New risk factors have drawn our attention in recent years, including the spread of COVID-19 and geopolitical events such as the wars against Ukraine and Israel. Tokyo Century is therefore focusing on quantitatively and qualitatively identifying risks that evolve as its business expands, such as by adding country risk to its risk categories in the wake of Russia-related losses in its aircraft business in fiscal 2022. As environmental and human rights initiatives are also under consideration as new risks, we interviewed Mr. Goto and Ms. Tamaki of the Risk Management Division, which supports the sustainable growth of the Tokyo Century Group’s business behind the scenes, about their mission and the significance of their efforts.

Using a Unified Yardstick to Identify the Risks to Be Taken and Those to Avoid

―The COVID-19 pandemic and wars against Ukraine and Israel have drawn attention to the impact of risks, including geopolitical risks, on business. Could you tell us about the role of the Risk Management Division and the fulfillment of its operations?

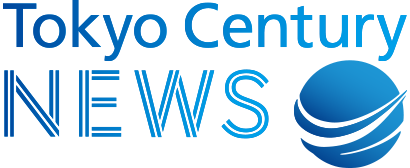

Goto: The mission of the Risk Management Division is to boldly take on the risks that should be taken and to support value creation and growth. A company’s ability to grow requires aggressively taking on risks, and not doing so―that is, taking on no risks―can itself present a risk.

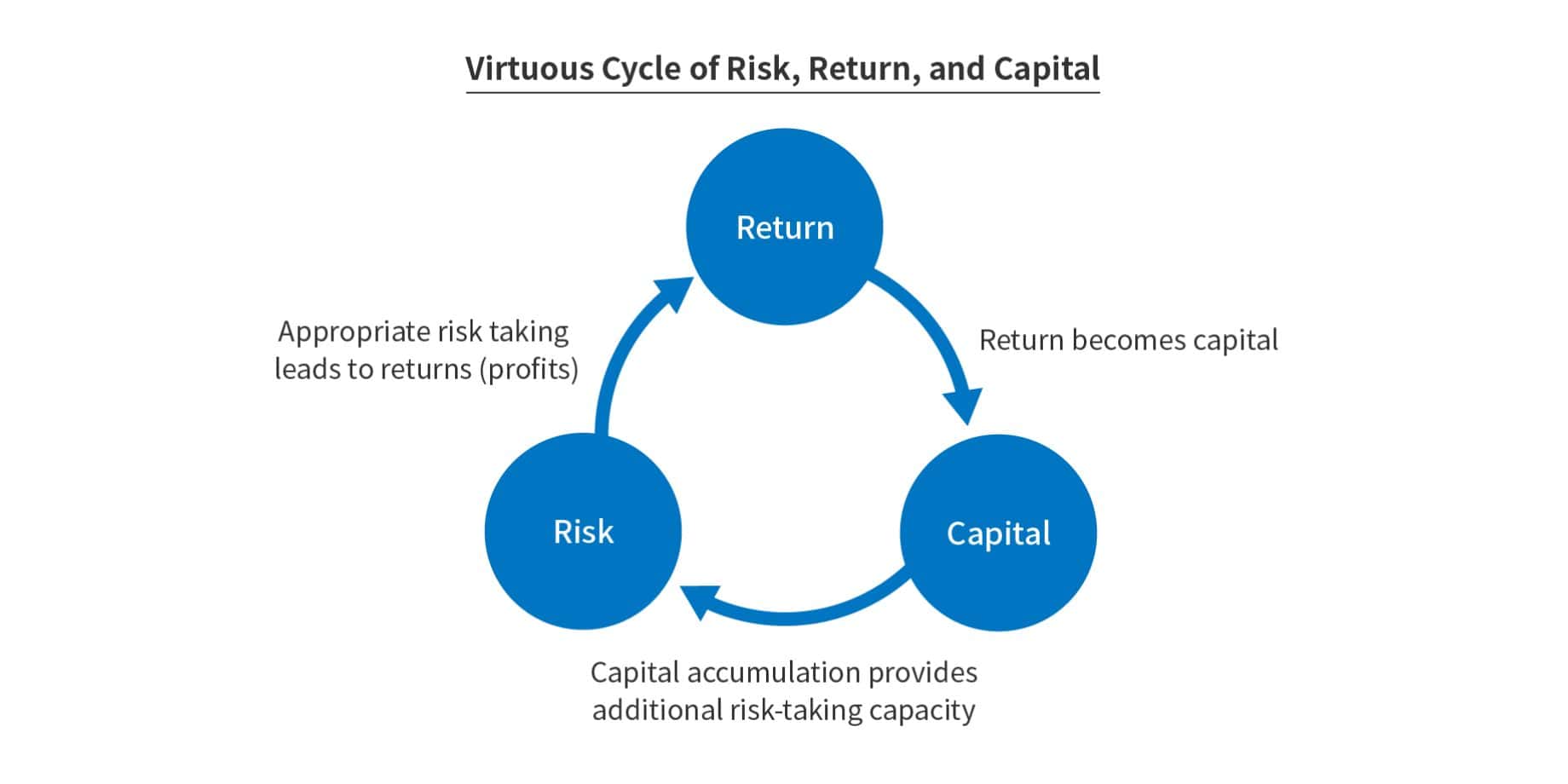

One of the roles of risk management is to quantitatively and qualitatively understand and share a yardstick for necessary risks that will not shake the foundation of an organization. From the perspective of history, unexpected events have occurred with a certain frequency. Due to the invasion of Ukraine, our aircraft business suffered losses, and since fiscal 2023 we have identified country risk, which was previously managed as credit risk, as an independent indicator. This reflects our stance that our business must be based on a common understanding throughout the Group.

―What are the key points of risk management that are unique to Tokyo Century?

Goto: In addition to making country risk independent, one key point is the speed of applying PDCA to correct and evolve risk factors that were lacking until now. Risk management was my job for over 25 years at a securities company and bank, but the risk factors associated with the products I dealt with were relatively easy to understand, including interest rates and stock market fluctuations. On the other hand, Tokyo Century handles a wide range of products, including aircraft, vessels, and mobility, as well as its founding business of leasing (credit risk), and these are geographically distributed. For example, the ability of people to freely move about was suppressed during the COVID-19 pandemic, and aircraft prices fluctuate with changes in the external environment. Since risk factors differ for each product, such as aircraft, study and imagination are required.

Goto: Although we provide a wide range of financial services, I believe that the scope of risk that we take is also broad. As we expand our business, it’s important that we develop guidelines such as a unified yardstick and seven risk categories that our shareholders and other stakeholders can feel comfortable with to reduce risk.

Tamaki: When Mr. Goto joined the Risk Management Division, I was transferred there at the same time. I’m mainly in charge of environmental and climate change risks. In order to understand how my projects will impact the environment, I’m assessing environmental risks and opportunities using the Environmental Impact Assessment Worksheet, as well as environmental management, including data calculation of supply chain CO2 emissions. I find it rewarding to be involved in a wide range of company-wide initiatives and international issues, such as climate change and sustainability, through discussions with various divisions.

―I have the impression that the Risk Management Division is a group of specialists, but could you describe the division’s personnel structure?

Goto: The Risk Management Division has ten members (as of October 2023), including those who also serve concurrently. Our duties range from overall risk management development, business continuity planning related to corporate survival crisis, and risk measurement to information security and compliance. In recent years, we have also been required to understand non-financial risks such as ESG and human rights. However, the country risk mentioned earlier and investment monitoring are handled by the Credit Supervision Division, disaster prevention by the General Affairs Division, and crisis management and public relations by the Public Relations & Investor Relations Division.

Tamaki: This system is very similar to a division of labor in which a small number of elite members work together. As I’d been working in sales, I wasn’t an expert in risk management or the environment when I was transferred in 2021. But with the support of my team, I managed to gain the abilities I needed, and in fiscal 2022 I received the TC Award (an in-house award) for excellence. More than half of the team is made up of mid-career employees from banks and securities firms, and although the age range is relatively high, I think young and inexperienced employees can also fully thrive here.

What Is the Enterprise Risk Management (ERM), a Framework for Evaluating and Controlling Diversified Risks?

―The medium-term management plan starting in fiscal 2023 states the efficient allocation of management resources through enterprise risk management (ERM). Can explain what that is?

Goto: Imagine comparing and adding up apples, oranges, and grapes, which would first involve deciding how to measure them, be it quantity or amount of a certain ingredient. Similarly in ERM, where assessing diverse elements such as credit risk to aircraft, vessels, real estate, and stock investments, we must have a unified indicator or yardstick to compare them and add up their risks.

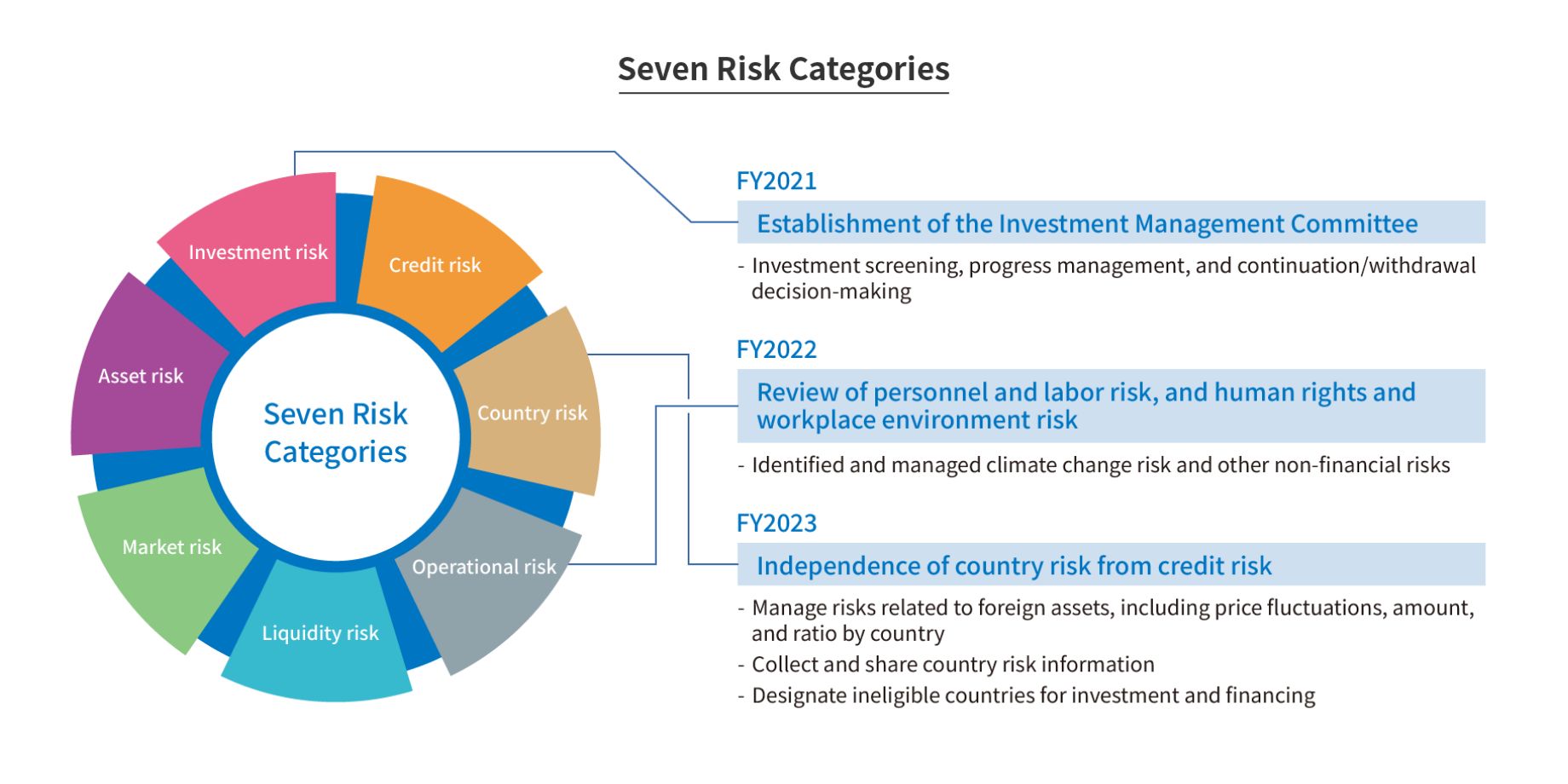

For example, if a company has several airplanes worth ten billion yen each, and a once-in-a-century crisis has damaged the airplanes, the total maximum loss can be approximately calculated from a probabilistic and statistical point of view. ERM is the process of calculating the amount of capital that the company would have in reserve to adequately cover such a maximum loss, presenting it to the respective business division as a unified yardstick (i.e., risk volume) and setting guidelines as necessary such as upper limits to manage risks.

(Left graph)Capital Use Rate Guidelines (Right graph): Moderate maximum risk limits (guideline levels) introduced for certain categories such as aircraft, investments, and real estate with high risk volume

(Left graph)Capital Use Rate Guidelines (Right graph): Moderate maximum risk limits (guideline levels) introduced for certain categories such as aircraft, investments, and real estate with high risk volume―ERM may be a difficult indicator for the business divisions, so how do you encourage them to offer feedback and gain understanding?

Goto: In regulated industries such as banking and securities, risk management divisions often decide on ERM in accordance with regulations. In our case, though, we decide on a framework after holding discussions with each business division and then confirm the direction with management. In fiscal 2023, we set and introduced a maximum risk limit on a trial basis for relatively high-risk assets such as aircraft as a guideline to avoid unintended concentration of risk. But we have no intention of breaking them down, and we’re rather encouraged to talk with them to reduce uncertain factors so that they can focus on expanding their business.

―You have also set a management framework for investment. Do you recommend project continuation or withdrawal?

Goto: These specific decisions and consultations are made by the Credit Supervision Unit. We don’t impose restrictions or tell them not to invest in a specific project due to concerns such as country risk. For large-scale M&A, however, we’ve been actively providing opinions and estimates, such as noting the amount of capital that may be required or that a certain measure may be necessary from the standpoint of resources and financial discipline.

Maintaining Close Communication for Non-financial Risks that Are Changing at an Accelerated Pace

―I understand that you’ve recently been emphasizing the importance of non-financial operational risks such as the environment and human rights. Could you give us some specific examples of initiatives?

Tamaki: In terms of environmental initiatives, we’re engaged in calculating the Group’s CO2 emissions toward achieving carbon neutral. And we’re cooperating with the Sustainability Management Division and others in promoting initiatives to expand the scope of Group calculations, refine calculation methods, and reduce CO2 emissions.

Carbon dioxide emissions are verified by a third party, and we use the verified emissions to respond to international Carbon Disclosure Project (CDP) questionnaires. Since there is a deadline for CDP responses, the key is to obtain environmental data for the previous year from each company and division and then efficiently and accurately calculate them. In fiscal 2022, with the support of the IT Promotion Division, we digitally transformed data and reviewed the data aggregation method. As a result, we received a certain evaluation from the third-party verifier and won the TC Award for excellence, which was a great experience.

In cooperation with the Sustainability Management Division, we began trial implementation of internal carbon pricing this fiscal year, which is designed to rationally incorporate CO2 emission risks (negative aspects) and reduction effects (positive aspects) into investment decisions for Scopes 1 and 2, as well as to enhance the perception of risks and costs by visualizing CO2 prices. We’re also discussing human rights with the Personnel Division and other relevant divisions and plan to start a human rights risk assessment for investment and loan projects on a trial basis in January 2024. We feel that we must continue to address new risks in response to the external environment.

―As we are forced to broaden both scope and perspectives, the key is to maintain close risk communication with business units and affiliated companies.

Tamaki: That’s right. As the variety of our businesses subsidiaries increase, I think it will become necessary to take action against risk events that are completely different from those we’ve cultivated in our founding business of leasing, making risk communication vitally important.

Advancing Risk Management by Boldly Taking on the Risks that Should Be Taken

―How do you view the ever-growing importance of risk management?

Goto: As I’ve mentioned, the mission of risk management is to boldly take on risks that should be taken and support value creation and growth. Our medium-term management plan also calls for more sophisticated risk management. In addition, as the external environment becomes more complex and predicting the future becomes more difficult, the importance of operating our business from a risk management perspective is growing, and we feel that what’s required of us is changing. Tokyo Century’s training offerings are diverse, and I believe that such investment in people, as well as ESG and human rights, will ultimately make the greatest contribution to our finances. That’s why my focus is now on understanding the points I’m looking at by uniquely applying non-financial risk indicators.

Tamaki: Even though environmental management, my area of responsibility, is only one part of overall risk management, I’ll continue to play a role in addressing international issues, such as climate change, in whatever way I can.

Kikuo Goto

Deputy General Manager, Risk Management Division

Joined in October 2021 as a mid-career employee after experiencing a wide range of risk management operations such as market risk and credit risk at a domestic financial institution. He has been responsible for promoting the development of risk management frameworks and measuring risks.

Shiho Tamaki

Manager, Risk Management Division

Joined Tokyo Leasing Co., Ltd. in 2002. She worked in area sales and then moved to the international unit, where she was involved in vendor sales and operational support for local subsidiaries. She has been in her current position since October, in charge of the environmental secretariat and responsible for the overall environmental management system, calculation of CO2 emissions, including those of Group companies, and other environmental operations.

Note: The contents of the article and the position titles are current as of the date posted.

RECOMMEND ARTICLES

Dec 20, 2023

New risk factors hav…

—Employees Encouraged by Family Ties and Understanding of Their Work

Oct 19, 2023

Every August since 2…

Feb 22, 2023

With its founding bu…