The core strength of Tokyo Century’s business is our discerning eye—that is, the ability to determine asset value. This feature explores how that power is demonstrated across six products offered by Tokyo Century. This second article focuses on aircraft as infrastructure for the skies, carrying people from one place to another. Tokyo Century operates across the entire aviation value chain through its Group companies, including Aviation Capital Group (ACG), one of the world’s top aircraft leasing companies, and GA Telesis (GAT), which trades in aircraft parts and provides financing services. We spoke with Ikumi Katayama from the Aviation Finance Division to discuss the business and its strengths.

Responding to the Diverse Needs of Airlines

Ikumi Katayama, Aviation Finance Division

—First of all, could you tell what the Tokyo Century Group’s aviation business does?

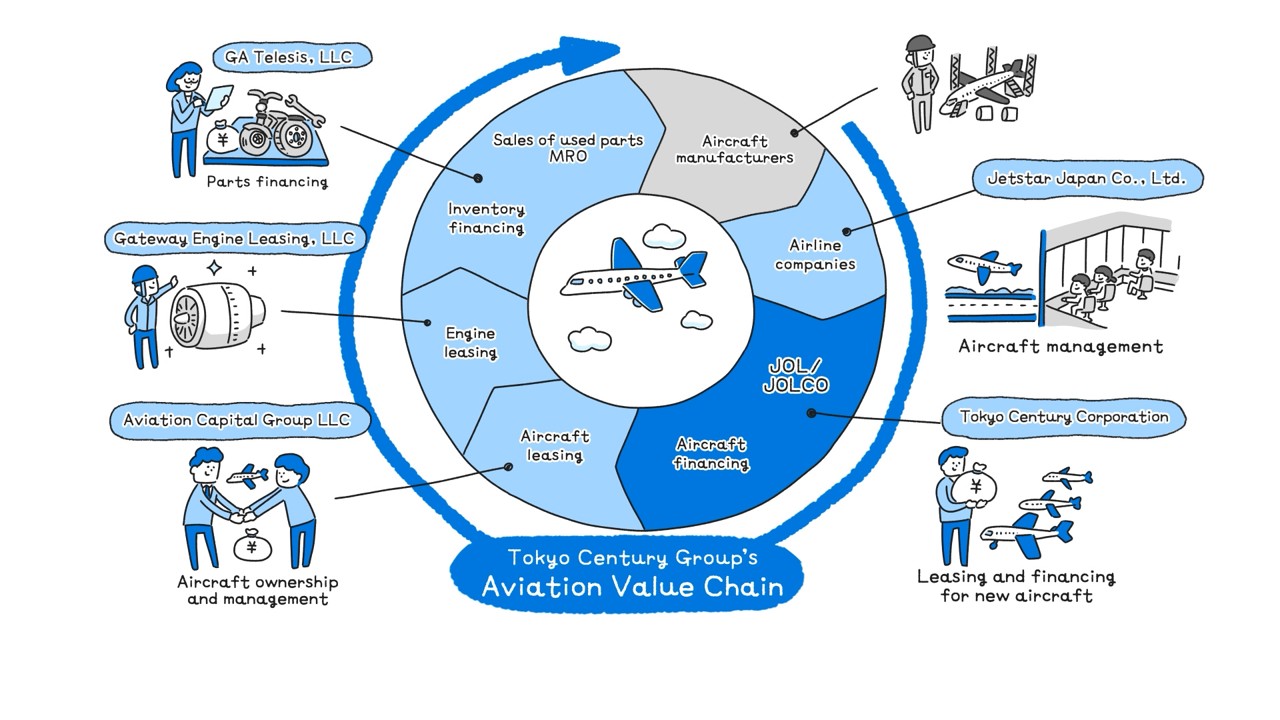

Katayama: As an integrated Group, we operate across a wide range of businesses, including aircraft and engine leasing, the trading of parts, and the provision of various services.

ACG, our aircraft leasing subsidiary, supplies aircraft and engines to airlines worldwide. We also offer investors opportunities to invest in the aircraft leasing business through Japanese operating lease products (JOL/JOLCO* ).

Although the general public may not realize it, about half of all aircraft in use around the world are leased, making leasing an essential and well-established business model in the aviation industry. Through leasing aircraft and other Group-owned assets to airlines across the globe, we are helping to expand a sustainable aviation network.

* https://www.tokyocentury.co.jp/jp/business/service/aviation/jol.html

MAX8 aircraft leased through ACG

—How does the aviation business contribute to society?

Katayama: Aircraft plays an important role in facilitating people’s mobility around the world, and the Tokyo Century Group’s business provides the backbone that makes this possible. Purchasing an aircraft requires an initial investment of tens of billions of yen, a major hurdle for any single airline. Leasing addresses this financing challenge and promotes the stable use of aircraft. In that sense, leasing can be said to support society itself. And that’s why we view aircraft not only as valuable investments but also as an essential social infrastructure for public mobility.

We also place great emphasis on environmental conservation. With the growing use of Sustainable Aviation Fuel (SAF) as an eco-friendly option in recent years, our division has developed a framework with overseas airlines in which interest rates change during the leasing term based on the volume of SAF used.

Offering Proposals that Integrate Our Knowledge of Aircraft and Finance

—What are the defining features of Tokyo Century’s aviation business?

Katayama: Our distinctive advantage lies in owning an extensive product line within the Group, which allows us to respond flexibly to strong demand for aircraft. At the core of our business is ACG, an aircraft leasing company ranked among the world’s top ten, which continues to expand its global network. We also focus on leasing engines, a vital aircraft component. Tokyo Century Corporation, together with Group company GAT and All Nippon Airways Trading Co., Ltd., established Gateway Engine Leasing, LLC (GEL), a joint venture dedicated to engine leasing. GEL plays a central role in the Tokyo Century Group’s aviation value chain.

In addition to leasing aircraft and engines, we engage in businesses such as leasing and trading aircraft parts through GAT. Retired aircraft are often disassembled, with airframes and engines reconditioned and sold separately. We also provide a range of other aircraft-related services, such as financing.

Our investment portfolio includes Jetstar Japan Co., Ltd. , which operates domestic and international flights. And while we are not directly involved in aircraft manufacturing, our solutions maximize value across the entire aviation value chain, from leasing new aircraft to trading retired aircraft parts.

Aviation Value Chain

—How does Tokyo Century’s discerning eye—its core strength—function in this business?

Katayama: I believe our expertise lies in combining our knowledge of aircraft and finance to provide a variety of solutions.

For example, an aircraft’s asset value largely depends on the performance and condition of its engine, along with the interior and various functions of the airframe. Working with Group companies to accurately evaluate asset value and determine the details of a contract relies on Tokyo Century’s discerning eye.

Finding Fulfillment in the Challenging Tasks of Building Infrastructure

—What do you find rewarding and exciting about this business?

Katayama: I’m currently responsible for managing equipment during the lease term. For example, some airlines pay maintenance reserves linked to actual flight hours and cycles, separate from the monthly leasing fee. I calculate this amount based on the flight records airlines provide each month and issue the corresponding invoice. I used to handle the process of airlines exercising purchase options as part of managing a JOLCO lease. Across these responsibilities, I’ve worked with many parties, including both domestic and overseas companies such as airlines, lenders, and law firms. Timelines can get tight at times, but seeing each task through is always rewarding.

I’ve been involved in the aviation business since joining the Company 13 years ago. Having been through some of the industry’s tough times during the COVID-19 pandemic, I feel deeply moved seeing so many aircraft taking to the skies again. Another rewarding aspect of working in this division is spotting at an airport an aircraft that I previously handled, or even having the chance to fly on it.

—What is your personal goal for the future?

Katayama: Over the years, I’ve gained personal experience in both sales and management. Looking ahead, I hope to contribute to the growth of the division by applying the knowledge and skills I’ve acquired. I’m also eager to take on new responsibilities in other areas as opportunities arise, with the aim of maximizing the value of aircraft and contributing to the infrastructure that supports people’s mobility around the world.

Ikumi Katayama

Aviation Finance Division

Katayama joined Tokyo Century in 2012 and was assigned to the aviation business during its launch phase, and has been involved in the business ever since. At the Aircraft Business Management Office, she is primarily responsible for managing leased aircraft and developing human resources. Effective February 2026, she will transfer to Sales Group II, where she will be in charge of JOLCO structuring.

*The contents of the article and the position titles are as of the date posted.