Japan Hydrogen Fund, Managed by Advantage Partners, Leads the Adoption of Hydrogen in the Hard-to-Abate Sectors

Mar 4, 2025

Hydrogen is gaining attention as a key next-generation energy source, and integrating hydrogen into society requires a robust supply chain. Many obstacles, however, remain in the way, while a clear roadmap to implementation has yet to emerge. What factors are crucial for hydrogen to become widely used? To gain insights into the topic, we spoke with Mr. Suzuki of Advantage Partners, Inc., which manages the Japan Hydrogen Fund, and Mr. Kimizu, who is on loan to Advantage Partners from Tokyo Century. After securing capital commitments of over $430 million by December 2024 and already making two investments *1 , the fund is now in full swing to promote a decarbonized society.

*1:Announcement Regarding Investment in INFINIUM HOLDINGS, INC.

Left: Sho Kimizu, Vice President, Advantage Partners (on loan from Tokyo Century), Right: Keiichi Suzuki, Partner, Advantage Partners

From Fossil Fuels to Hydrogen, Technology Development for Decarbonization Accelerates in Various Industries

——The Japan Hydrogen Fund has been launched to encourage the use of hydrogen in society. Mr. Suzuki, how do you view the current situation surrounding hydrogen?

Suzuki: Many industries in Japan are developing technologies to move away from fossil fuels to enable our country to achieve carbon neutrality by 2050. Hydrogen has great potential as a next-generation energy source to replace fossil fuels. For example, in the steel industry, which emits large volumes of CO2 during the iron-making process, attention is focused on a technology for using hydrogen instead of coal in the reduction process to remove oxygen from iron oxide, a raw material. In the electric power industry, hydrogen and ammonia are being co-fired instead of coal and gas to reduce CO2 emissions from thermal power plants.

In this way, hydrogen is attracting attention as a means of decarbonization in areas that cannot be replaced by other green power sources. At present, however, the market is still immature due to numerous issues such as costs and distribution. I believe that resolving these issues will lead to the widespread use of hydrogen.

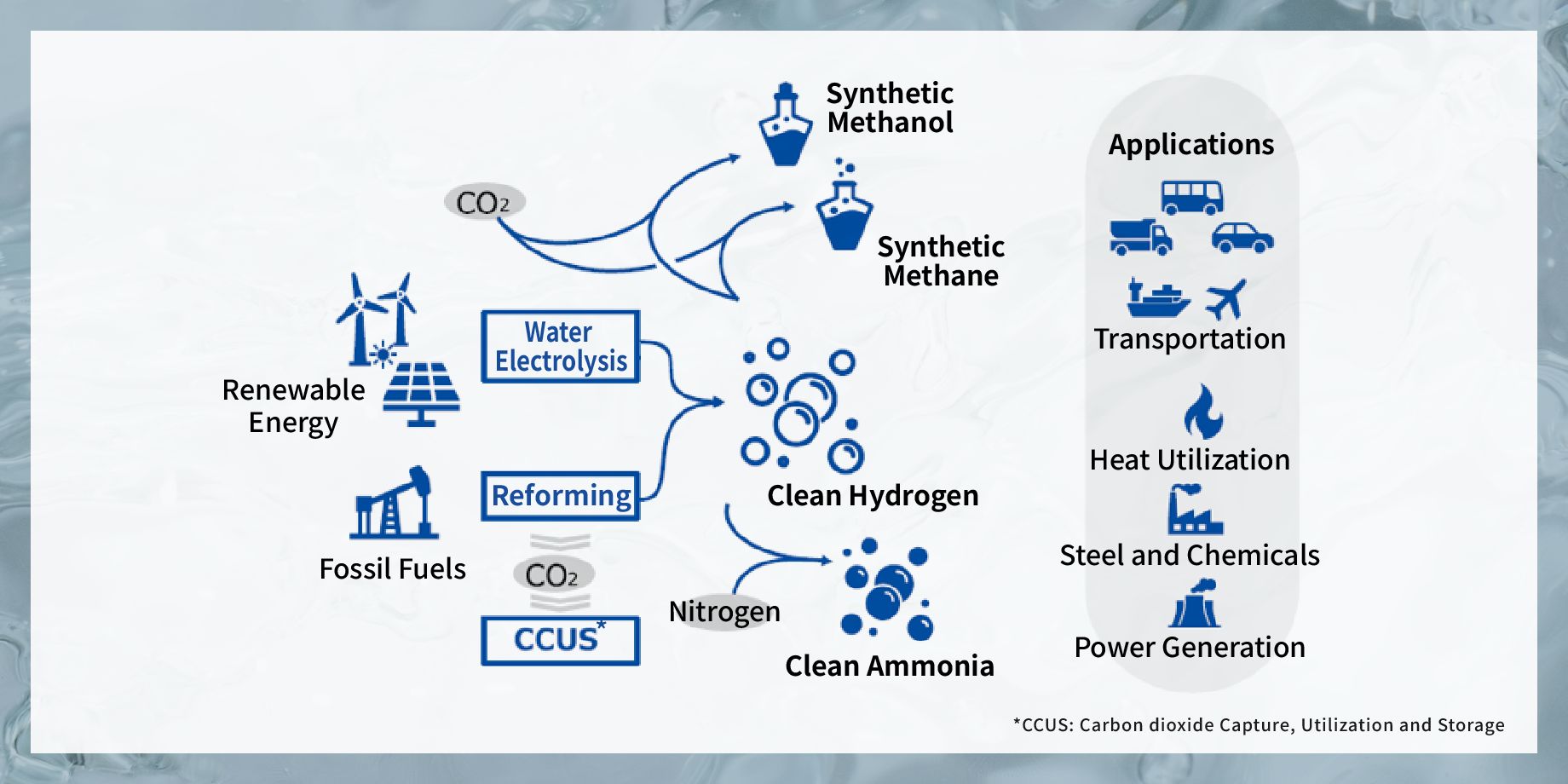

About hydrogen: Hydrogen is being positioned as the final means of achieving decarbonization in areas where electrification is difficult, as its use does not emit CO2.

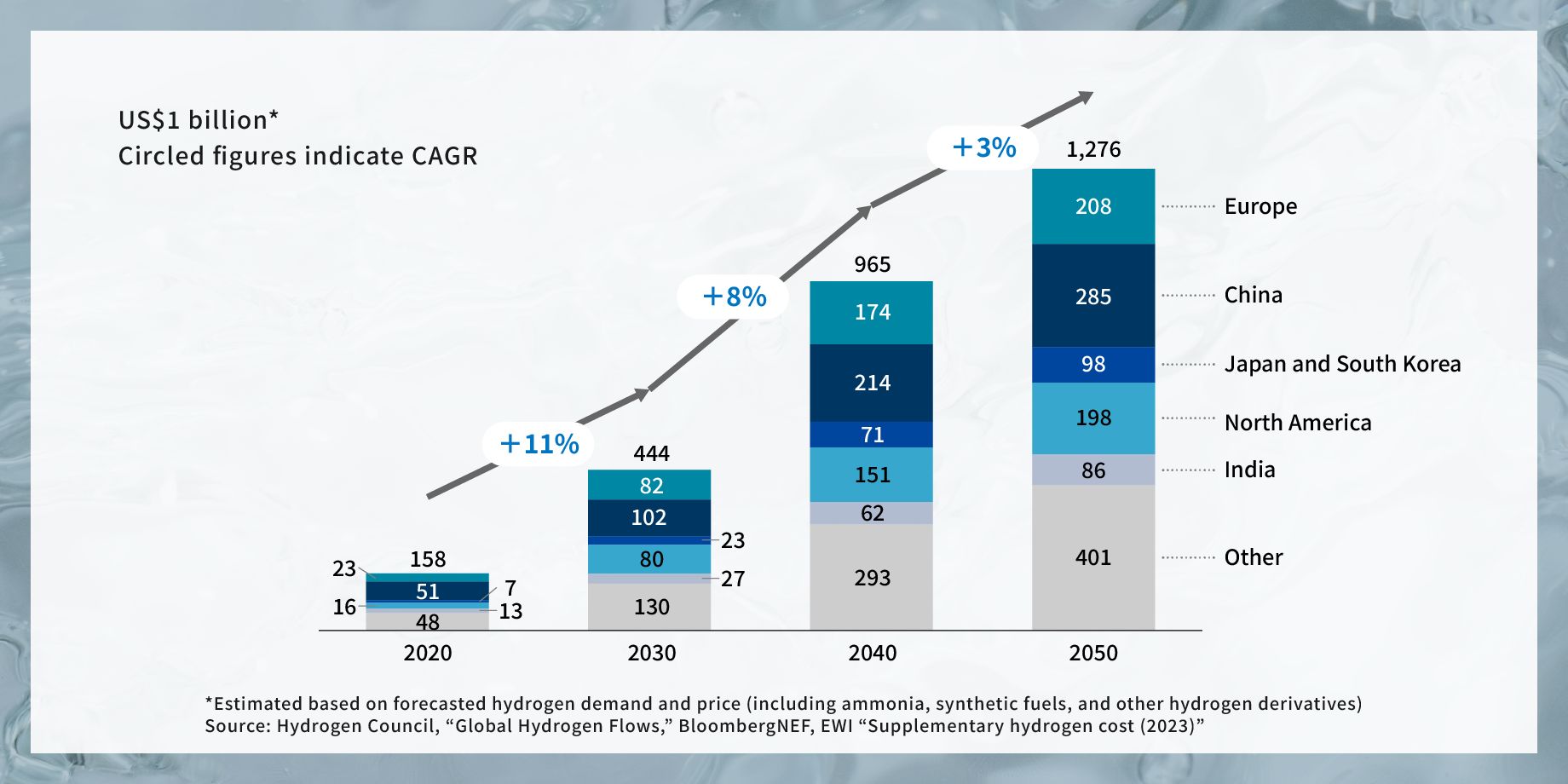

Global hydrogen market size: Demand for hydrogen is expected to increase by approximately eightfold by 2050 compared to 2020.

Japan’s First Hydrogen-Focused Fund Aims for the Social Implementation of Hydrogen

——The Japan Hydrogen Fund was established to realize a hydrogen society, and many companies, including Advantage Partners and Tokyo Century, are participating in this project. How is the fund structured?

Suzuki: The Japan Hydrogen Fund is managed by three parties: the Japan Hydrogen Association (JH2A), Sumitomo Mitsui DS Asset Management, and Advantage Partners. A total of 475 companies, organizations, and municipalities (as of January 1, 2025) are participating in JH2A, and Advantage Partners is responsible for the fund’s investment advisory and operational support services.

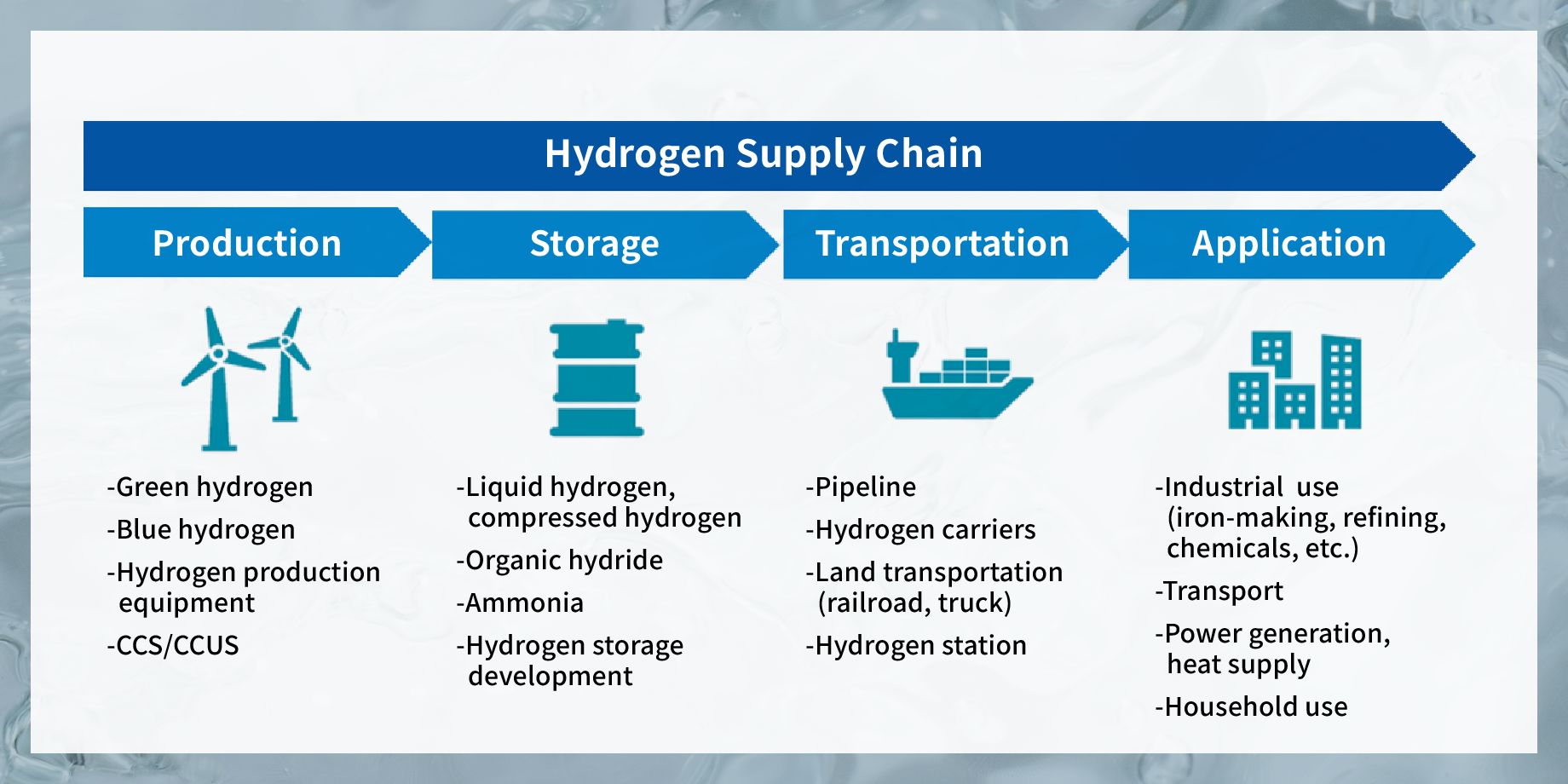

It is Japan’s first global hydrogen fund for generating attractive returns through investments in hydrogen infrastructure and companies as well as establishing a hydrogen supply chain in Japan and abroad. It plans to invest in production, storage, transportation, and utilization facilities for hydrogen and hydrogen-derived molecules, as well as technology and service providers responsible for constructing this entire infrastructure.

Current investors include 11 companies: Toyota Motor Corporation, Iwatani Corporation, Sumitomo Mitsui Banking Corporation, MUFG Bank, Ltd., Japan Green Investment Corp. for Carbon Neutrality, TotalEnergies, The Bank of Fukuoka, Development Bank of Japan Inc., Maruichi Steel Tube Ltd., Mitsui Sumitomo Insurance Co., Ltd., and Tokyo Century.

This is the Japan Hydrogen Fund’s vision of the hydrogen supply chain.

——Advantage Partners launched its renewable energy and sustainability investment strategy in 2021. I understand that the fund was established based on this new approach. Could you tell us about the background to these strategies?

Suzuki: We initially began as a buyout*2 business in Japan and have since expanded our business scope by investing in Asia and listed companies to support their growth. We are proud to pioneer in the private equity*3 market. In response to the recently growing international interest in the SDGs, we launched a new renewable energy and sustainability investment strategy as the next step. The fund was established to promote the energy shift from fossil fuels to hydrogen based on this new strategy.

The Japanese government has set a goal of reducing greenhouse gas emissions by 46% by 2030 (compared to the 2013 level) and is promoting the broader use of renewable energy. However, energy needs cannot be satisfied by renewable energy sources only. The steel, chemical, aviation, and marine fuel industries are considered as hard-to-Abate sectors and are seen to be almost completely dependent on fossil fuels and therefore face significant challenges to reducing CO2 emissions. Decarbonizing these hard-to-Abate sectors is necessary for achieving the reduction target, and hydrogen and ammonia are the keys to this end.

*2 Buyout is the acquisition of shares that would give management a majority of voting rights in a company to gain control for the purpose of restructuring management, taking over business operations, or improving earnings.

*3 Private equity refers to unlisted stocks and is also used as a concept to refer to investments in unlisted companies and businesses in general.

Suzuki: Many hurdles must be overcome to establish the practical use of hydrogen in society, but we launched this fund together with JH2A and have now reached our first closure.

——Tokyo Century is participating in the Japan Hydrogen Fund as a limited partner. Could you tell me about the background of the investment?

Kimizu: We believe that the significance of this fund lies in accepting the risks of investing in socially meaningful yet underdeveloped markets. Regardless of the risk of investing in advanced initiatives, we are confident the fund provides value by actively investing in hydrogen-related fields that are expected to grow in earnest, as part of our decarbonization efforts, including those for hard-to-Abate sectors.

Advantage Partners and Tokyo Century entered into a strategic capital and business alliance in 2019, and since then the two companies have generated synergies in many investment projects through joint investments and actions to improve the corporate value of our investees. Although we have received concerns about uncertainty of developing hydrogen in the near future, Advantage Partners has the foresight and track record of having been the first to enter the Japanese private equity industry, and it has successfully implemented a number of investment strategies.

Tokyo Century therefore decided to participate in this fund, as we believe that collaboration is possible in a variety of ways beyond economic returns and hope to play a role in global decarbonization and enhancing Japan’s presence in the global market together with Advantage Partners through this fund.

In addition to these initiatives, many other collaborations are underway, including investments as a limited partner and financing/equity projects (seven employees have been transferred from Tokyo Century to Advantage Partners, with three currently on loan).

——How does Tokyo Century hope to contribute through this fund?

Kimizu:Tokyo Century excels in such schemes as debt finance, which raises funds by borrowing or issuing bonds; equity finance, which mainly involves the issuance of shares; and mezzanine finance, which falls somewhere in between the two methods. By using these schemes effectively, we would like to expand the scope of Japan Hydrogen Fund’s investment activities. We would also like to contribute to the fund’s activities through joint investment, technical collaboration, and by providing opportunities with our business partners.

Kimizu: Our collaboration with Advantage Partners is an asset that was established by our predecessors. Through our collaboration, we’d like to make 1 + 1 = not 2, but rather 3 or more.

Challenges of Building a Hydrogen Supply Chain in Hard-to-Abate Sectors

——How would you describe the challenge in using a hydrogen supply chain?

Suzuki: I see the challenge as uncertainty about the profitability of setting up a plant to produce and purchase hydrogen energy. The cost burden compared to other renewable energy sources cannot be resolved through the efforts of private companies alone. Continued government support will be necessary. For example, the U.S. government provides incentives such as tax credits to companies promoting decarbonization, while in the EU we see stricter regulations being taken to promote decarbonization.

Kimizu: Currently, the market isn’t fully established, and so there’s a supply-demand gap. But I think the gap will narrow as hydrogen use becomes more common in society due to increased demand and the principle of competition. For example, the use of renewable energy from solar power generation didn’t spread without subsidies at first, but the number of solar power equipped facilities has been growing.

——Could you tell us about the fund’s future management policy?

Suzuki: As I mentioned, the hard-to-Abate sectors are highly dependent on fossil fuels, making it difficult to reduce CO2 emissions. The same is true for aircraft and ships, which are powered by liquid fuels rather than electricity. The fund already has several parallel investment projects underway targeting these sectors.

Kimizu: Japan interest*4 is one of the main purposes of the fund’s activities. We would like to attract overseas companies to accelerate the implementation of the hydrogen supply chain in society, or to explore the overseas expansion of hydrogen-related technologies held by Japanese companies, thereby increasing business opportunities for Japanese companies.

*4 Japan interest: It is expected that profits are now being or will be returned to Japan, either directly or indirectly.

Suzuki: We must not forget the perspective of transporting energy as we build a hydrogen supply chain.

So, we also plan to focus on port development and increasing the number of hydrogen stations on land.

What We Can Do Now for the Next Generation

——Thank you very much. What would you like to say in closing our conversation?

Suzuki: The efficient production and use of hydrogen energy will require assets such as power generation facilities and storage batteries. Given the high hurdle for businesses to own these assets, leasing is the best possible solution. We are relying on the knowledge of Tokyo Century as we aim to accelerate the use of hydrogen energy.

Although the mission of the Japan Hydrogen Fund is to contribute to the establishment of a hydrogen market and the use of hydrogen in society, I don’t think these are its only goals. Even though the average global temperature is said to have risen by 1 degree, the perceived temperature in Japan is even higher. So I would like to grow a future-oriented fund to create a global environment where children can live in peace.

Kimizu: Although I’m currently on loan to Advantage Partners, I communicate closely with the Tokyo Century team. Taking advantage of Tokyo Century’s strengths in business, combining “Finance × Services × Business Expertise” with its customer base of more than 20,000 companies, I’d like to contribute to this initiative while valuing the mindset of continuing to take on new challenges, as expressed in our corporate slogan “Solutions to your Pursuits.”

Keiichi Suzuki

Partner, Head of Renewables and Sustainability, Advantage Partners, Inc.

Joined Advantage Partners, Inc. in 2021. He launched a SPAC specializing in sustainability and organized fund businesses such as for solar power generation and offshore wind power generation. In his previous position at a major general trading company, he was involved in many aspects of investment in infrastructure projects that developed environmental businesses such as offshore wind power generation facilities and seawater desalination plants in the EU, Middle East, Africa, and other regions.

Sho Kimizu

Vice President, Renewables and Sustainability,

Advantage Partners, Inc.

Joined a large financial institution as a new graduate and engaged in loan-related work. In 2017, he joined Tokyo Century Corporation, and in Specialty Financing he was involved in acquiring shares of U.S.-based aircraft lessor Aviation Capital Group and forming a strategic capital and business alliance with Advantage Partners. In 2020, he was transferred to the Japan Buyout team at Advantage Partners and worked on its domestic buyout business. In 2023, he returned to Tokyo Century and took charge of M&A projects, and in 2024 he was transferred back to Advantage Partners where he has been working exclusively on the Japan Hydrogen Fund.

Note: The contents of the article and the position titles are current as of the date posted.

RECOMMEND ARTICLES

—NTT and Tokyo Century Take on the World Through Co-Creation

Nov 11, 2025

Demand for data cent…

Mar 4, 2025

Hydrogen is gaining …

Feb 3, 2025

In March 2022, Tokyo…