produced valuable input about strengthening management systems. Recognizing its importance, we will use this feedback to make improvements.

Aoki

Aoki: We were able to develop the self-assessment-based PIF framework thanks to the understanding and cooperation of people involved inside and outside the company. It allows us to communicate the impact of our business activities on society and our story for an ideal future to stakeholders.

Framework for Shared Growth between Companies and Financial Institutions

—What have been the outcomes of this financing initiative?

Nakamoto

Through the self-assessment-based PIF, we procured three syndicated loans, each arranged by one of the three megabanks, and secured the participation of 25 financial institutions. A total of ¥171.4 billion was raised, the highest level of funding we have ever achieved through ESG finance. It was also our first attempt to bring three megabanks in as arrangers at the same time. In addition, we attracted the participation of new financial institutions, which has further broadened and strengthened our financing network.

Nakamoto: I am very thankful that the PIF framework, long a goal of the Treasury Division, was made possible not only by external support but also with the cooperation of divisions across the Company, especially the Sustainability Management Division.

—What has been the response of financial institutions, and what benefits are they seeing?

Nakamoto

Many financial institutions said they saw real value in reducing the time and effort required to execute PIF. In particular, they told us that the annual review process set up with external certification bodies will help reduce their workload and lower the barrier to taking part in PIF.

Isobe

Another major advantage is that we can provide financial institutions with higher-quality information by conducting the impact assessment ourselves. Our business covers a wide range of areas, and there are aspects that cannot be fully understood from publicly disclosed information alone. With the self-assessment-based PIF, we, as the business operator, are able to directly present detailed data, which strengthens the reliability of the information. What’s more, we can demonstrate strong commitment by setting our own goals and KPIs, and financial institutions perceive our plans as more credible and achievable.

Shaping the Future through Self-Assessment-Based Positive Impact Finance (PIF)

—How will this affect Tokyo Century’s corporate value and growth?

Isobe

This scheme creates a cycle of self-assessment, identifying impacts, setting KPIs, monitoring, and engaging with stakeholders. This cycle requires various elements, including a management philosophy aligned with the SDGs, internal structures, and expertise. Having successfully implemented this cycle is itself an achievement that strengthens recognition from investors, including financial institutions.

—What impact might this have on the sustainable finance market?

Sustainable finance could become more accessible for other companies with diverse businesses, and it may well build momentum for the movement to link each company’s unique sustainability initiatives to financing.

Developing such a framework requires deeply analyzing and systematically organizing the ways that business activities relate to social and environmental impacts, which also tests a company’s ability to generate impact. Evaluating not only individual projects but also the activities of an organization as a whole can open the way to more flexible financing, which could in turn help vitalize the market as a whole.

Unno

Shojiro Isobe

Deputy General Manager, Treasury Division

Isobe joined Tokyo Century in 2005 mid-career and was assigned to the Information System Division (now IT Promotion Division) as he had worked in the IT area. After moving to the Treasury Division in 2011, he led Sustainability-Linked Loans (SLL), PIF, and other ESG finance initiatives, demonstrating leadership in financing. He was appointed to the current role in 2023.

Saki Nakamoto

Treasury Division

Nakamoto joined the Company in 2022 as a new graduate and has mainly handled financing from financial institutions in the Treasury Division. Until last fiscal year, she was involved in financing for overseas Group companies, and since FY2025 she has been supporting financing for domestic affiliates. To further enhance her expertise, she took on responsibility for sustainable finance and participated in the self-assessment-based PIF project.

Chisa Unno

General Manager, Sustainability Management Division

Unno joined the Company in 1996, starting her career as a sales representative in Equipment Leasing. She then worked in TCBS (now Business Support Division II) and Metro Tokyo Business Division II and was transferred to the Risk Management Division while also serving in the former Sustainability Promotion Office. She began working with the Treasury Division on the Company’s first SLL in 2021. She was appointed deputy general manager of the Sustainability Management Division in 2022, and has been serving as general manager since 2023.

Hiromi Aoki

Sustainability Management Division

Aoki joined Tokyo Century in 2024 after a career in banking, including capital adequacy regulation and disclosure projects. Since around 2019, she had engaged in sustainability disclosure, related long-term goal-setting, and policy development. She is now responsible for sustainable disclosure according to regulations, and internal training.

Note: The contents of this article and the position titles are current as of the date posted.

RECOMMEND ARTICLES

Sep 26, 2025

Positive Impact Fina…

—Exploring the Communication Required to Become a Truly Global Company

Aug 21, 2024

Communication has be…

Dec 20, 2023

New risk factors hav…